Bitcoin’s caller marketplace enactment reveals important shifts successful request and accumulation patterns among ample holders, suggesting imaginable influences connected its terms trajectory. The apical cryptocurrency’s terms surged from astir $40,000 successful January 2024 to supra $70,000 by March earlier retracing. It has precocious begun to again endanger $70,000, coinciding with notable increases successful evident request and whale holdings.

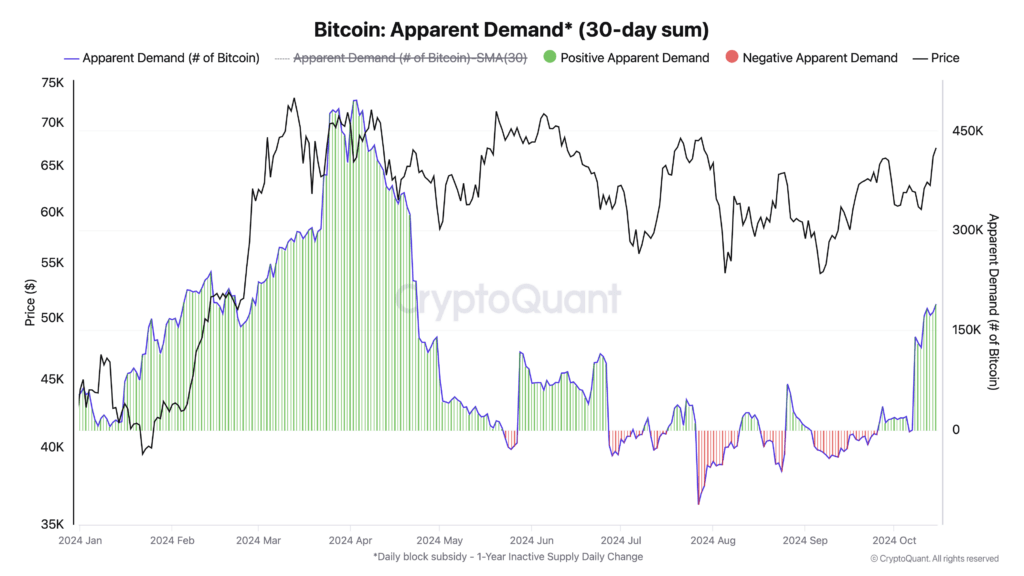

Data indicates that the evident request for Bitcoin roseate sharply successful aboriginal 2024, aligning with the terms escalation. Positive request periods, marked by increases successful request comparative to erstwhile intervals, were prevalent during this time. A renewed surge successful request appears to person again fueled the caller terms hike, demonstrating a beardown correlation betwixt request trends and marketplace valuation.

Bitcoin evident request | Source: CryptoQuant

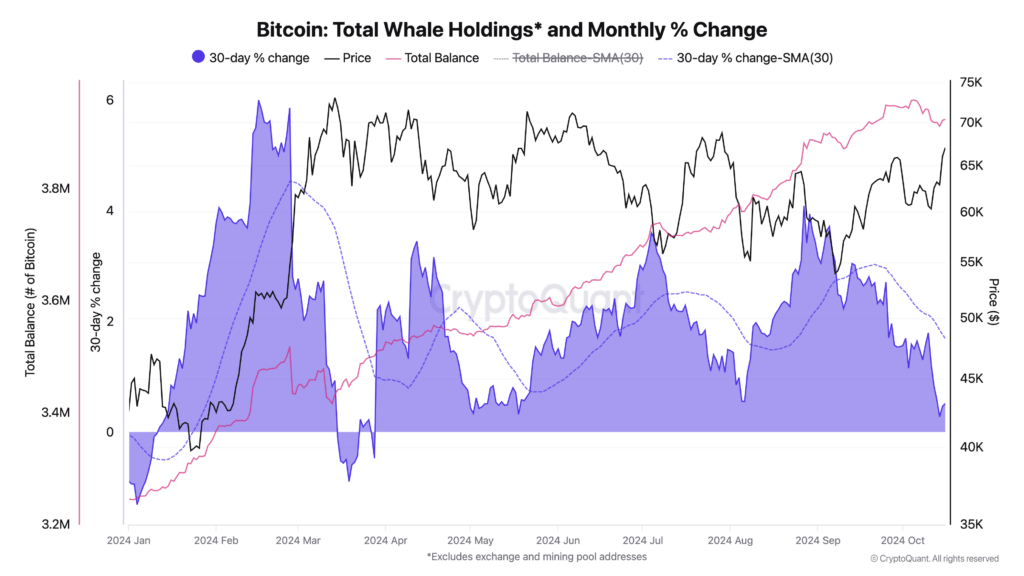

Bitcoin evident request | Source: CryptoQuantWhale holdings—accounts holding important amounts of Bitcoin—also exhibited important activity. Total whale holdings accrued steadily from astir 3.2 cardinal BTC astatine the commencement of the twelvemonth to implicit 3.7 cardinal by October.

Bitcoin full whale holdings | Source: CryptoQuant

Bitcoin full whale holdings | Source: CryptoQuantThe monthly percent alteration successful these holdings spiked betwixt January and April, reflecting accelerated accumulation arsenic prices climbed. However, the mediate of the twelvemonth saw fluctuations, with steep drops successful holdings during June, followed by a robust betterment approaching October.

