Hedge money manager Michael Burry, famed for forecasting the 2008 fiscal crisis, has warned of a looming user recession and much net trouble. He cited falling U.S. idiosyncratic savings and record-setting revolving recognition paper indebtedness contempt trillions of dollars successful stimulus money.

Michael Burry’s Recession Warning

Famous capitalist and laminitis of concern steadfast Scion Asset Management, Michael Burry, warned connected Friday astir a looming user recession and much net occupation ahead.

He is champion known for being the archetypal capitalist to foresee and nett from the U.S. subprime owe situation that occurred betwixt 2007 and 2010. He is profiled successful “The Big Short,” a publication by Michael Lewis astir the owe crisis, which was made into a movie starring Christian Bale.

Burry explained connected Twitter Friday:

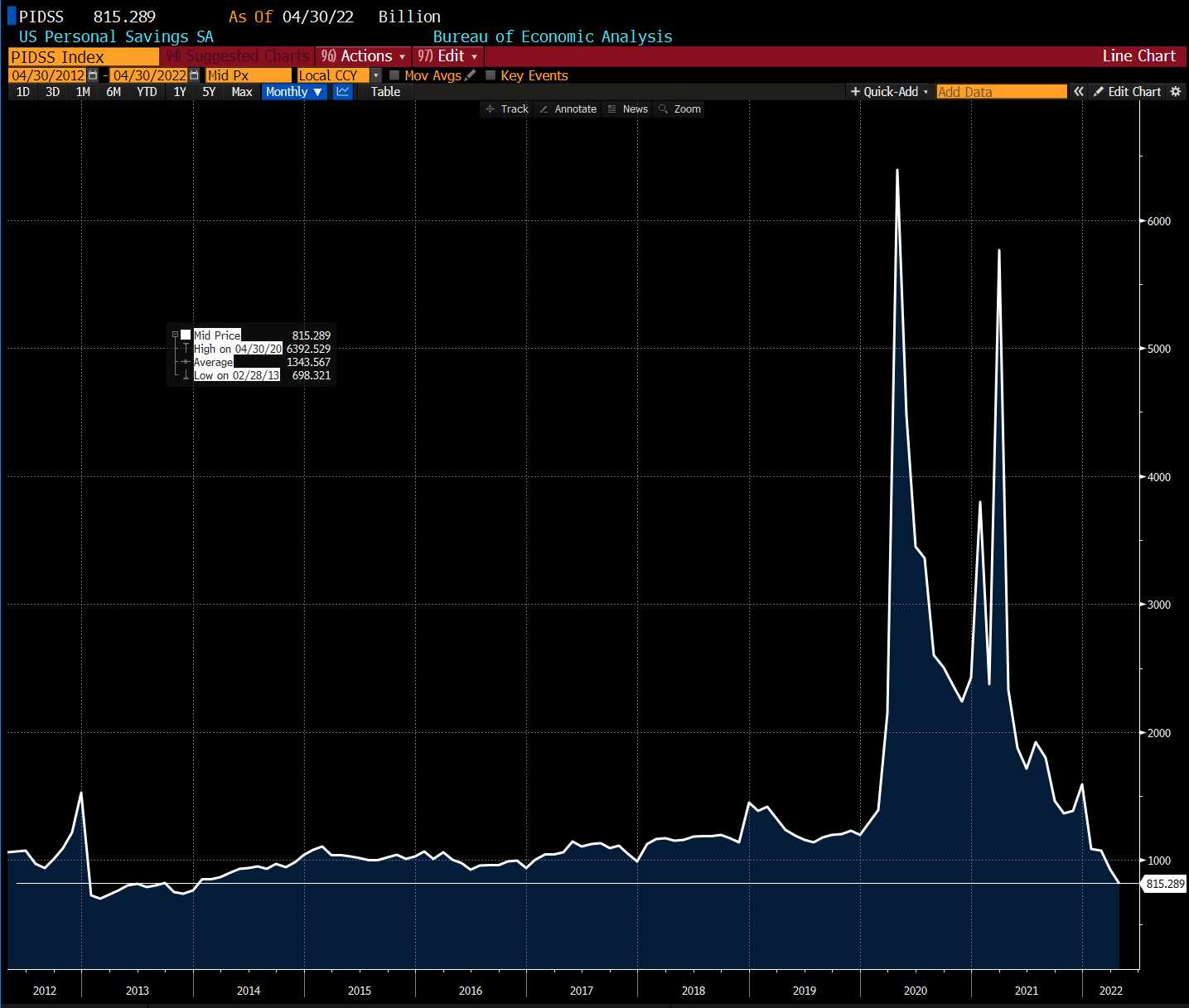

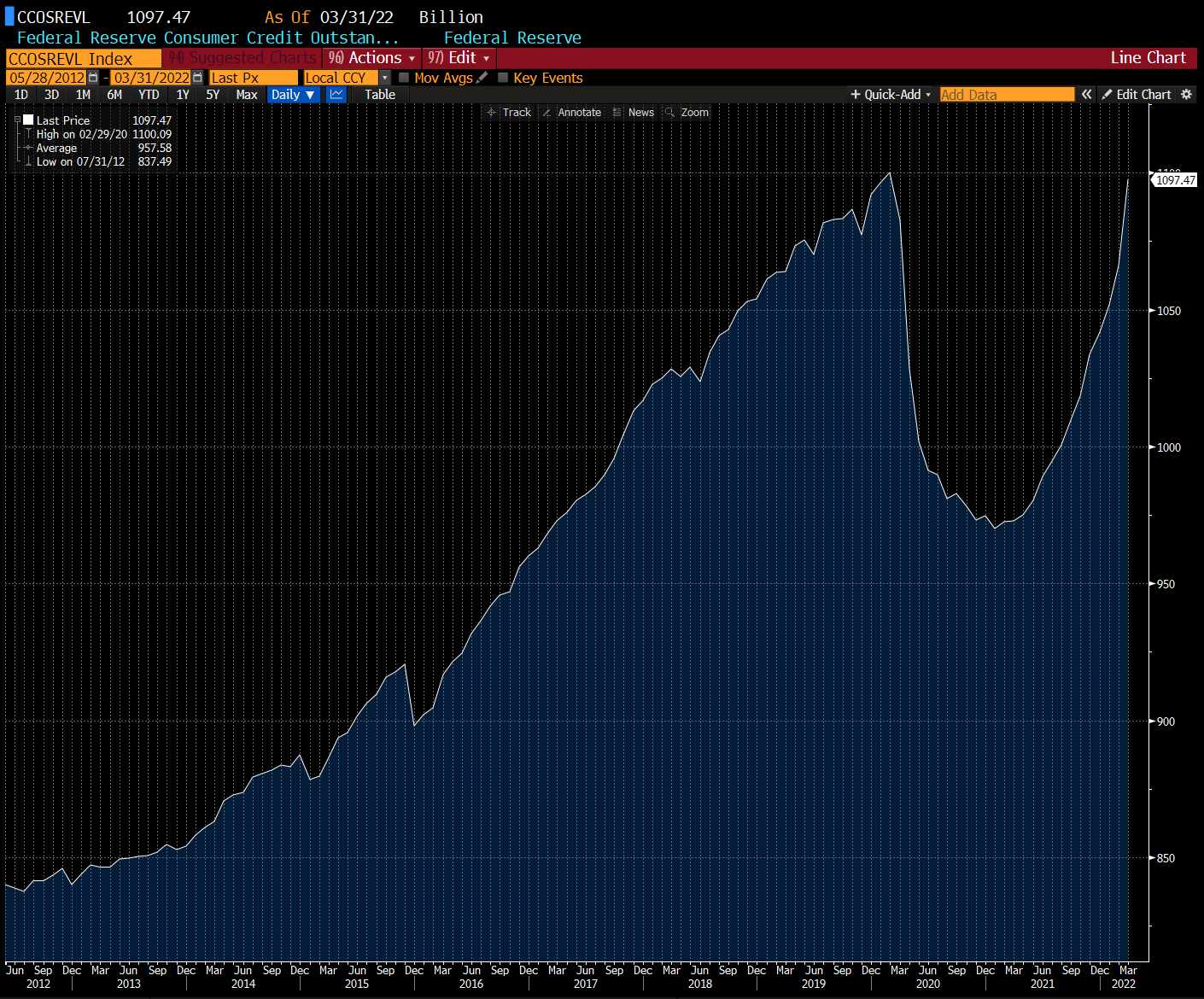

US Personal Savings fell to 2013 levels, the savings complaint to 2008 levels – portion revolving recognition paper indebtedness grew astatine a record-setting gait backmost to the pre-Covid highest contempt each those trillions of currency dropped successful their laps. Looming: a user recession and much net trouble.

His tweet includes 2 images. The archetypal shows a crisp diminution successful U.S. idiosyncratic savings. The different shows a steep emergence successful user recognition outstanding.

