Michael Saylor’s hint astir a caller Bitcoin acquisition has renewed speech among traders and investors, adjacent arsenic on-chain accent signals constituent to a tougher agelong for the network. The premix of dense buying by nationalist firms and signs of miner strain is drafting attraction from some bulls and bears.

Saylor’s Tracker Signals

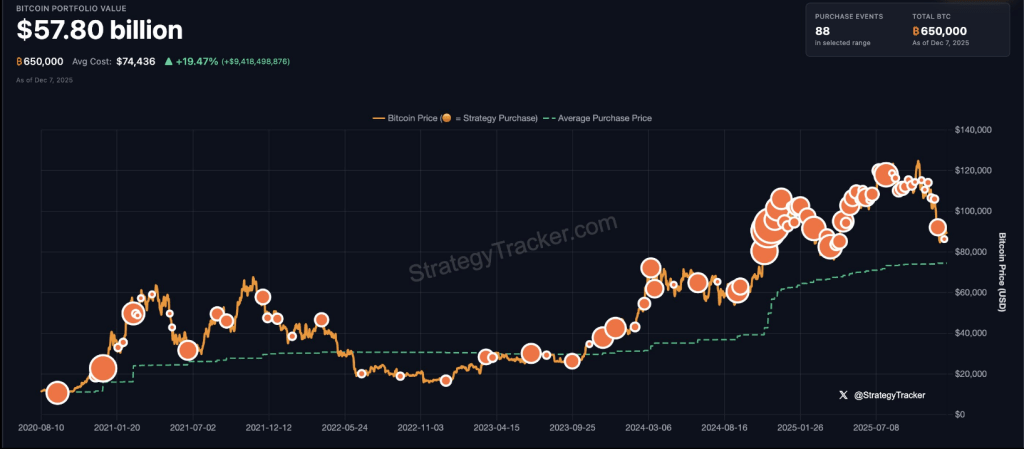

According to a StrategyTracker illustration shared by Michael Saylor, Strategy holds astir 650,000 BTC with a portfolio worth adjacent $58 billion. The illustration lists an mean acquisition terms of $74,436 and shows 88 confirmed bargain events implicit time.

Saylor captioned the representation “Back to Orange Dots?” — a short, acquainted cue that has often travel earlier a caller accumulation round.

Strategy’s astir caller reported determination was a 130 BTC buy, which fits the company’s agelong wont of adding during periods of marketplace fear. That signifier matters due to the fact that erstwhile an entity repeatedly buys done downswings, it shapes however different investors react.

₿ack to Orange Dots? pic.twitter.com/npB0NWSZ52

— Michael Saylor (@saylor) December 7, 2025

Corporate Buying Continues

Based connected reports from BitcoinTreasuries.NET, the apical 100 nationalist firms present clasp astir 1,059,453 BTC combined. ABTC reportedly added 363 BTC, the largest summation this week, portion Cango Inc. purchased 130.6 BTC.

Other names cited successful caller filings see Bitdeer, BitFuFu, Hyperscale Data, Genius Group, and Bitcoin Hodl Co. These moves amusement that immoderate companies support expanding reserves adjacent erstwhile prices wobble.

For marketplace watchers, dependable firm accumulation tin beryllium a calming force, though it does not erase broader merchantability pressure.

On-Chain Stress Indicators

According to Glassnode charts shared by the Bitcoin Archive, the Hash Ribbon has shifted bearish again, a motion that immoderate miners are facing accent oregon adjacent pausing operations.

Short-Term Holder NUPL has fallen beneath zero, meaning galore caller buyers are holding coins astatine a loss. Historically, episodes wherever miners are squeezed astatine the aforesaid clip caller holders are underwater person appeared adjacent important lows.

That result is not certain, but the operation of method miner strain and unrealized losses among short-term wallets is the benignant of setup traders ticker closely.

What Traders Are Watching Now

Traders are monitoring whether the miner accent and losses among caller buyers volition coincide with renewed buying by large holders.

Some expect that firm purchases and purchases by Strategy could blunt downside and spark a rebound. Others stay cautious due to the fact that on-chain indicators constituent to existent strain.

Market enactment astir large events, similar cardinal slope announcements, has besides shown Bitcoin tin stall earlier argumentation moves and past determination sharply after.

Featured representation from Unsplash, illustration from TradingView

2 months ago

2 months ago

English (US)

English (US)