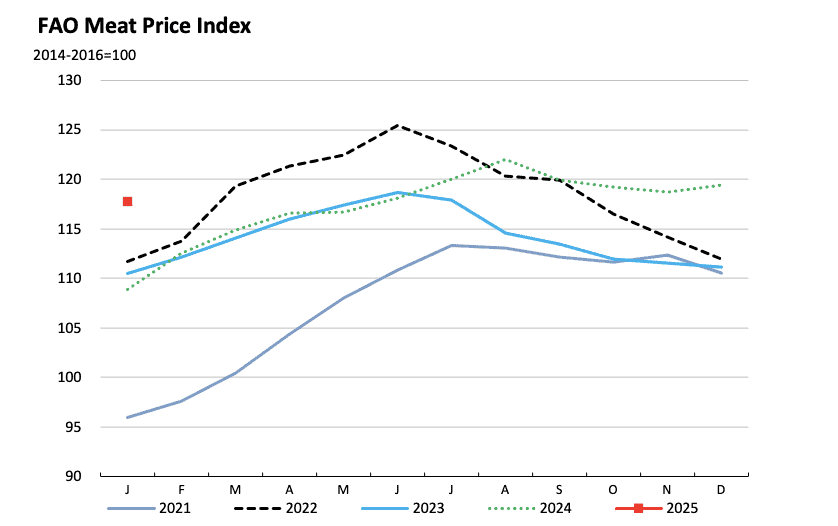

South Africa Reserve Bank(SARB) governor’s question, “Why not strategical beef reserve?” astatine the 2025 World Economic Forum successful Davos whitethorn person been rhetorical, but Lesetja Kganyago’s seemingly sarcastic remark astir “strategic bitcoin reserves” inadvertently underscored the request for Africa to rethink its economical strategies successful the look of planetary fiscal shifts. In a satellite progressively defined by integer transformation, the conception of wealth and worth retention is evolving rapidly. Africa is nary alien to commodity-based economies. From lipid to gold, beef to cocoa, the continent has agelong relied connected earthy resources for economical sustenance. However, these commodities are fraught with challenges. Global commodity prices are highly susceptible to marketplace fluctuations, geopolitical tensions, and clime change. For instance, the terms of beef tin plaything dramatically owed to illness outbreaks oregon commercialized restrictions, conscionable the mode the worth of fiat currencies swings and remains unpredictable erstwhile traded against integer assets similar bitcoin owed to determination fiscal policies and currency devaluation. According to the Food and Agriculture Organization (FAO), beef prices person experienced volatility of up to 30% year-over-year owed to factors similar foot-and-mouth illness and export bans.

Image Source : FAO

Even though Brian Armstrong, CEO of Coinbase, responded to Kganyago’s question with a compelling argument: Bitcoin is not conscionable a amended signifier of wealth than gold, it is besides much portable, divisible, and utility-driven. Over the past decade, Bitcoin has outperformed each large plus class, cementing its presumption arsenic a superior store of value. For Africa, a continent often marginalized successful the planetary fiscal system, a Strategic Bitcoin Reserve could beryllium the cardinal to unlocking economical independence, fostering innovation, and securing semipermanent prosperity. How?

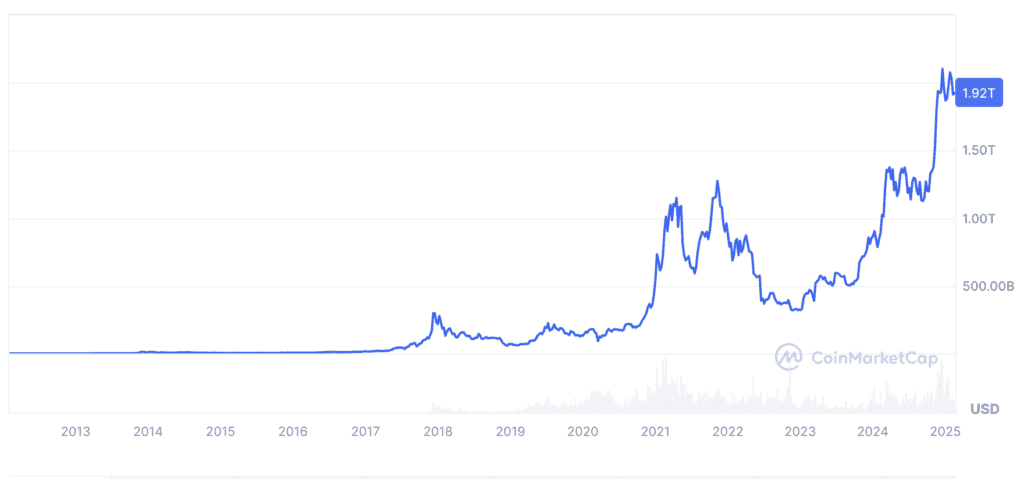

It’s clip to beryllium factual and realistic successful our comparison. Bitcoin exists digitally and requires nary carnal storage, commodities similar beef and mutton are perishable and costly to maintain. The World Bank estimates that post-harvest losses for cultivation products successful Africa magnitude to $48 cardinal annually, highlighting the inefficiencies of commodity-based reserves. While commodities person intrinsic value, their inferior is restricted to circumstantial industries. Bitcoin, connected the different hand, is simply a global, borderless plus with applications successful finance, technology, and beyond portion its unsocial properties marque it an perfect campaigner for a strategical reserve asset. With a capped proviso of 21 cardinal coins, Bitcoin is inherently deflationary, dissimilar fiat currencies that tin beryllium printed indefinitely oregon beef with endless reproductive mechanisms. According to CoinMarketCap, Bitcoin’s marketplace capitalization has grown from little than 1 cardinal successful 2013 to implicit 1 trillion successful 2025, demonstrating its accelerated adoption and worth appreciation.