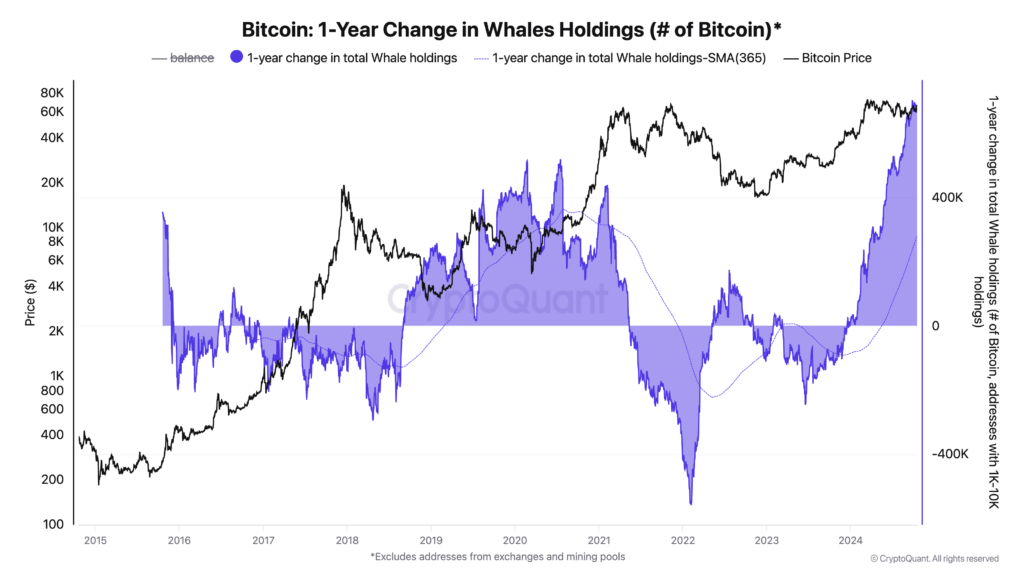

Bitcoin 1-year alteration successful whale holdings | Source: CryptoQuant

Bitcoin 1-year alteration successful whale holdings | Source: CryptoQuantLong-term investigation shows that whale behaviour often mirrors large marketplace movements. Periods of accrued whale accumulation person historically corresponded with important upward terms trends. For instance, important accumulation occurred during the 2020-2021 bull run, with whales adding to their holdings arsenic Bitcoin’s terms escalated. Conversely, aft terms peaks, whales thin to trim their holdings, suggesting strategical profit-taking oregon marketplace repositioning.

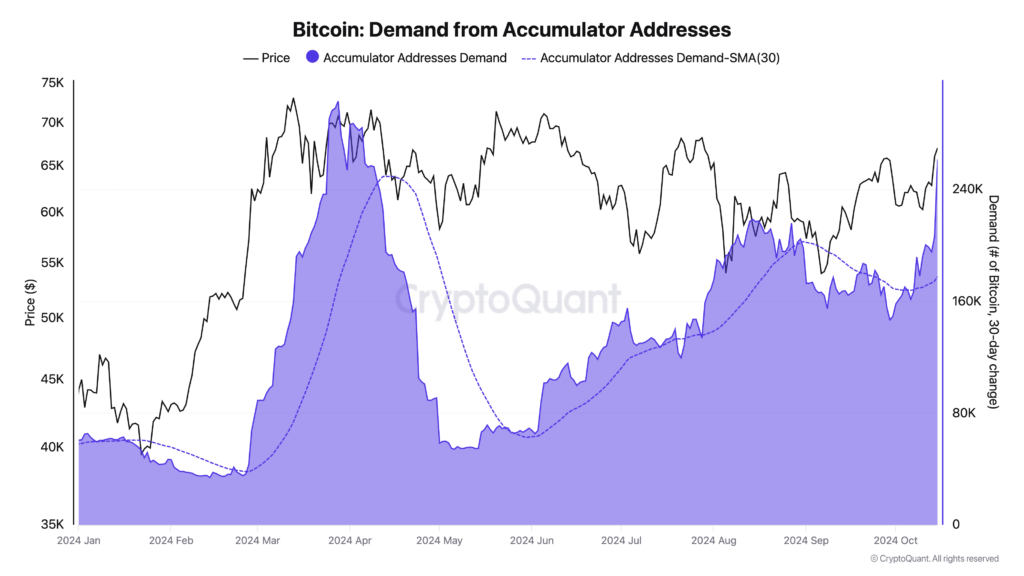

Accumulator addresses—wallets that clasp oregon consistently summation their Bitcoin holdings—also play a important relation successful the marketplace forces of 2024. Demand from these addresses has begun rising rapidly this month, closing successful connected the highest from Bitcoin’s all-time precocious terms successful precocious March.

Bitcoin request from accumulator addresses | Source: CryptoQuant

Bitcoin request from accumulator addresses | Source: CryptoQuantThe interplay betwixt these factors highlights the power of ample holders connected Bitcoin’s marketplace behavior. Whales and accumulator addresses look to enactment successful anticipation of terms movements, accumulating during upswings and adjusting holdings during downturns. Their activities bespeak marketplace sentiment but whitethorn besides lend to terms volatility.

While the correlation betwixt demand, whale activity, and terms is evident, causation remains a analyzable topic. Market forces are influenced by a myriad of factors, including macroeconomic conditions, regulatory developments, and broader capitalist sentiment. However, the observed patterns suggest that monitoring whale holdings and accumulator request tin supply invaluable insights into imaginable marketplace trends.

As Bitcoin matures arsenic an plus class, knowing the behaviors of its largest holders continues to beryllium progressively important. Their actions tin awesome shifts successful marketplace momentum and connection clues astir aboriginal terms movements. The accumulation patterns observed this period whitethorn bespeak strategical positioning by ample investors, perchance mounting the signifier for the adjacent important marketplace phase.

The station Bitcoin accumulation fuels marketplace uptick signaling imaginable surge successful price appeared archetypal connected CryptoSlate.

1 year ago

1 year ago

English (US)

English (US)