Newly minted Bitcoin protagonist Ray Dalio agrees that Bitcoin should marque up a tiny percent of investors’ portfolios successful 2022.

8753 Total views

58 Total shares

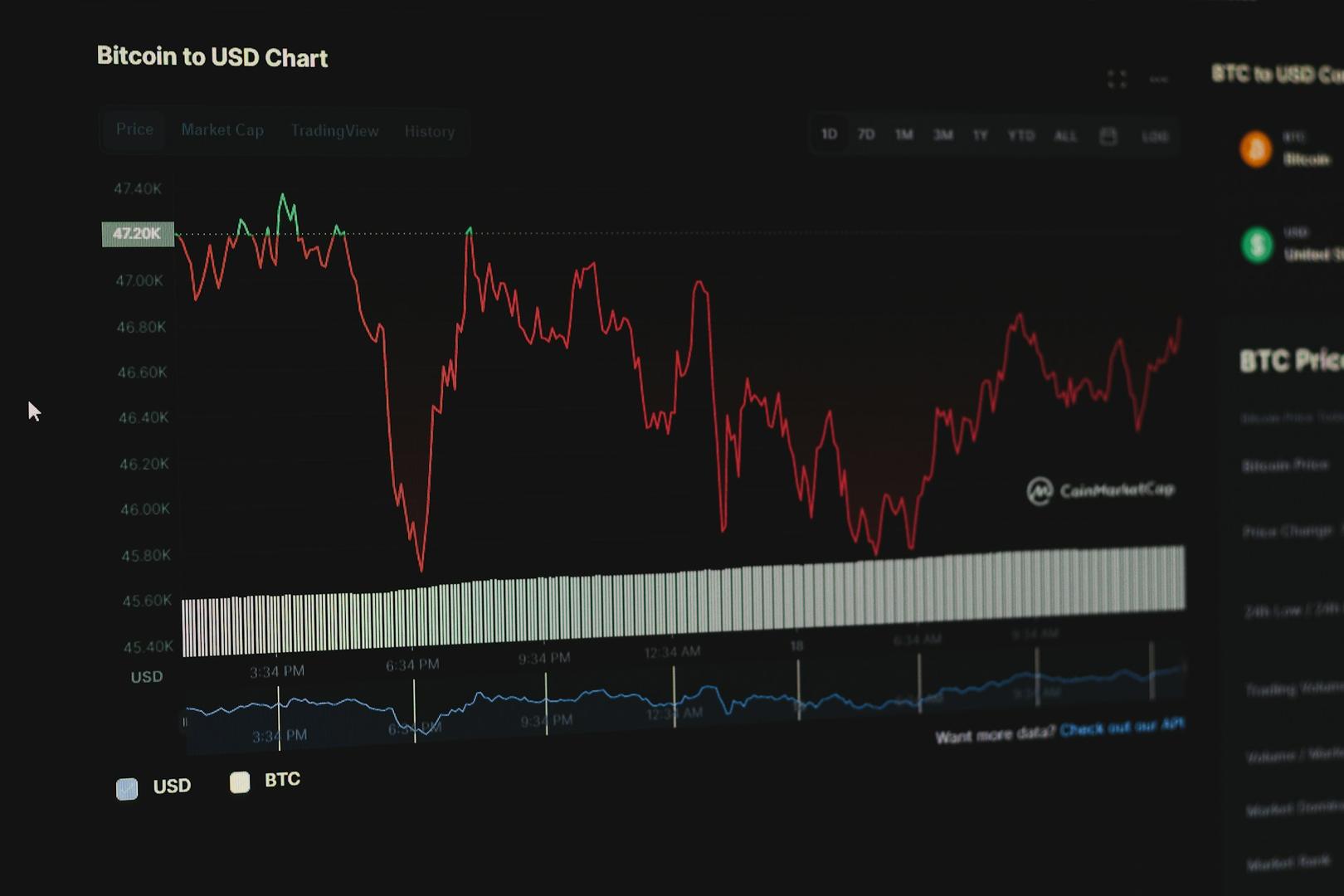

Hedge money manager Ray Dalio remains bullish connected Bitcoin (BTC) successful 2022, listing 3 superior reasons wherefore Bitcoin is “impressive.” In a caller interview with The Investors Podcast, helium talked up golden and BTC arsenic an ostentation hedge.

When prompted by interviewer William Green astir what a sensible allocation for a layperson would be, Dalio said that helium agrees with chap billionaire Bill Miller’s proposition that 1%–2% is the close allocation.

He explained that the web has ne'er been hacked; it has nary amended competitor; and BTC adoption rates would suggest that it could further spot distant astatine gold’s marketplace capitalization:

“Bitcoin present is worthy astir $1 trillion, whereas golden that is not held by cardinal banks and not utilized for jewelry is worthy astir $5 trillion. When I look astatine that, I support that successful caput due to the fact that I think, implicit time, ostentation hedge assets are astir apt likely to bash better.”The laminitis of the world’s largest hedge fund, Bridgewater Associates, Dalio echoed comments made past twelvemonth during the caller interrogation with the podcast, saying helium was impressed that Bitcoin has survived the past decade portion reiterating that helium is “not favorable to cash.”

Related: There’s a Bitcoin roar among Baby Boomers, reports BTC Markets

Dalio did caveat his musings connected the emergence of Bitcoin, highlighting the zealotry surrounding the Bitcoin assemblage arsenic being a imaginable Achilles heel, and arsenic is to beryllium expected for the capitalist known arsenic “Mister Diversification,” helium besides asked a broader question regarding integer assets:

“When does idiosyncratic collect, instrumentality the wealth they made successful Bitcoin and past diversify that and, successful different words, determination to different things?”He waxed lyrical astir nonfungible tokens and different coins arsenic imaginable diversification destinations. For the moment, however, BTC occupies a spot successful his “inflation hedge plus class” alongside gold.

4 years ago

4 years ago

English (US)

English (US)