An investigation of Bitcoin and Ethereum futures measurement showed that some had re-established themselves implicit spot volume.

In spot markets, traders tin bargain and merchantability tokens for contiguous delivery. Spot measurement refers to the full magnitude of coins transferred on-chain with lone palmy transfers counted.

By contrast, futures traders bargain and merchantability derivatives contracts representing the worth of a circumstantial cryptocurrency. Experienced traders similar futures trading arsenic profits tin beryllium made successful either marketplace direction.

As experienced traders usage leverage and are mostly amended capitalized than retail spot traders, nether “normal” conditions, futures markets thin to crook implicit much measurement comparative to spot markets.

Ethereum spot and futures markets

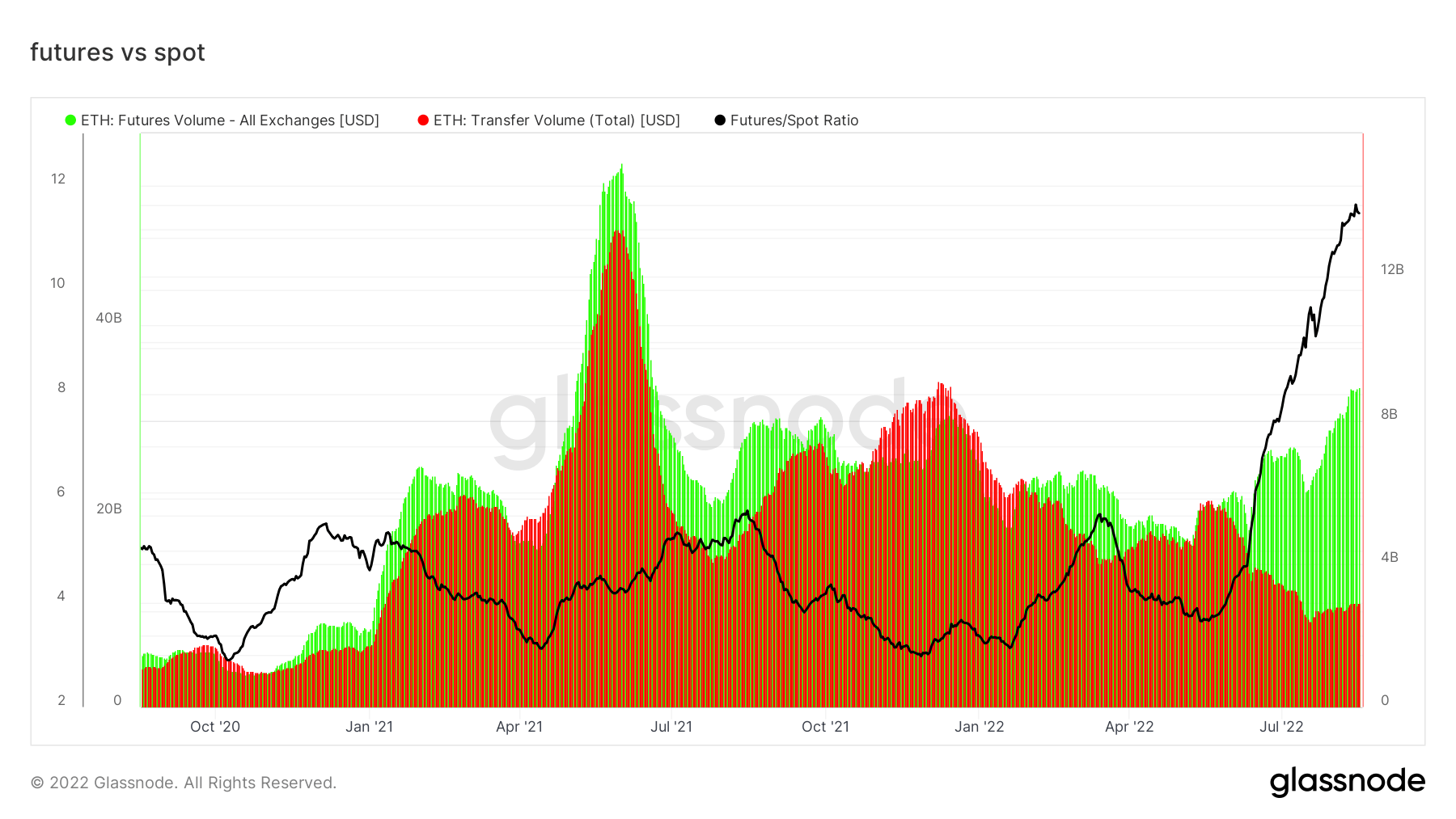

The illustration beneath shows the wide inclination being Ethereum spot measurement lagging down the futures market. However, spot markets were peculiarly prevalent astatine the extremity of 2021 going into the caller year.

