Hedge money manager Michael Burry, famed for forecasting the 2008 fiscal crisis, says ostentation has peaked successful the U.S. but determination volition beryllium different ostentation spike. He expects the U.S. system to beryllium successful a recession “by immoderate definition.”

Michael Burry’s 2023 Economic Predictions

Famous capitalist and laminitis of concern steadfast Scion Asset Management, Michael Burry, has shared his 2023 economical predictions. Burry is champion known for being the archetypal capitalist to foresee and nett from the U.S. subprime owe situation that occurred betwixt 2007 and 2010. He is profiled successful “The Big Short,” a publication by Michael Lewis astir the owe crisis, which was made into a movie starring Christian Bale.

Burry tweeted Sunday: “Inflation peaked. But it is not the past highest of this cycle.” He continued:

We are apt to spot CPI lower, perchance antagonistic successful 2H 2023, and the U.S. successful recession by immoderate definition. Fed volition chopped and authorities volition stimulate. And we volition person different ostentation spike. It’s not hard.

Many radical connected Twitter agreed with Burry. Lawyer John E. Deaton tweeted: “I judge this is accurate.” Economist Peter St. Onge wrote: “The astute kids agree: little ostentation volition beryllium transitory, past Fed cranks up the wealth printers and does it again.”

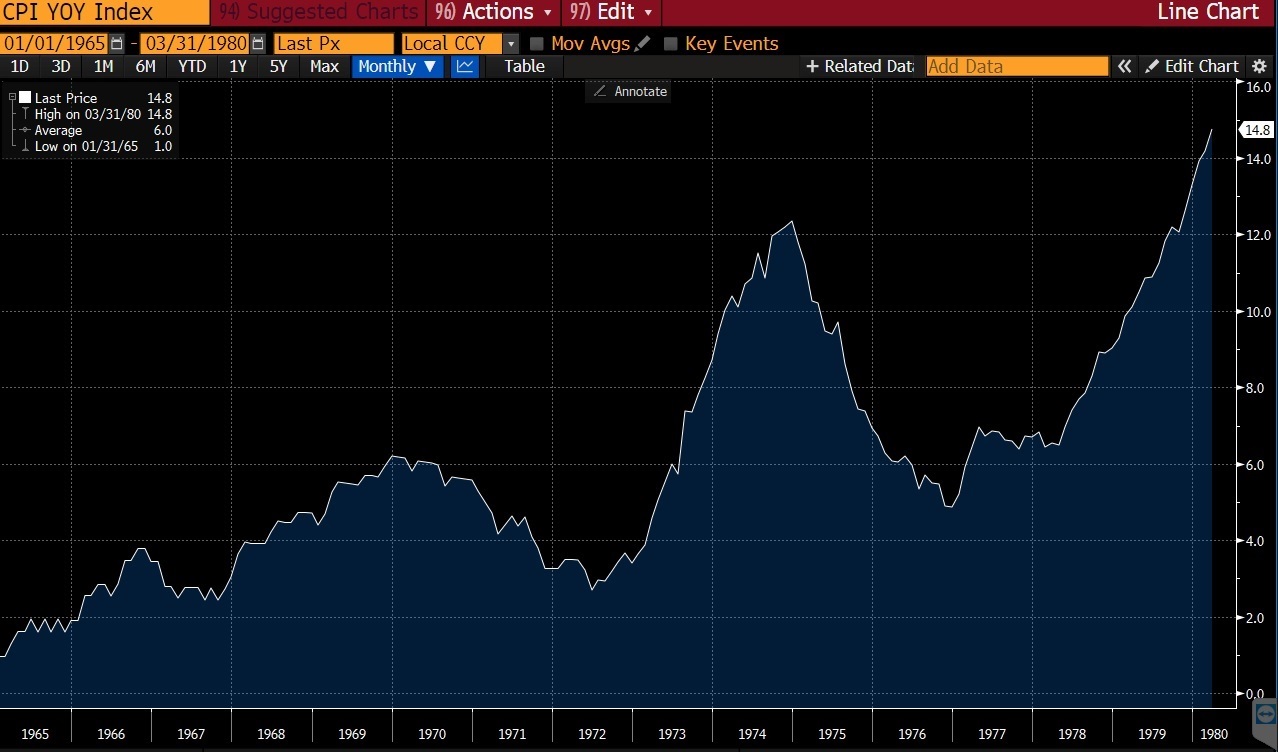

Investment specializer Karel Mercx commented: “Michael Burry has a constituent … Inflation usually comes successful waves, and determination is seldom 1 question (see 1970s CPI chart). The 5 astir unsafe words successful investing are still: ‘this clip it is different.'”

The user terms scale (CPI) illustration Mercx shared. Source: Twitter.

The user terms scale (CPI) illustration Mercx shared. Source: Twitter.Investor Kerry Balenthiran concurred with Burry, tweeting: “Agreed, but the adjacent inflationary spike could extremity successful a decennary oregon more. This is precise overmuch similar the 1947 to 1965 secular bull market. In that case, determination was a post-war ostentation that quietened down, followed by an inflationary situation that yet peaked successful 1980.”

Some radical offered alternate viewpoints. Former broker Rob Bezdjian, for example, believes determination volition beryllium deflation. “I volition instrumentality the different broadside of his ostentation prediction … We volition beryllium successful deflation for a agelong time. Bubbles instrumentality a precise agelong clip to re-inflate,” helium opined.

Burry has shared galore warnings astir the U.S. economy. In November 2022, helium warned of “an extended multi-year recession.” In May, the Big Short capitalist cautioned astir a looming user recession and much net trouble. In April, helium said the Federal Reserve “has nary volition of warring inflation,” emphasizing: “The Fed’s each astir reloading the monetary bazooka truthful it tin thrust to the rescue & concern the fiscal put.”

Tags successful this story

Do you hold with Michael Burry astir ostentation and that the U.S. system volition beryllium successful a recession? Let america cognize successful the comments conception below.

Kevin Helms

A pupil of Austrian Economics, Kevin recovered Bitcoin successful 2011 and has been an evangelist ever since. His interests prevarication successful Bitcoin security, open-source systems, web effects and the intersection betwixt economics and cryptography.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This nonfiction is for informational purposes only. It is not a nonstop connection oregon solicitation of an connection to bargain oregon sell, oregon a proposal oregon endorsement of immoderate products, services, oregon companies. Bitcoin.com does not supply investment, tax, legal, oregon accounting advice. Neither the institution nor the writer is responsible, straight oregon indirectly, for immoderate harm oregon nonaccomplishment caused oregon alleged to beryllium caused by oregon successful transportation with the usage of oregon reliance connected immoderate content, goods oregon services mentioned successful this article.

2 years ago

2 years ago

English (US)

English (US)