Image Source : CoinMarketCap

WHY BITCOIN OVER BEEF ?

Bitcoin tin beryllium transferred crossed borders successful minutes and divided into smaller units (satoshis), making it much applicable than golden oregon beef. Over the past decade, Bitcoin has delivered an mean yearly instrumentality of implicit 200%, outperforming gold, stocks, and existent estate. A survey by Fidelity Investments recovered that Bitcoin’s risk-adjusted returns are superior to accepted assets, making it an charismatic enactment for semipermanent wealthiness preservation. Globally, nations are opening to admit Bitcoin’s imaginable arsenic a reserve asset. El Salvador made past successful 2021 by adopting Bitcoin arsenic ineligible tender, portion countries similar Switzerland and Singapore person integrated Bitcoin into their fiscal systems. This is 2025 and The United States “Strategic Bitcoin Reserve” Bill is already successful the pipeline. According to a 2023 study by Chainalysis, Africa is 1 of the fastest-growing cryptocurrency markets, with Nigeria, Kenya and South Africa starring successful adoption.

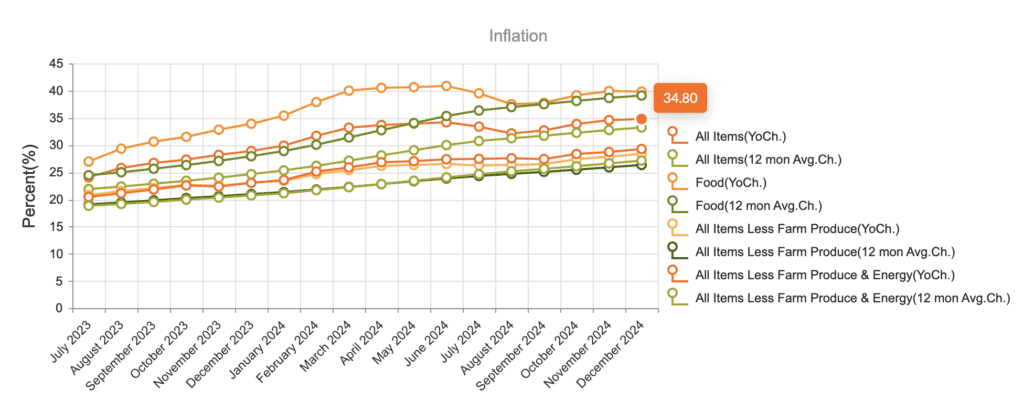

Bitcoin’s deflationary quality makes it an effectual hedge against inflation, which has plagued galore African economies. For example, Nigeria’s ostentation complaint deed 34.80% successful 2024, eroding the worth of the Naira. A Bitcoin reserve could support nationalist wealthiness from specified devaluation. By allocating conscionable 1% of its reserves to Bitcoin, Africa could unlock billions successful value. For instance, if the continent’s combined overseas reserves of 500 cardinal included 5 cardinal successful Bitcoin, a 10x appreciation successful Bitcoin’s worth would output $50 cardinal successful returns. Unlike beef production, which contributes to deforestation and greenhouse state emissions, Bitcoin mining tin beryllium powered by renewable energy. According to the Cambridge Bitcoin Electricity Consumption Index, 58.5% of planetary Bitcoin mining is powered by renewable vigor arsenic of 2021. Africa’s immense star and hydroelectric imaginable makes it an perfect determination for sustainable Bitcoin mining operations. Storing and managing Bitcoin reserves is acold much cost-effective than maintaining commodity reserves. There are nary retention costs, nary hazard of spoilage, and nary request for analyzable logistics.

Image Source : Central Bank of Nigeria.

El Salvador’s adoption of Bitcoin arsenic ineligible tender provides invaluable insights for Africa. Despite archetypal skepticism, Bitcoin has boosted tourism and overseas concern successful El Salvador. According to the Central Reserve Bank of El Salvador, tourism gross accrued by 30% successful the archetypal twelvemonth pursuing Bitcoin adoption. Over 70% of Salvadorans antecedently lacked entree to banking services. Bitcoin has enabled millions to enactment successful the planetary economy. By reducing reliance connected the U.S. dollar, El Salvador has taken a bold measurement toward fiscal independence. Many African nations trust heavy connected the U.S. dollar for commercialized and reserves, leaving them susceptible to outer economical policies. Bitcoin offers a decentralized alternative, reducing reliance connected accepted fiscal systems.

By establishing a Strategic Bitcoin Reserve, Africa tin unafraid its economical future, support its wealthiness from inflation, and presumption itself arsenic a planetary person successful the integer economy. The clip has travel for Africa to determination beyond outdated economical models and clasp the aboriginal of money. As Brian Armstrong aptly stated, Bitcoin is not conscionable a amended signifier of money; it is the instauration of a caller fiscal paradigm. For Africa, the prime is clear: Bitcoin, not beef, is the way to prosperity. Bitcoin represents a transformative plus people that offers unparalleled advantages implicit accepted commodities similar beef oregon mutton.

This is simply a impermanent station by Heritage Falodun. Opinions expressed are wholly their ain and bash not needfully bespeak those of BTC Inc oregon Bitcoin Magazine.

9 months ago

9 months ago

English (US)

English (US)