From precocious June 2022 onwards, the disparity betwixt futures and spot is becoming progressively prevalent. Analysts wager this is owed to mounting speculation implicit the Merge, successful which Ethereum’s existing execution furniture volition integrate with its Proof-of-Stake (PoS) statement layer.

ETH Futures Volume vs. Transfer Volume (Source: Glassnode)

ETH Futures Volume vs. Transfer Volume (Source: Glassnode)Bitcoin spot and futures markets

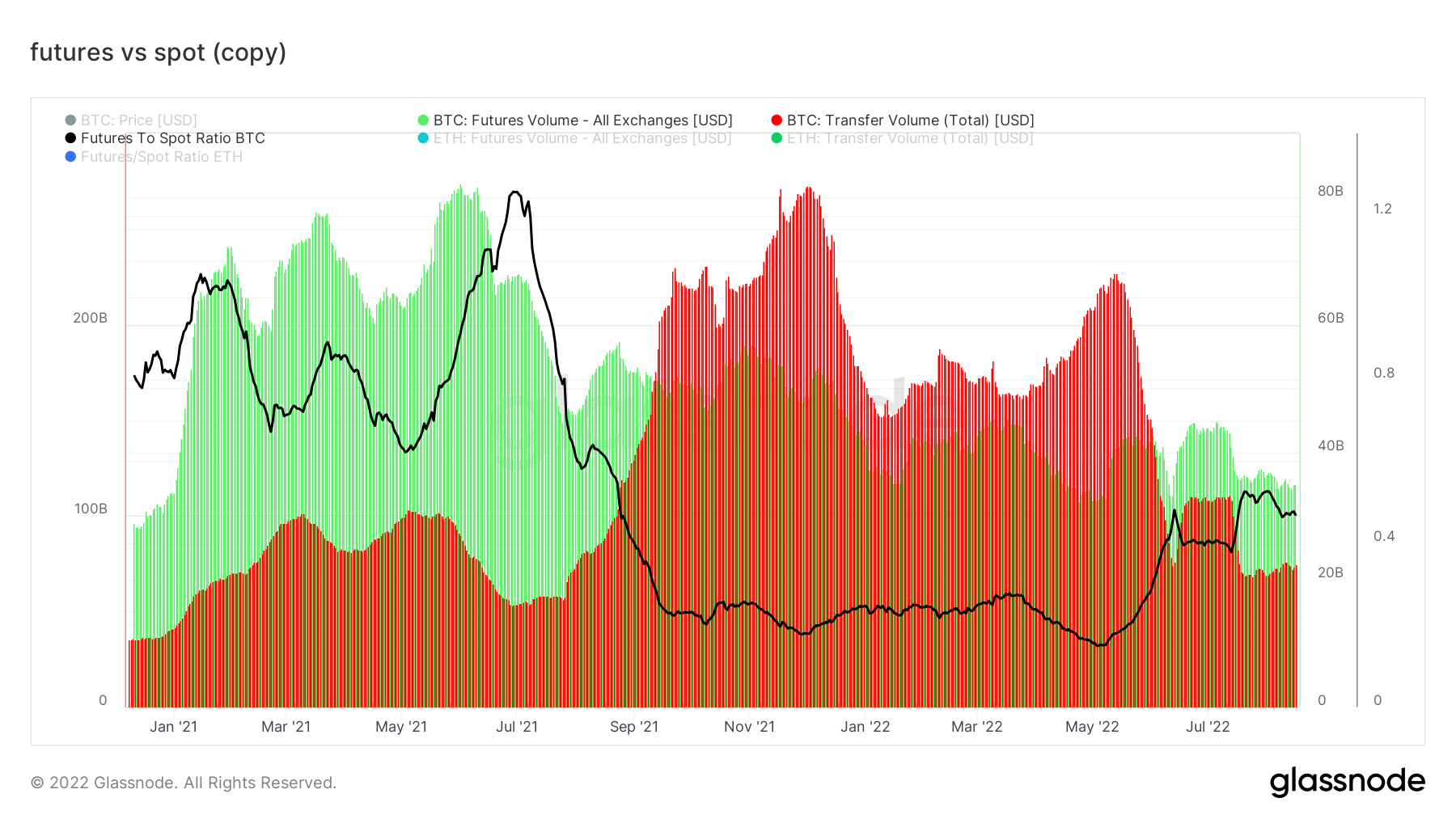

An investigation of Bitcoin spot and futures markets paints a antithetic picture. The illustration beneath shows futures measurement holding a important pb going into the 2021 bull run. However, arsenic the terms of BTC peaked successful Q4 2021, this script flipped with spot measurement taking over.

Since June 2022, futures traders person re-asserted their position, starring to a resurgence successful futures measurement implicit spot volume.