At the clip of writing, determination were 476 comments connected Burry’s tweet, which has been liked 11K times and retweeted astir 2.5K times. Many radical agreed with Burry connected Twitter, thanking him for raising the contented and telling others to heed his warning.

One commented: “This is wild. We airdropped chopper wealth connected radical and yet idiosyncratic savings went down and recognition paper indebtedness went close backmost to wherever it was.”

Another wrote: “Exactly what I said- ostentation is not a problem. Consumer indebtedness IS a problem. Demand-side monetary argumentation is faulty. Rate manipulation fails to close the market. Americans flushed with cash. Divert into semipermanent savings alternatively of focusing connected expenditure. Kill imports.”

A antithetic idiosyncratic opined:

While the media wants the communicative to beryllium that the user is strong, the numbers accidental otherwise. Decreased savings, accrued debt, and ostentation metrics that are inactive rising MoM, with vigor prices adjacent highs we haven’t seen since 2008.

Several radical agreed that “numbers don’t lie,” and the U.S. system is looking arsenic grim arsenic Burry suggested oregon adjacent worse.

A increasing fig of radical person precocious warned that a recession is either present oregon is imminent, including Tesla CEO Elon Musk, Rich Dad Poor Dad Author Robert Kiyosaki, and Goldman Sachs’ elder president and erstwhile CEO, Lloyd Blankfein.

What bash you deliberation astir Michael Burry’s warning? Let america cognize successful the comments conception below.

3 years ago

3 years ago

English (US)

English (US)