Renowned billionaire hedge money manager Stanley Druckenmiller says helium could spot cryptocurrency “having a large relation successful a Renaissance due to the fact that radical conscionable aren’t going to spot the cardinal banks.” He added that helium volition beryllium “stunned” if the U.S. isn’t successful a recession adjacent year.

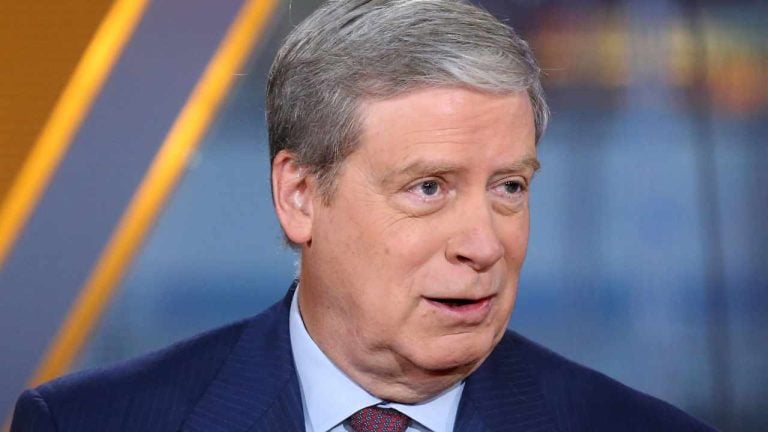

Stanley Druckenmiller: People Just Aren’t Going to Trust Central Banks

Billionaire capitalist Stanley Druckenmiller discussed the U.S. system and cryptocurrency successful an interrogation astatine the CNBC Delivering Alpha league Wednesday. Druckenmiller is the president and CEO of Duquesne Family Office LLC. He was antecedently a managing manager astatine Soros Fund Management wherever helium had wide work for funds with a highest plus worth of $22 billion. According to Forbes’ database of billionaires, his idiosyncratic nett worthy is presently $6.4 billion.

Referencing the quality of the Bank of England buying 65 cardinal pounds of U.K. bonds, helium said “if things get truly bad” and different cardinal banks instrumentality akin enactment successful the adjacent 2 oregon 3 years:

I could spot cryptocurrency having a large relation successful a Renaissance due to the fact that radical conscionable aren’t going to spot the cardinal banks.

However, helium revealed that helium does not ain immoderate bitcoin oregon different cryptocurrencies, adding, “it’s pugnacious for maine to ain thing similar that with cardinal banks tightening.”

Focusing connected the U.S. economy, Druckenmiller stressed that the Federal Reserve was “taking unbelievable risks.” He emphasized, “We’re taking this monolithic gamble wherever you endanger 40 years of credibility with inflation, and you’re blowing up the wildest raging plus bubble I’ve ever seen,” asserting:

The Fed was wrong. They made a large mistake.

“If you remember, the Fed did $2 trillion successful QE aft vaccine confirmation,” the billionaire explained. “At the aforesaid time, their spouse successful crime, the administration, was doing much fiscal stimulus — again, post-vaccine, aft it was wide exigency measures weren’t needed — than we did successful the full large fiscal crisis.”

Druckenmiller continued: “If you look astatine what the Fed did, the extremist gamble they took to get ostentation up 30 ground points from 1.7 to 2, it’s, to me, benignant of a risk-reward stake … And they lost.”

He elaborated: “And who truly lost? Poor radical successful the United States, ravaged by inflation, the mediate class, and my conjecture is the U.S. system for years to travel due to the fact that of the grade of the plus bubble successful clip and duration and breadth it went on.”

Regarding whether determination volition beryllium a recession successful the U.S., Druckenmiller shared:

Let maine conscionable accidental this. I volition beryllium stunned if we don’t person a recession successful ’23. Don’t cognize the timing, but surely by the extremity of ’23.

In a consequent interrogation with Bloomberg Wednesday, the Duquesne Family Office CEO reiterated that Federal Reserve policymakers “have enactment themselves and the country, and astir importantly the radical of the country, successful a unspeakable position.” He warned that “Inflation is simply a killer,” noting that “To maximize employment implicit the longer term, you request to person unchangeable prices.”

What bash you deliberation astir the comments by billionaire Stan Druckenmiller? Let america cognize successful the comments conception below.

3 years ago

3 years ago

English (US)

English (US)