Bitcoin has seen immoderate alleviation successful the past mates of days with a 4.5% nett successful 24-hours. The archetypal crypto by marketplace headdress trades astatine $42,947, aft climbing backmost from the lows astatine astir $39,000.

BTC trends to the upside successful the 1-hour chart. Source: BTCUSD Tradingview

BTC trends to the upside successful the 1-hour chart. Source: BTCUSD TradingviewRelated Reading | TA: Bitcoin Bounces To $42K, Why BTC Could Recover To $43.5K

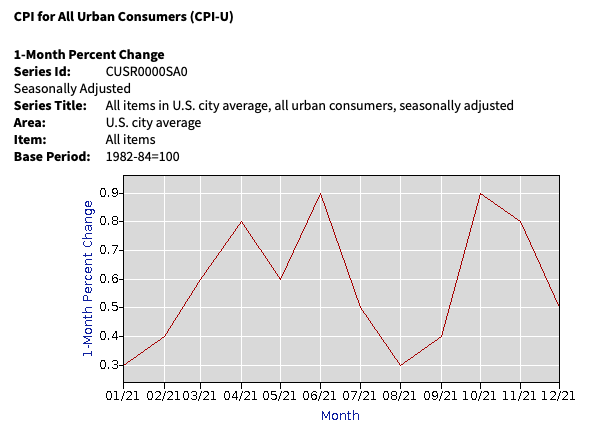

The caller bullish terms enactment comes astatine the heels of the astir caller Consumer Price Index (CPI) study published successful the U.S.; the metric has go 1 of the apical issues for investors astir the world. Used to measurement ostentation successful U.S. dollars, the CPI printed a 7% for December 2021.

The metric recorded a percent beneath investors’ expectations and was mostly 1 of the reasons Bitcoin saw a speedy recovery. However, it stood astatine a 40 twelvemonth precocious suggesting the contented volition stay a precedence for fiscal institutions crossed 2022.

As seen below, idiosyncratic ostentation information paints a antithetic representation with galore sectors reaching treble digits for their year-over-year periods. This includes aesculapian attraction with 37.3%, proscription with 21%, and vigor with 29.3%.

The full ostentation misery successful 1 chart! US ostentation of 7% is highest since 1980s. Monthly terms increases travel successful higher than expected. Used cars, food, covering thrust terms gains. (Chart via @MOstwald1) pic.twitter.com/mJOCun6UOK

— Holger Zschaepitz (@Schuldensuehner) January 12, 2022

Inflation has caused the U.S. Federal Reserve and its Chairman Jerome Powell to hint astatine tapering and an summation successful involvement rates. At the moment, ostentation fears person been reduced, but could soon instrumentality to warrant a displacement successful the fiscal institution’s monetary policy. According to Yuya Hasegawa, expert for bitbank:

(…) if the CPI and PPI crook retired to beryllium higher than the marketplace expects, they could rekindle ostentation fearfulness and, successful turn, besides warrant the first-rate hike arsenic aboriginal arsenic this March. According to the CME’s FedWatch, astir 70% of the marketplace participants are expecting the March complaint hike, truthful bitcoin whitethorn beryllium capable to support $40k successful lawsuit of different sell-off, but it surely is not the clip for optimism successful the abbreviated run.

Bitcoin, More Blood In The Short Term?

Therefore, the expert believes $44,000 to $48,000 to run arsenic short-term important absorption levels. A interruption supra the second could propulsion Bitcoin to the precocious of its existent range, adjacent $50,000, otherwise, the crypto could re-visit the lows, arsenic it has been moving implicit the past weeks.

Data from Material Indicators indicates precise small enactment for Bitcoin beneath its existent levels. Over $12 cardinal successful bid orders are stacked successful the $39,000 to $40,000, with astir the aforesaid magnitude successful inquire orders astir the $44,000 to $45,000 area.

Bid bid for Bitcoin (price successful blue) that could enactment arsenic enactment adjacent $40,000. Source: Material Indicators

Bid bid for Bitcoin (price successful blue) that could enactment arsenic enactment adjacent $40,000. Source: Material IndicatorsThis goes to amusement the uncertainty successful the market, but with Bitcoin inactive holding connected to immoderate bullish terms action. If the ostentation metrics successful the U.S. proceed to inclination to the downside oregon beneath investors’ expectations, the archetypal crypto could resume its upside inclination with much spot successful the coming months.

Related Reading | President Bukele Predicts BTC At $100k With Hope That More Countries Adopt It As Legal Tender

Jan Wüstenfeld, expert for CryptoQuant, wrote the pursuing connected the CPI and its imaginable interaction connected BTC’s terms successful the agelong term:

(…) if it (inflation) continues coming down successful the adjacent months this would beryllium the cleanable excuse for the FED to reverse its hawkish stance, which would beryllium bullish for Bitcoin.

Source: Jan Wüstenfeld via Twitter

Source: Jan Wüstenfeld via Twitter

3 years ago

3 years ago

English (US)

English (US)