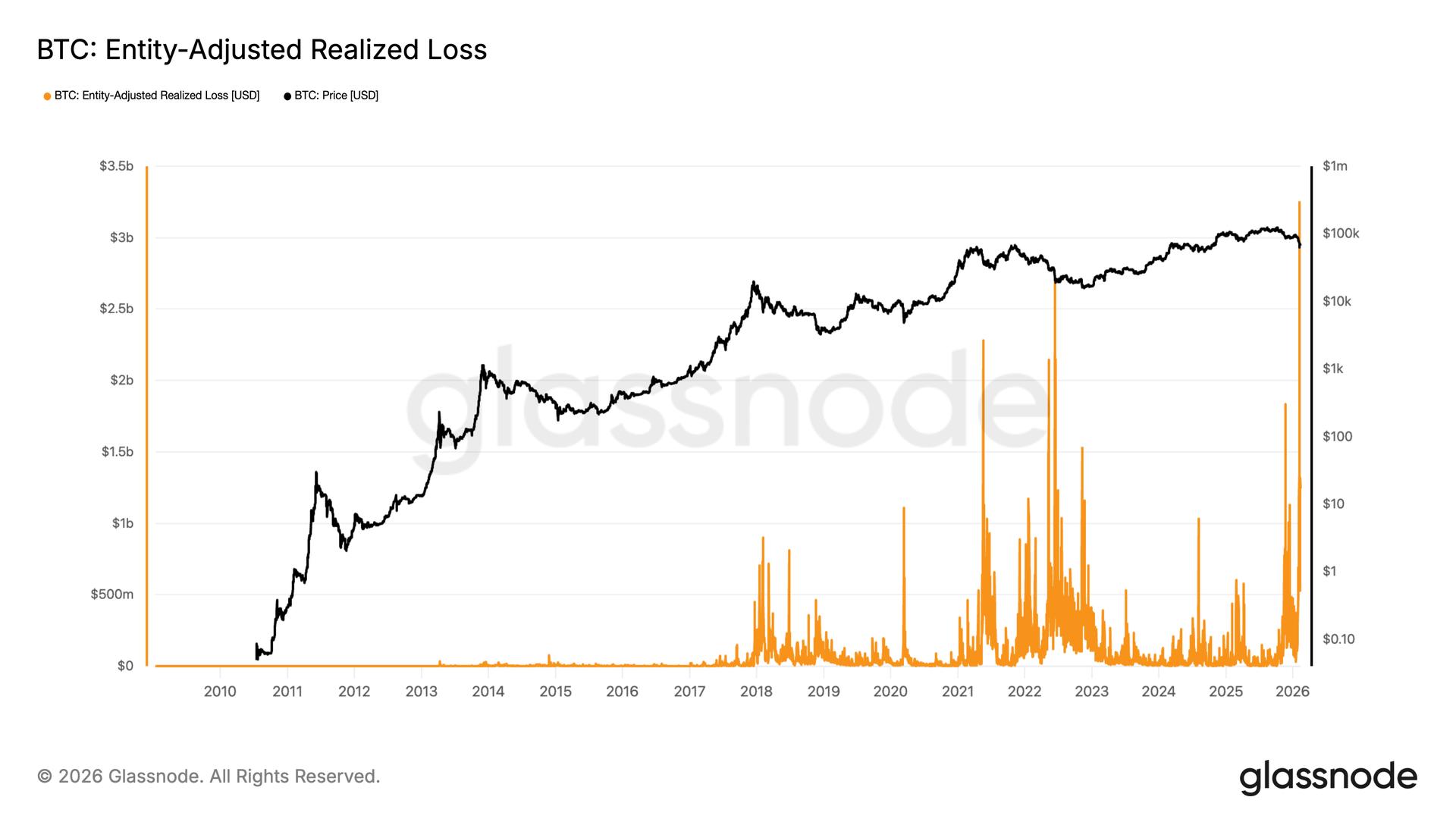

Fresh information from Glassnode claims that Bitcoin (BTC) could beryllium successful for different “prolonged signifier of range-bound” terms enactment if cardinal enactment levels are not reclaimed.

Key takeaways:

Bitcoin is stuck betwixt cardinal cost-basis levels, predicting 2022-type consolidation unless cardinal enactment levels are reclaimed.

Bitcoin terms needs to instrumentality retired the absorption astatine $72,000 to interruption retired of consolidation.

