Bitcoin is trending little astatine spot rates, sliding distant from all-time highs. Looking astatine the show successful the regular chart, it looks similar bears are stepping up, pursuing the wide inactivity successful an overwhelmingly bearish trend. When writing, the coin is down 10% from March 2024 highs but steady.

Will Bitcoin Consolidate For Two More Months?

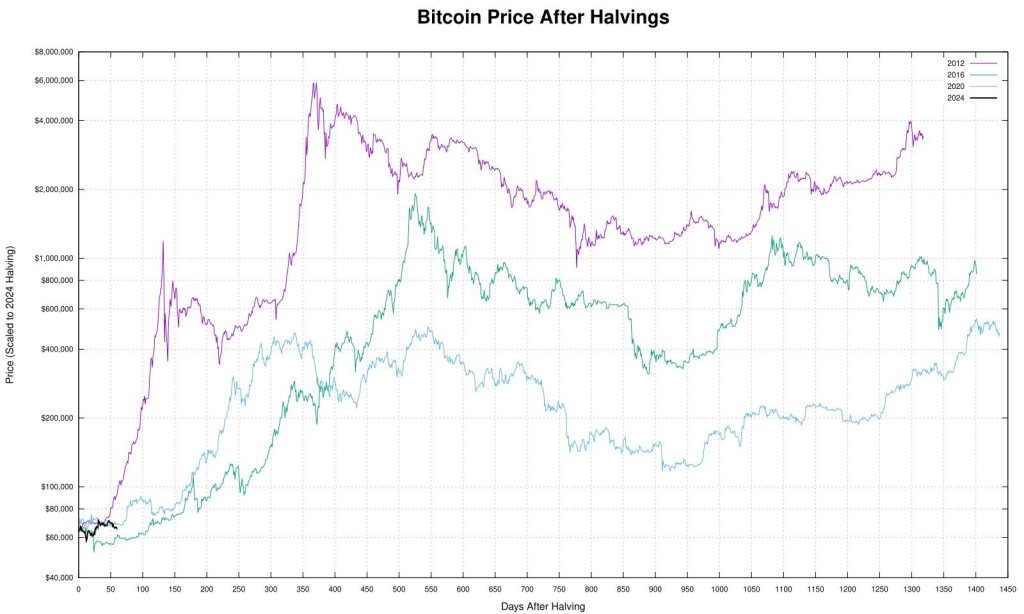

Taking to X, 1 expert argued that the existent authorities of affairs volition apt proceed successful the days ahead. While astir experts predicted Bitcoin prices to rebound sharply, adjacent breaching all-time highs and contention to $100,000 aft the all-important Halving lawsuit connected April 20, bears person had the precocious hand.

BTC prices apt to consolidate | Source: @QuintenFrancois via X

BTC prices apt to consolidate | Source: @QuintenFrancois via XSo far, the coin is stuck successful a wide horizontal scope with caps astatine astir $74,000 connected the precocious extremity and $56,500, registered successful May. Technically, the uptrend remains from a top-down preview pursuing the welcomed propulsion higher successful Q1 2024.

However, adjacent arsenic traders expect much gains successful the days ahead, the expert said prices volition apt stagnate successful the adjacent fewer trading weeks.

When the web halved web rewards successful 2020, the expert notes that the coin moved sideways for 150 days, with prices capped betwixt $9,000 and $11,000. Currently, the sideways consolidation, the expert added, has been for 90 days, astir halfway done the past cycle.

If this guides, prices could proceed moving sideways for the adjacent 2 months, adjacent dumping beneath the key enactment levels.

Thus far, Bitcoin carnivore bars are banding on the little BB, pointing to aggravated selling momentum. At the aforesaid time, the divergence betwixt the mediate and little BB points to rising volatility, swinging successful favour of sellers.

Crypto Hedge Funds Reducing BTC Exposure As Whales Sell Via OTC

Currently, macroeconomic factors and on-chain information overgarment a origin for concern. One expert observed that much crypto hedge funds person reduced their BTC exposure, indicating a nonaccomplishment of confidence.

Over the past 20 trading days, the expert claims that crypto hedge funds person slashed their Bitcoin marketplace vulnerability to 0.37, the lowest level since October 2020.

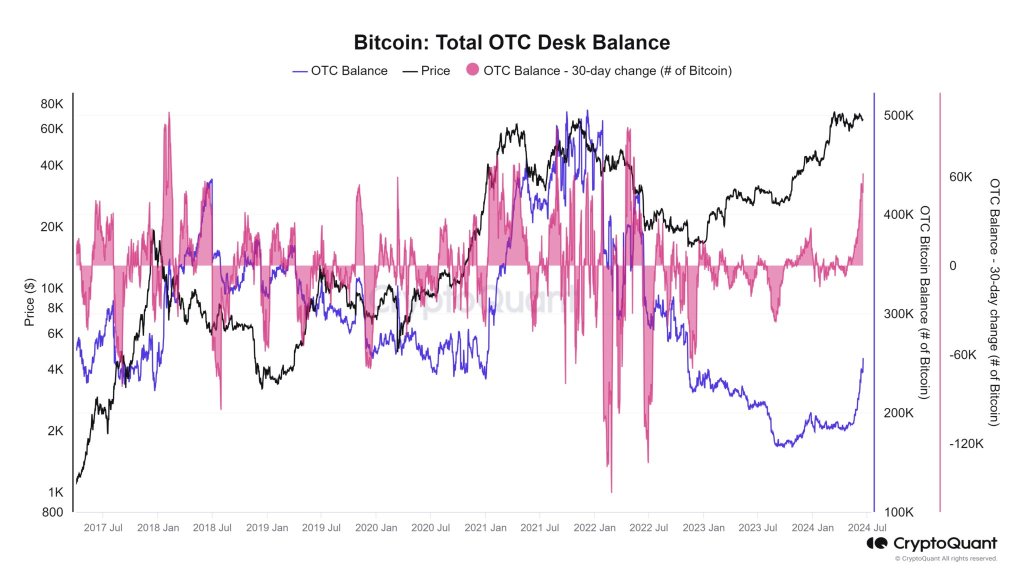

While crypto hedge funds trim exposure, different expert said inflow to over-the-counter (OTC) desks has risen since Halving.

BTC inflow to OTC desks rising | Source: @jvs_btc via X

BTC inflow to OTC desks rising | Source: @jvs_btc via XThis suggests that miners oregon large institutions are offloading BTC distant from exchanges. On-chain information shows that OTC balances roseate by 62,000 BTC, 1 of the largest 30-day recorded changes since 2017.

Feature representation from DALLE, illustration from TradingView

3 months ago

3 months ago

English (US)

English (US)