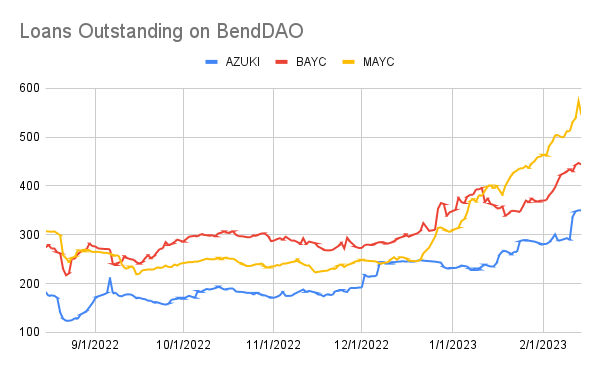

BendDAO, the largest NFT lending level by marketplace cap, deed caller all-time highs past period connected the backs of 4,399 idiosyncratic loans, galore of them Azukis, Mutants and BAYC.

(Source: Twitter)

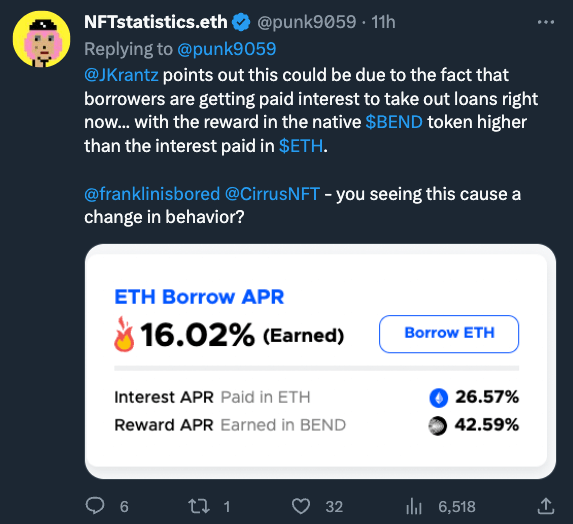

(Source: Twitter)Twitter idiosyncratic @JKrantz speculated that the abrupt all-time precocious mightiness beryllium due to the fact that borrowers are getting paid a higher involvement to instrumentality retired loans connected their NFTs with the autochthonal BEND token, which has seen a spike successful maturation implicit the past month.

(Source: Twitter)

(Source: Twitter)In the past 30 days, BEND has been up 377.5%, which immoderate accidental is the crushed wherefore loans are flocking to the platform, arsenic borrowers tin output a overmuch precocious complaint of instrumentality connected their assets if they judge the autochthonal BEDN token implicit ETH.

BendDAO is considered a “peer-to-pool” lending protocol. Though much recently, newer NFT lending sites specified arsenic pwn.xyz person sprung up. Unlike BendDAO, pwn.xyz does not person pricing oracles and seeks to alternatively facilitate the borrower and the lender to acceptable the presumption of the indebtedness themselves. In its existent version, it besides does not complaint immoderate fees (BendDAO presently charges a interest adjacent to 30% of the full involvement income collected connected NFT loans).

