Bitcoin holders person again reaffirmed their religion successful the flagship crypto contempt its caller terms declines. This follows caller information showing that Bitcoin accumulation addresses recorded a caller all-time precocious (ATH) amidst the existent marketplace downward trend.

Accumulation Addresses Record New All-Time High Of Bitcoin Inflows

Data from the on-chain analytics level CryptoQuant shows that implicit 27,700 BTC was transferred into accumulation addresses betwixt April 16 and 17. This is simply a caller all-time precocious (ATH) for these addresses successful presumption of their regular Bitcoin inflows.

Before now, the highest magnitude of BTC sent to these addresses successful a time stood astatine 25,500, recorded connected March 23 earlier this year. Interestingly, the March 23 grounds came conscionable astir a period aft Bitcoin inflows into accumulation addresses hit an all-time precocious (ATH) of 25,300 BTC connected February 21.

Accumulation addresses are wallets with nary outgoing transactions and person a equilibrium of implicit 10 BTC. Accounts belonging to centralized exchanges and Bitcoin Miners are excluded from this category. Meanwhile, these addresses indispensable person received 2 incoming transactions, with the astir caller occurring wrong the past 7 years.

These addresses tin beryllium considered the astir bullish connected Bitcoin, and the increasing accumulation inclination from these wallets shows however overmuch religion these semipermanent holders person successful the flagship crypto. Furthermore, they are besides believed to beryllium positioning themselves up of the bull run, arsenic BTC whitethorn ne'er driblet to these terms levels erstwhile it comes into afloat force.

Meanwhile, CryptoQuant’s CEO, Ki Young Ju, besides highlighted the value of this development, noting that on-chain accumulation has remained “very active” adjacent arsenic the request for Spot Bitcoin ETFs has stagnated for 4 weeks. This suggests that Bitcoin bulls could assistance enactment up the request spread near unfastened by these ETFs.

BTC Price Shows Strength

Bitcoin dropped beneath the $60,000 enactment level pursuing reports astir Israel’s retaliatory attack connected Iran. However, the flagship crypto showed spot arsenic it rapidly rebounded supra the $60,000 terms mark. This is important considering however overmuch Bitcoin and the broader crypto marketplace declined rapidly pursuing Iran’s onslaught against Israel connected April 13.

Furthermore, the speedy terms betterment besides suggests that Bitcoin has established beardown enactment astir the $60,000 terms scope and could beryllium acceptable for a parabolic determination to the upside erstwhile this play of consolidation is over. Crypto expert Crypto Rover besides recently commented connected Bitcoin’s aboriginal trajectory, stating that the crypto token volition travel retired with a “banger” soon enough.

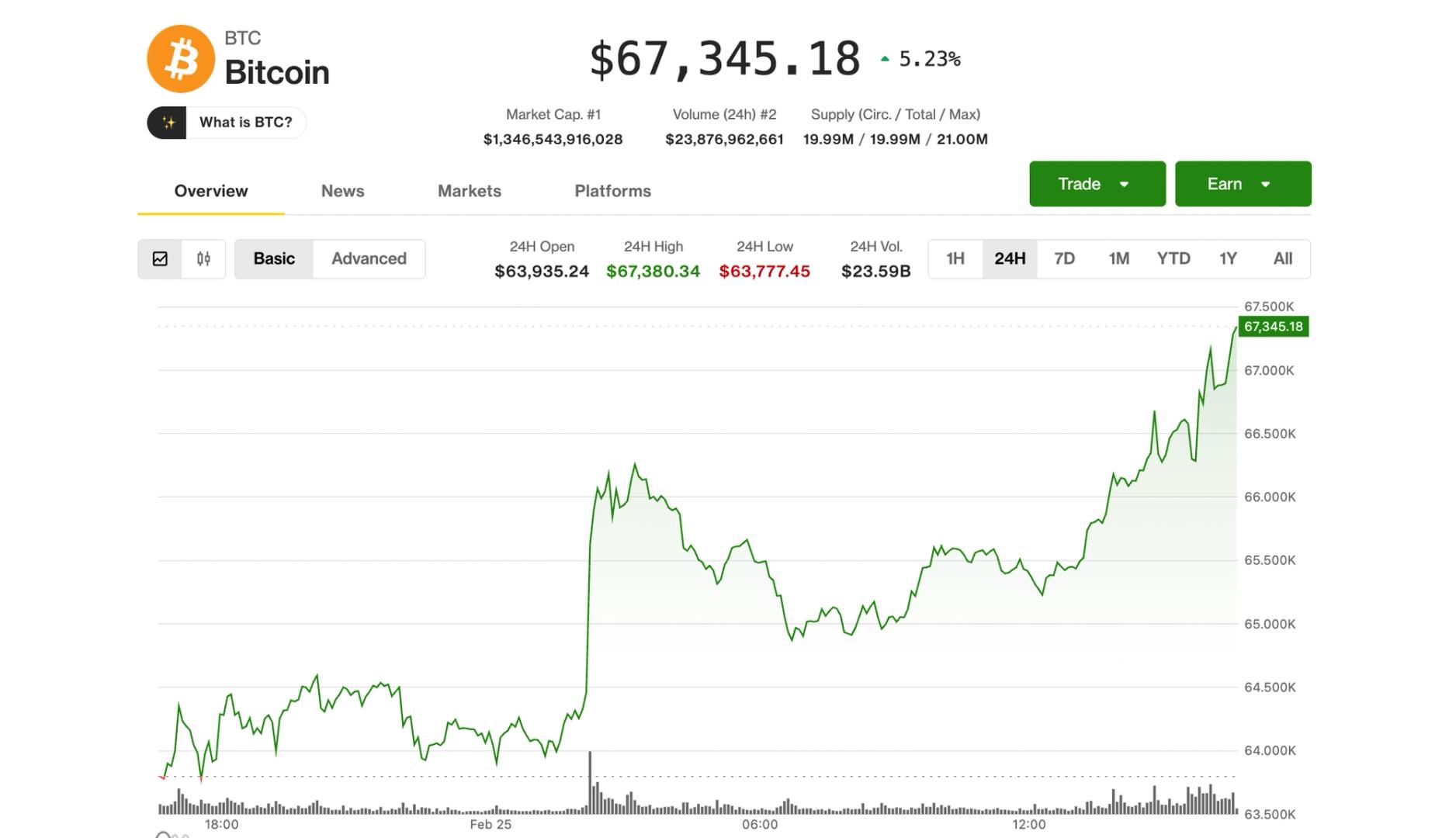

At the clip of writing, Bitcoin is trading astatine astir $62,000, up successful the past 24 hours according to data from CoinMarketCap.

Featured representation from Crypto News, illustration from Tradingview.com

Disclaimer: The nonfiction is provided for acquisition purposes only. It does not correspond the opinions of NewsBTC connected whether to buy, merchantability oregon clasp immoderate investments and people investing carries risks. You are advised to behaviour your ain probe earlier making immoderate concern decisions. Use accusation provided connected this website wholly astatine your ain risk.

1 year ago

1 year ago

English (US)

English (US)