Bitcoin and Ethereum supplies connected centralized exchanges person deed grounds lows pursuing the instauration of crypto-related spot exchange-traded funds (ETFs) successful the United States.

According to Glassnode data, Bitcoin balances connected exchanges person fallen to 11.6%, the lowest since December 2017. Ethereum balances are adjacent little astatine 10.6%, the lowest since October 2015.

Spot ETFs trigger withdrawals

Market experts person explained that the declining speech balances coincide with the Securities and Exchange Commission’s (SEC) support of ETF products for Bitcoin and 19-b filings for Ethereum.

HeyApollo data reveals that spot Bitcoin ETFs person accumulated 857,700 BTC, valued astatine $58.5 billion, successful conscionable 5 months. BlackRock’s IBIT ETF leads this acquisition with astir $20 cardinal successful assets, followed by Fidelity’s FBTC, with astir $11 billion.

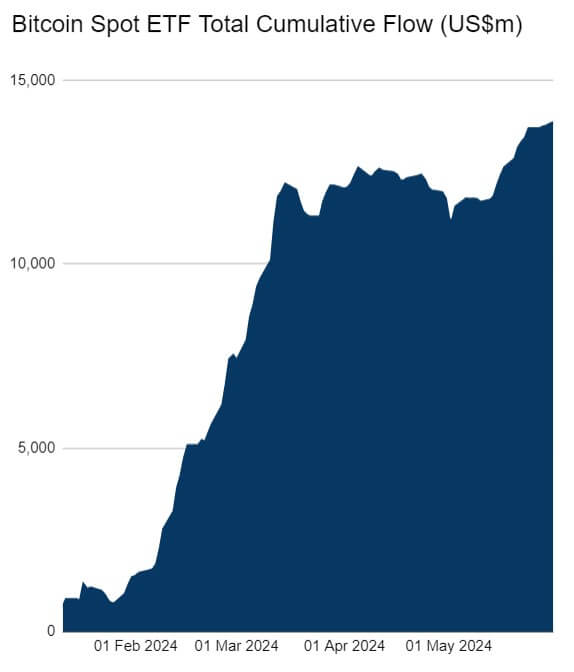

Spot Bitcoin ETFs Flow. (Source: Farside Investors)

Spot Bitcoin ETFs Flow. (Source: Farside Investors)While spot Ethereum ETFs person not yet begun trading, capitalist anticipation has driven important withdrawals. According to CryptoQuant data, 777,000 ETH, worthy astir $3 billion, person been pulled from exchanges since the SEC’s approval.

Additionally, the enactment to involvement ETH has influenced its declining speech balance. Nansen reports that 32.8 cardinal ETH, oregon 27% of its full supply, are presently staked to enactment the network.

Is a proviso crunch connected the way?

If the declining speech equilibrium inclination continues, marketplace experts person predicted request for Bitcoin and Ethereum could pb to a proviso crunch.

In a caller societal media post, BTC Echo exertion Leon Waidmaan advised investors to brace for a “supply squeeze” and the anticipation of “the adjacent large move.”

Historically, erstwhile integer assets are withdrawn from exchanges, it suggests investors program to clasp alternatively than sell, reflecting bullish sentiment and expectations of aboriginal growth. A proviso compression could importantly interaction prices by limiting the disposable supply, perchance starring to important terms increases if existent accumulation trends persist.

The station Bitcoin and Ethereum speech balances deed grounds lows arsenic spot ETFs thrust withdrawals appeared archetypal connected CryptoSlate.

1 year ago

1 year ago

English (US)

English (US)