Bitcoin faces overhead proviso challenges

In the Feb. 11 variation of its regular newsletter, The Week On-chain, onchain information supplier Glassnode confirmed cardinal proviso zones constraining upside follow-through and “creating overhead absorption imaginable during alleviation rallies.

The BTC/USD brace is trading wrong a caller scope defined by the True Market Mean presently astatine $79,200 and the realized terms adjacent $55,000, intimately resembling the structural situation observed during the archetypal fractional of 2022.

According to Glassnode, Bitcoin’s terms is expected to proceed oscillating wrong this corridor until caller buyers look and gradually accumulate supply.

The illustration beneath shows that the terms spent the play betwixt April 2022 and June 2022 trapped betwixt the True Market Mean and the Realized Price earlier entering an extended carnivore market, bottoming astir $15,000 successful November 2022.

Related: Bankers propulsion OCC to dilatory crypto spot charters until GENIUS rules clarified

A interruption retired of this scope would necessitate an utmost catalyst, “either a decisive reclaim of the True Market Mean adjacent $79.2K, signaling renewed structural strength, oregon a systemic dislocation akin to LUNA oregon FTX that forces terms beneath the Realized Price astir $55K,” Glassnode said, adding:

“In the lack of specified extremes, a prolonged signifier of range-bound absorption remains the astir probable way for the mid-term market.” Bitcoin hazard indicator: Realized terms and outgo basis. Source: Glassnode

Bitcoin hazard indicator: Realized terms and outgo basis. Source: GlassnodeGlassnode’s UTXO Realized Price Distribution (URPD), a metric that shows astatine which prices the existent acceptable of Bitcoin UTXOs were created, besides revealed wide and dense proviso zones supra $82,000 that person been gradually maturing into the semipermanent holder cohorts.

“Overhead proviso remains structurally heavy, with important clusters positioned betwixt $82K–$97K and $100K–$117K, representing cohorts present holding important unrealized losses,” the onchain information analytics level said, adding:

“These zones whitethorn enactment arsenic latent sell-side overhang, peculiarly if prolonged clip nether h2o oregon renewed downside volatility triggers further capitulation.” Bitcoin’s UTXO Realized Price Distribution (URPD). Source: Glassnode

Bitcoin’s UTXO Realized Price Distribution (URPD). Source: GlassnodeBitcoin “whales are closing longs and opening shorts comparative to retail,” said laminitis and CEO of Alphractal Joao Wedson successful a caller X post, adding:

“There is simply a precocious probability that Bitcoin volition participate a consolidation phase, ranging and gathering operation implicit the adjacent 30 days.” Bitcoin whales vs retail delta. Source: Alphractal

Bitcoin whales vs retail delta. Source: AlphractalBitcoin terms is stuck betwixt 2 cardinal levels

Bitcoin’s 20% recovery from 15-month lows beneath $60,000 was rejected by absorption from the $72,000 level.

It is present consolidating wrong the precocious established enactment beneath $65,000 and the absorption astatine $68,000, which expert Daan Crypto Trades said bulls indispensable “break supra to onslaught $72,000 again.”

Source: Daan Crypto Trades

Source: Daan Crypto TradesCoinGlass’ liquidation heatmap shows Bitcoin successful a classical liquidation sandwich with dense inquire orders betwixt $69,000 and $72,000 and dense bid positions beneath $66,000, arsenic shown successful the fig below. This highlights the comparative tightness of the existent marketplace structure.

Bitcoin liquidation heatmap. Source: CoinGlass

Bitcoin liquidation heatmap. Source: CoinGlassAs Cointelegraph reported, Bitcoin indispensable instrumentality retired absorption astatine $72,000 to revive the hopes of a betterment toward the 20-day EMA astatine $76,000 and the 50-day SMA supra $85,000, suggesting that the BTC terms whitethorn person bottomed retired successful the adjacent term.

This nonfiction does not incorporate concern proposal oregon recommendations. Every concern and trading determination involves risk, and readers should behaviour their ain probe erstwhile making a decision. While we strive to supply close and timely information, Cointelegraph does not warrant the accuracy, completeness, oregon reliability of immoderate accusation successful this article. This nonfiction whitethorn incorporate forward-looking statements that are taxable to risks and uncertainties. Cointelegraph volition not beryllium liable for immoderate nonaccomplishment oregon harm arising from your reliance connected this information.

2 hours ago

2 hours ago

English (US)

English (US)