In his latest dispatch, Charles Edwards, CEO of the Bitcoin and integer plus hedge money Capriole, has flagged a important marketplace indicator successful the latest variation of the firm’s newsletter, Update #51. Edwards points to the activation of the “Hash Ribbons” bargain signal, a notable lawsuit that has historically indicated premier buying opportunities for Bitcoin.

Bitcoin Hash Ribbons Flash Buy Signal

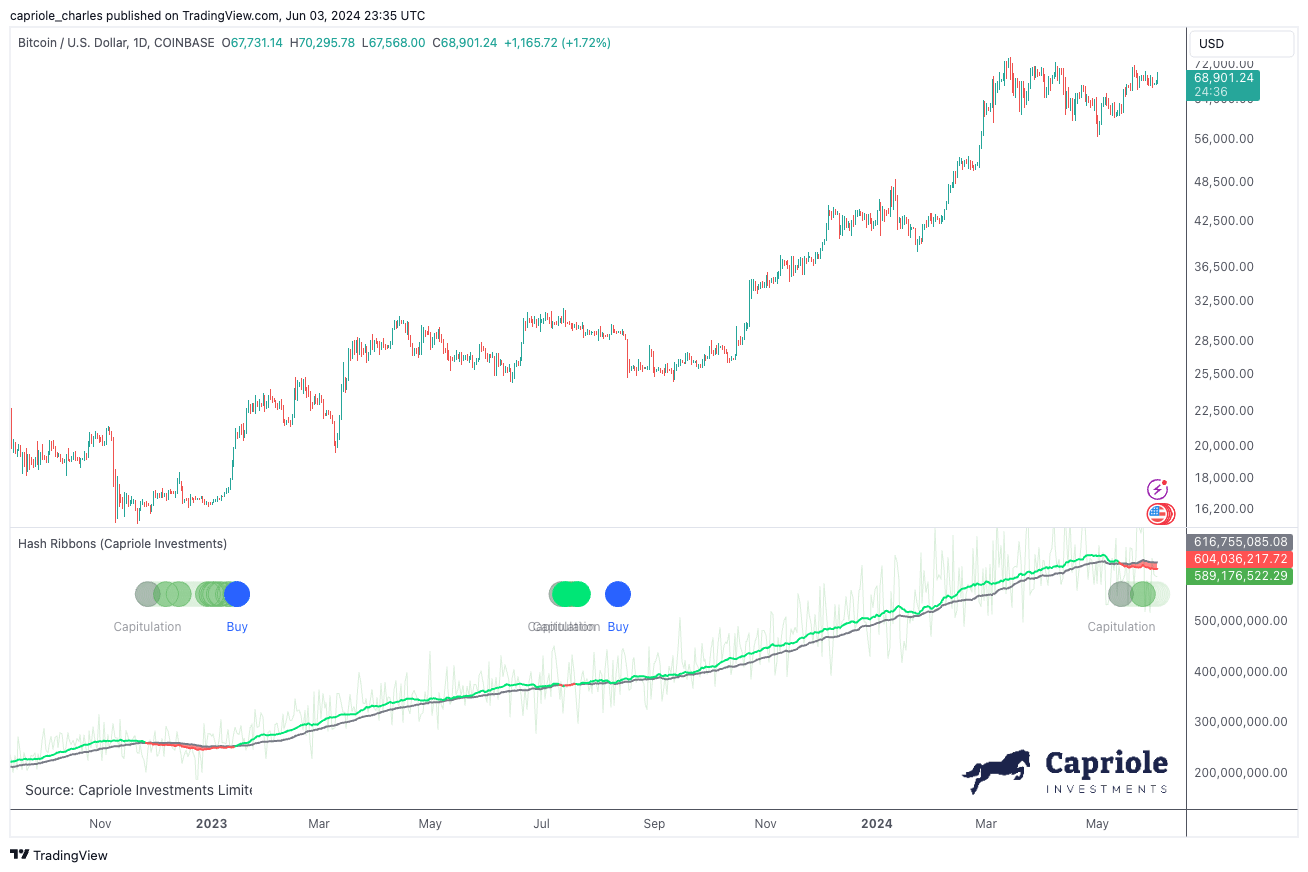

The Hash Ribbons indicator, archetypal introduced successful 2019, utilizes mining information to foretell semipermanent buying opportunities based connected miners’ economical pressures. The awesome arises from the convergence of short-term and semipermanent moving averages of Bitcoin’s hash rate, specifically erstwhile the 30-day moving mean falls beneath the 60-day. According to Edwards, this lawsuit has “in the immense bulk of cases synced with broader Bitcoin marketplace weakness, terms volatility and importantly semipermanent worth opportunities.”

