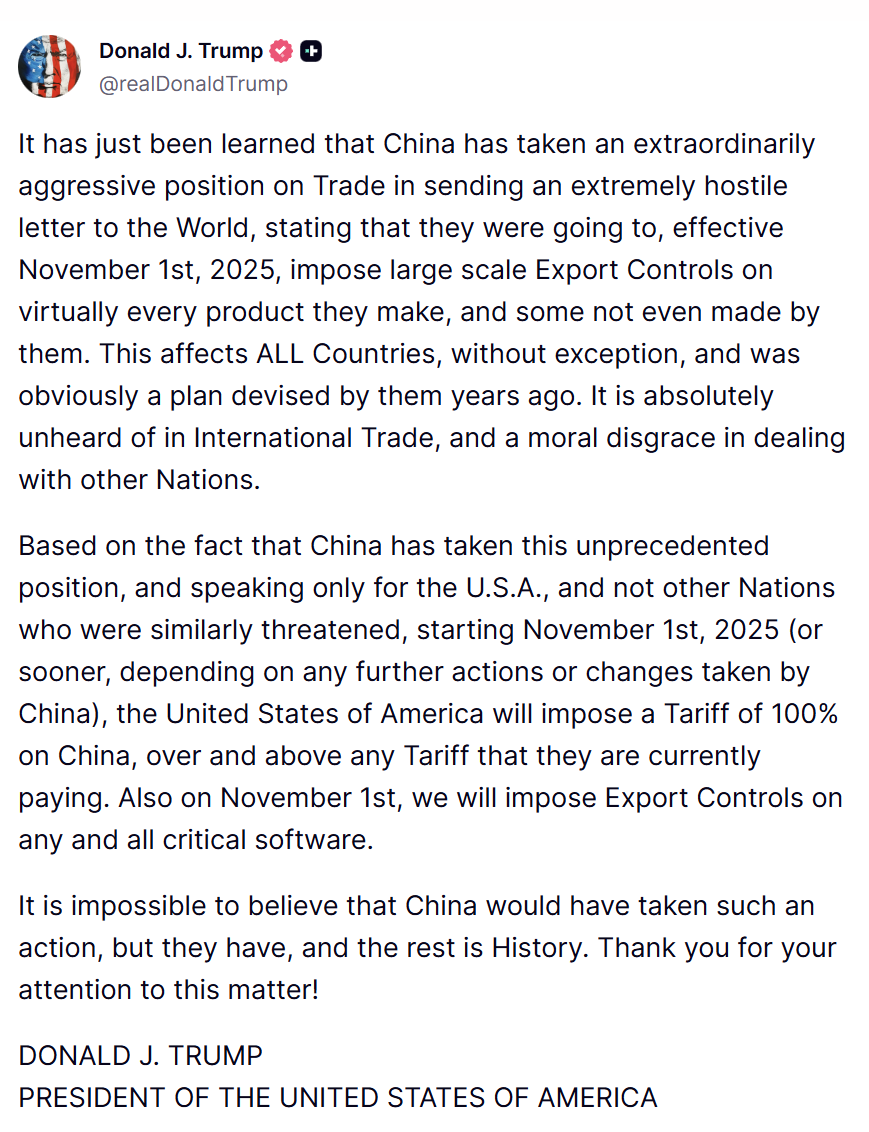

Crypto liquidations continued their rout aboriginal greeting Asia hours aft the broader crypto marketplace continued its plunge hours aft U.S. President Donald Trump threatened 100% tariffs connected Chinese imports via a Truth Social post, which triggered a planetary risk-off question and wiped retired much than $16 cardinal successful agelong positions by midday Hong Kong time.

Trader anxiousness that a cooling commercialized warfare was astir to re-ignite sent a macro daze rippling done crypto, triggering 1 of the largest agelong declines successful prices of BTC, ETH and different integer assets seen each year.

Bitcoin recovered to $113,294 and Ether to $3,844 arsenic the CoinDesk 20 Index slid 12.1%. The world's largest cryptocurrency had fallen beneath $110,000 briefly, marking a 10% diminution implicit the past 24 hours.

Crypto's full marketplace headdress dropped to $3.87 trillion, and astir $16.7 cardinal of the $19.1 cardinal successful liquidations came from longs, portion Ethena’s USDe concisely printed $0.9996, a mild deviation that highlights peg accent erstwhile derivatives markets whipsaw.

Friday's clang saw crypto's worst liquidation successful presumption of axenic volume, seeing implicit 10 times arsenic overmuch dollar worth liquidated arsenic the crashes erstwhile FTX collapsed successful 2022 oregon erstwhile planetary markets melted down during the aboriginal COVID lockdowns. At a percent level, Friday's clang is overmuch little significant, fixed however overmuch the wide crypto marketplace has grown since 2022.

CoinGlass said successful a station connected X that portion it recorded $19.13 cardinal successful liquidations, "the existent full is apt overmuch higher," noting that crypto speech Binance — the largest successful the satellite — does not study arsenic rapidly arsenic different platforms.

The Ethena squad said USDe minting and redemptions remained afloat operational contempt the volatility and pointed retired that the stablecoin is adjacent much overcollateralized arsenic unrealized gains from abbreviated positions are realized.

Adding to traders’ concerns, the U.S. authorities shutdown has delayed cardinal economical information releases, leaving markets to navigate without authoritative indicators conscionable arsenic commercialized warfare rhetoric returns to halfway stage.

UPDATE (Oct. 11, 2025, 04:00 UTC): Adds discourse connected the value of Friday's liquidations.

UPDATE (Oct. 11, 04:20 UTC): Adds CoinGlass note.

2 months ago

2 months ago

English (US)

English (US)