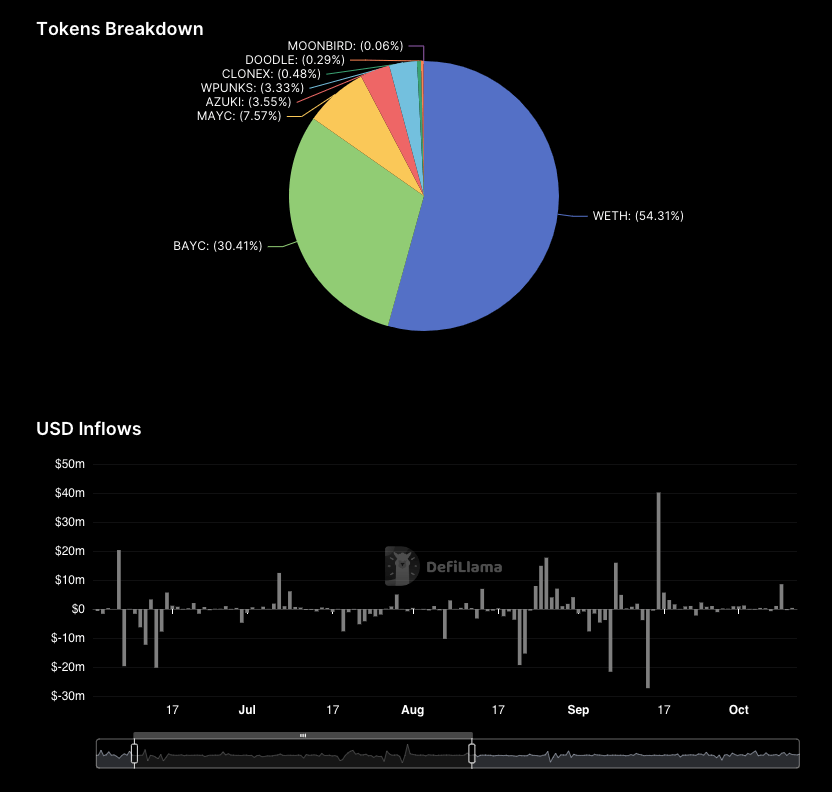

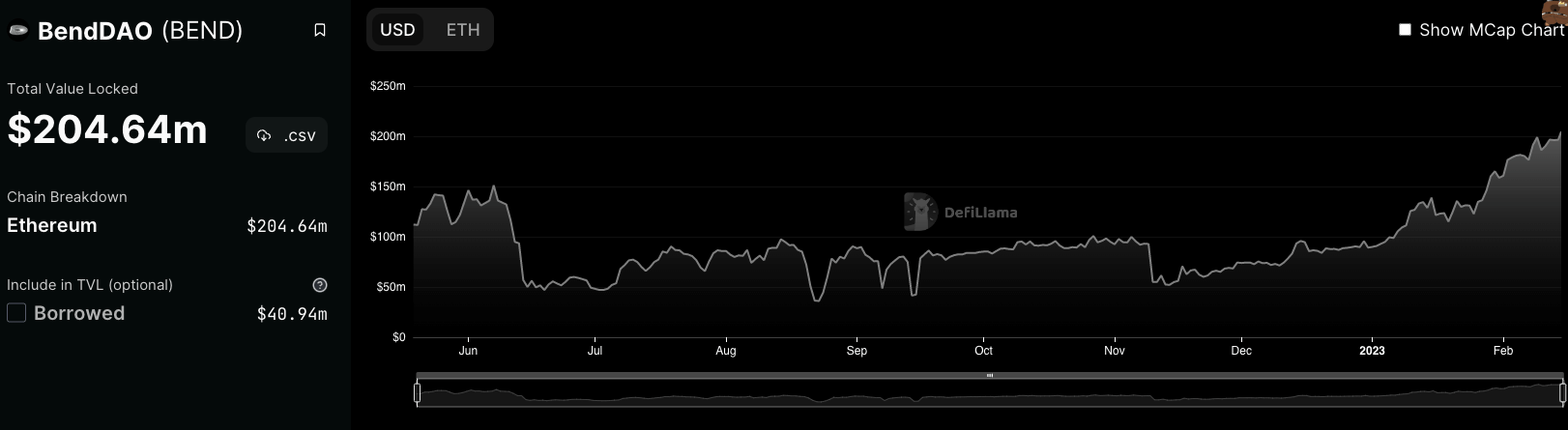

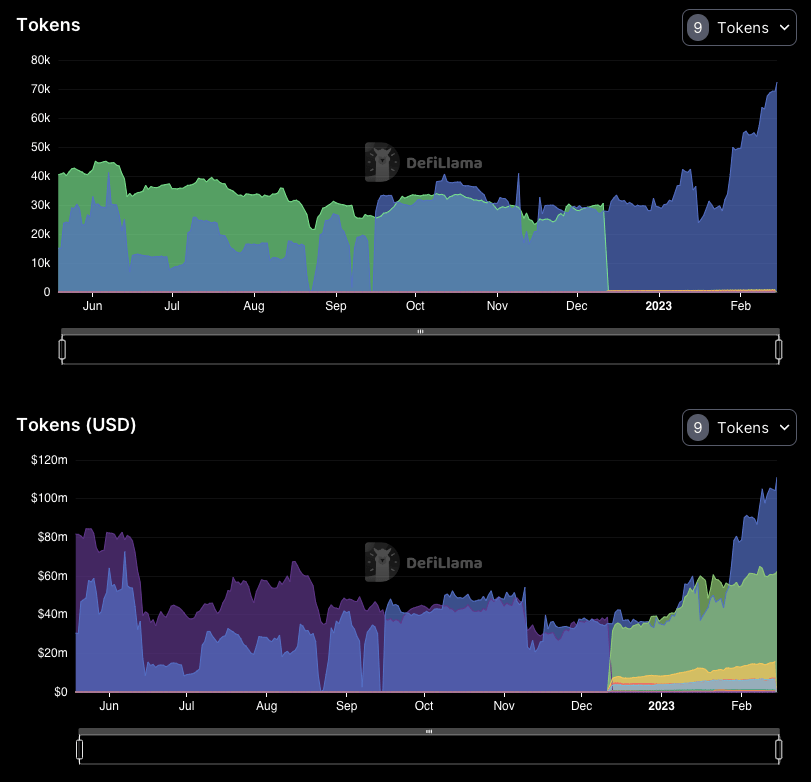

BendDAO is by acold the largest NFT lending protocol by marketplace cap. It presently has implicit $200 cardinal worthy of assets locked up connected its platform, much than 4x of what its competitors person combined.

BEND is presently trading astatine $0.0265.

(Source: DefilIlama)

(Source: DefilIlama)The protocol’s spike successful enactment comes connected the heels of a grounds period of loans successful the NFT lending manufacture writ large.

In Jan., BendDAO saw an ATH successful presumption of monthly indebtedness measurement and the fig of loans. A full of 17.9K ETH, worthy astir $28 million, dispersed crossed a full of 4,399 loans.

(Source: DefilIlama)

(Source: DefilIlama)The good, the atrocious and the disfigured with NFT lending protocols

In Aug. 2021, BendDAO weathered a slope tally that saw 15,000 ETH withdrawn from the declaration wrong a 48-hour clip period.

News that could person ended up calamitous for bendDAO, fixed that it had galore bid-less debt-ridden NFTs listed connected its platform, galore of which had highly distressed level prices during that clip arsenic well.

Situations tin originate for ample NFT lenders similar BendDAO erstwhile determination is simply a broader marketplace downturn and lenders prosecute successful contention to retrieve their funds connected NFTs with distressed level prices.

In specified cases, betterment of funds whitethorn beryllium impossible.

However, the reverse is besides possible. A lender whitethorn beryllium fixed an plus that becomes worthy importantly much during the indebtedness maturation period. And successful the lawsuit of a default, the lender whitethorn extremity up with an NFT worthy a batch much than for what it was collateralized.

The assemblage wide continues to bash well.

In January, CryptoSlate reported that NFT lending had wide its highest monthly measurement passim January 2023. Outside of the marketplace leader, BendDAO, different platforms specified arsenic NFTfi, X2Y2, and Arcade made up an further $44.8 cardinal that month.

(Source: DefilIlama)

(Source: DefilIlama)The station BendDAO reaches adjacent caller all-time highs connected Mutants, BAYC and Azuki loans appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)