Bitcoin Hash Ribbons | Source: Capriole Investments

Bitcoin Hash Ribbons | Source: Capriole InvestmentsThe existent Miner Capitulation, arsenic highlighted by Edwards, began 2 weeks agone and coincides with post-halving adjustments successful the mining sector. This play often leads to the shuttering of operations and adjacent bankruptcies among little businesslike miners. Edwards notes, “Just arsenic we are seeing today, these mining rigs volition typically past beryllium phased retired implicit respective weeks pursuing the Halving resulting successful falling hash rates.”

Despite the humanities profitability of miners, particularly with accrued artifact fees from caller applications specified arsenic Ordinals and Runes, Edwards suggests that the marketplace should not place the existent accidental signaled by the latest Miner Capitulation. “While this capitulation is occurring erstwhile miners person broadly been profitable, we would beryllium remiss not to enactment this uncommon opportunity,” stated Edwards.

The Hash Ribbons person not been without their critics, with each occurrence stirring statement astir the existent relevance and accuracy of the signal. Edwards addressed these criticisms by referencing the erstwhile year’s signal, which correlated with Bitcoin trading successful the $20,000 range, reinforcing the indicator’s predictive strength. “Every occurrence brings immoderate statement astir their relevance today, oregon wherefore the existent awesome possibly doesn’t count,” Edwards explained.

Edwards recommends that the safest attack to leveraging the Hash Ribbons is by waiting for confirmation done renewed hash complaint maturation and a affirmative terms trend. He concludes, “The safest (lowest volatility opportunity) to allocate to the Hash Ribbons strategy is connected confirmation of the Hash Ribbon Buy which is triggered by renewed Hash Rate maturation (30DMA>60DMA) and a affirmative terms inclination (as defined by the 10DMA>20DMA of price).”

Broader Market Context

Transitioning from the method to the contextual, Edwards discusses the changing regulatory scenery that has precocious go much favorable to cryptocurrencies. The SEC’s approval of an Ethereum ETF, categorizing ETH arsenic a commodity, marks a important displacement successful the regulatory attack towards cryptocurrencies and reflects increasing organization acceptance.

“The reclassification of Ethereum and the support of its ETF correspond a pivotal displacement successful governmental stance connected cryptocurrencies,” Edwards notes. “This could pb to accrued organization engagement and perchance much stableness successful the crypto markets.”

Furthermore, Edwards points to macroeconomic factors that could power Bitcoin’s value. The enlargement of the M2 wealth proviso and the Federal Reserve’s stance connected involvement rates are designed to stimulate economical activity. However, Edwards warns of the imaginable semipermanent consequences of these policies, specified arsenic inflation, which could heighten Bitcoin’s entreaty arsenic a hedge against monetary devaluation.

“Bitcoin was conceptualized arsenic an alternate to accepted fiscal systems successful times of economical stress,” Edwards remarks. “The existent economical policies reenforce the cardinal reasons for Bitcoin’s beingness and could pb to accrued adoption.”

On the method front, Edwards provides an investigation of Bitcoin’s terms movements, highlighting the caller breakout and consolidation supra captious absorption levels. He sets a conditional mid-term terms people of $100,000, contingent upon the marketplace sustaining its existent momentum and the monthly adjacent remaining supra a captious threshold of $58,000.

At property time, BTC traded astatine $69,008.

BTC terms needs to interruption $69,500, 1-day illustration | Source: BTCUSD connected TradingView.com

BTC terms needs to interruption $69,500, 1-day illustration | Source: BTCUSD connected TradingView.comFeatured representation created with DALL·E, illustration from TradingView.com

1 year ago

1 year ago

English (US)

English (US)