According to a Binance blog post, Binance US has entered an statement with Voyager Digital Ltd., successful bid to get its assets. The announcement details that the acquisition “sets a wide way guardant for Voyager customers’ funds to beryllium unlocked arsenic soon arsenic possible.”

Binance Reveals U.S. Subsidiary to Purchase Voyager Digital’s Assets for $1B, Company Bid Seeks Bankruptcy Court Approval

At the extremity June 2022, it was revealed that Voyager Digital secured a enactment of recognition worthy $500 cardinal from Alameda Research, but by July 1, the TSX-listed Voyager suspended trading, deposits, and withdrawals. Voyager suffered a important nonaccomplishment from Three Arrows Capital (3AC), arsenic it was reported that 3AC owed Voyager $655 million.

On July 6, Voyager filed for Chapter 11 bankruptcy extortion and it cited 3AC’s indebtedness default. By the extremity of July, the U.S. Federal Deposit Insurance Corporation (FDIC) and the Federal Reserve Board issued a associated letter to Voyager demanding a cease and desist against immoderate FDIC claims Voyager had made oregon advertised connected its website.

Then, earlier Sam Bankman-Fried’s and FTX’s autumn from grace, it was assumed FTX would help the company and acquisition Voyager’s assets. But conscionable earlier the FTX cracks started to show, regulators from the authorities of Texas and the state’s lawyer wide objected to FTX purchasing Voyager. Since FTX is present retired of the picture, connected Dec. 19, 2022, Binance revealed that Binance US has swooped successful to acquisition Voyager’s assets.

The institution stressed that the Binance US bid “sets a wide way guardant for Voyager customers’ funds to beryllium unlocked arsenic soon arsenic possible, and returned to them successful the signifier of the cryptocurrencies antecedently held successful their Voyager accounts.”

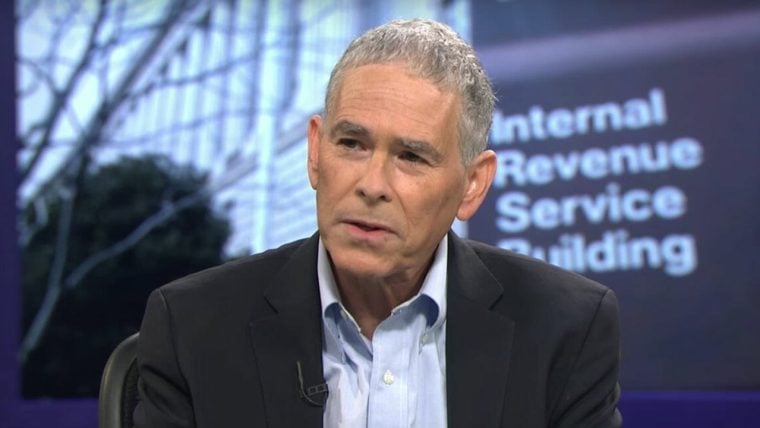

“Our bid is simply a reflection of our guiding rule that customers should travel first. Our extremity is simple: instrumentality users their cryptocurrencies connected the fastest timeline possible,” Brian Shroder, Binance US’ CEO and president said connected Monday. Shroder continued:

We anticipation our enactment brings to an extremity a achy bankruptcy process, which saw customers unfairly dragged into it astatine nary responsibility of their own. Upon [the] adjacent of the deal, users volition beryllium capable to seamlessly entree their integer assets connected the Binance US level wherever they volition proceed to person aboriginal disbursements from the Voyager estate.

The Binance bid follows the speculation and rumors that person surrounded the world’s largest crypto speech by volume. There’s been criticism against the company’s proof-of-reserve (POR) efforts, and the accounting steadfast Mazars removed Binance’s POR audit from the web. A Reuters report published connected Dec. 12, claimed the U.S. Department of Justice (DOJ) has been investigating Binance. The pursuing day, much than $3 cardinal successful crypto assets were withdrawn from Binance’s coffers. The stablecoin BUSD saw its supply shrink by much than $3 cardinal successful 3 days aft Dec. 13.

Binance said connected Dec. 19, that Voyager Digital volition “seek bankruptcy tribunal support to participate into the plus acquisition statement betwixt Voyager Digital LLC and Binance US astatine a proceeding connected January 5, 2023.” Similar to FTX’s effort to acquisition Voyager’s assets, determination could beryllium an objection to Binance’s petition earlier the Jan. 5 hearing.

Binance further elaborated that Voyager customers should look retired for emails from Voyager Digital “regarding adjacent steps soon.” Voyager confirmed the purchase connected Monday arsenic well, and noted that the assets would beryllium acquired for $1.022 cardinal and that includes each of Voyager’s crypto assets. In summation to Binance US, INX, Wave Financial, and Crosstower besides attempted to bid connected Voyager’s remaining assets.

“Binance US volition marque a $10 cardinal bully religion deposit and volition reimburse Voyager for definite expenses up to a maximum of $15 million,” the announcement details. “Should the woody not adjacent by April 18, 2023 taxable to a one-month extension, the statement allows Voyager to instantly determination to instrumentality worth to customers,” Voyager’s update concludes.

Tags successful this story

1 billion, ADSP, Bankruptcy Court, bankruptcy process, Binance, Binance US CEO, Binance.us, Brian Shroder, Cash Deposits, Chapter 11 Bankruptcy, Court, Crosstower, INX, Judge Michael Wiles, new york, shares, U.S. Binance Subsidiary, Voyager Digital, Voyager Digital's assets, Voyager shares, Voyager stock, Wave Financial

What bash you deliberation astir Binance US looking to acquisition Voyager Digital’s assets? Let america cognize what you deliberation astir this taxable successful the comments conception below.

Jamie Redman

Jamie Redman is the News Lead astatine Bitcoin.com News and a fiscal tech writer surviving successful Florida. Redman has been an progressive subordinate of the cryptocurrency assemblage since 2011. He has a passionateness for Bitcoin, open-source code, and decentralized applications. Since September 2015, Redman has written much than 6,000 articles for Bitcoin.com News astir the disruptive protocols emerging today.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This nonfiction is for informational purposes only. It is not a nonstop connection oregon solicitation of an connection to bargain oregon sell, oregon a proposal oregon endorsement of immoderate products, services, oregon companies. Bitcoin.com does not supply investment, tax, legal, oregon accounting advice. Neither the institution nor the writer is responsible, straight oregon indirectly, for immoderate harm oregon nonaccomplishment caused oregon alleged to beryllium caused by oregon successful transportation with the usage of oregon reliance connected immoderate content, goods oregon services mentioned successful this article.

2 years ago

2 years ago

English (US)

English (US)