Futures to Spot Ratio BTC (Source: Glassnode)

Futures to Spot Ratio BTC (Source: Glassnode)BTC and ETH ratios

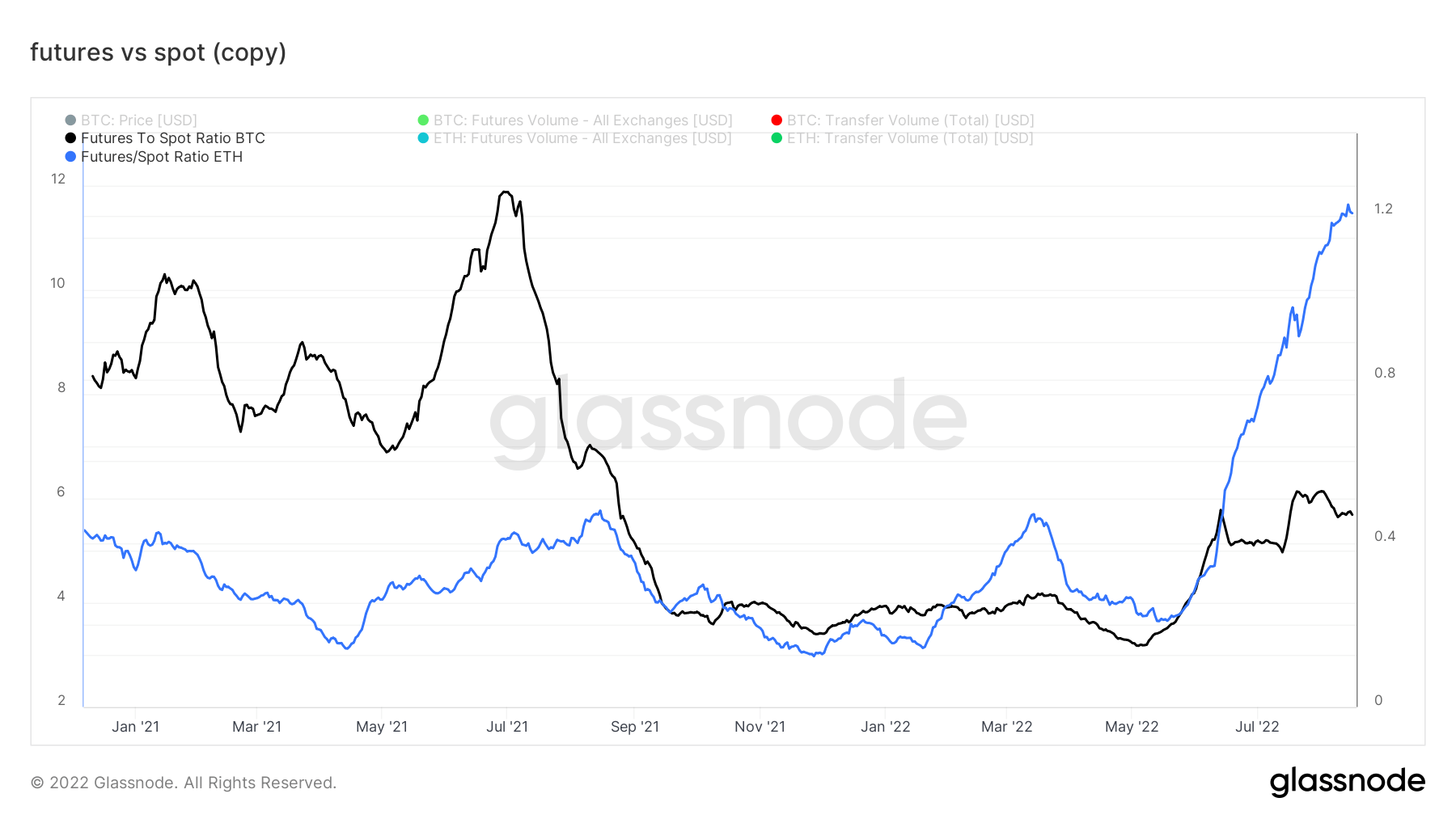

The futures/spot ratio depicts the supra arsenic a enactment chart. The Bitcoin futures/spot ratio was considerably higher than Ethereum’s done the archetypal fractional of 2021.

A lull followed successful which some ratios sunk and moved successful adjacent correlation. However, the Ethereum futures/spot ratio took off, comparative to the BTC ratio, from June 2022 onwards owed to terms speculation connected the upcoming Merge event.

Futures to Spot Ratio, BTC and ETH (Source: Glassnode)

Futures to Spot Ratio, BTC and ETH (Source: Glassnode)The resurgence successful BTC and ETH futures measurement suggests that derivatives traders person returned to speculating connected hazard assets erstwhile again. This would bespeak that derivatives traders presume that the leverage coiled to the Terra illness has near the market.

The station Bitcoin and Ethereum futures are re-exerting dominance implicit spot markets appeared archetypal connected CryptoSlate.

3 years ago

3 years ago

English (US)

English (US)