Less than a time earlier the polls closed successful the United States, crypto analysts continued to connection their 2 cents connected the aboriginal of Bitcoin and cryptocurrencies.

For example, galore Wall Street analysts accidental chaotic BTC marketplace prices volition proceed aft the elections. Other analysts and observers person shared their terms predictions based connected who volition triumph this Tuesday.

Gautam Chhugani of the Berstein Group projects that Bitcoin tin summation to $80,000 oregon adjacent $90,000 if the Republican Donald Trump wins the election. If Kamala Harris wins the polls, Chhugani expects the BTC terms to dip to $50,000.

But Bernstein didn’t halt making Bitcoin predictions instantly aft the election; the radical remains bullish connected Bitcoin successful the abbreviated word and expects the integer plus to deed $200,000 by 2025.

According to Bernstein analysts, the different cardinal factors driving Bitcoin’s terms are the expanding request for spot BTC ETFs and rising US debts.

Bernstein Adjusts BTC Price Predictions: $50K Under Harris, $80-90K With Trump

Bernstein analysts person adjusted their Bitcoin terms estimates based connected the imaginable outcomes of the upcoming U.S. election. If Harris wins, they foresee Bitcoin dropping to astir $50,000, portion a… pic.twitter.com/Z1zJ21aJ48

— The Wolf Of All Streets (@scottmelker) November 4, 2024

Bernstein’s Bullish Outlook For Bitcoin Next Year

Analysts astatine Bernstein are betting connected Bitcoin and expect its terms to scope $200,000 by the extremity of adjacent year, careless of the predetermination results. Gautam Chhugani made this bold prediction days earlier the Americans visited the polls and added that the results would not interaction the semipermanent outlook for the asset.

BTC terms up successful the past month. Source: Coingecko

BTC terms up successful the past month. Source: CoingeckoThe analyst’s bullish task connected Bitcoin is anchored connected respective factors. He adjacent likened the plus to a “genie retired of the bottle” and said stopping its terms trajectory is difficult.

Chhugani identified a fewer factors that tin thrust the asset’s price, including accrued involvement connected the BTC ETFs and higher government’s nationalist debt. Last month, Bernstein’s apical expert targeted $100k for Bitcoin but soon revised his projection to bespeak changes successful marketplace trends.

BTC’s Erratic Price Action Ahead Of Elections

This year’s predetermination conflict betwixt Trump and Harris is among the astir highly debated and anticipated. In summation to accepted polling, information from betting markets similar Polymarket became famous, too.

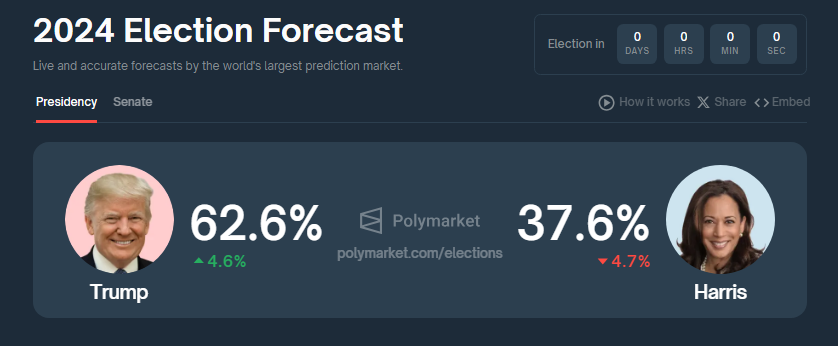

For example, astatine Polymarket, Trump remains the favorite, cornering 63% of each wagers, with Harris getting 38%. Bernstein analysts accidental that careless of the results, the plus volition person short-term terms movements.

Source: Polymarket

Source: PolymarketHowever, they expect BTC to payment much from a Trump win. In the aforesaid Bernstein analysis, Bitcoin whitethorn summation to $90,000 if the Republican wins.

Currently, Bitcoin’s terms has dropped to $69k to $68k owed to profit-taking. Also, analysts noted the anemic inflows this week to ETFs. Most analysts hold that Bitcoin is inactive poised for an end-of-the-year rally.

US Election Results Can Impact Other Digital Assets

The US elections impact different integer assets too Bitcoin. For example, successful a Harris presidency, Ether whitethorn summation owed to heightened regulations that tin bounds the show of its competition, similar Solana.

However, Chhuhani offers a differing view, saying if the SEC adopts mean policies, these tin propel Bitcoin and different assets.

This year’s predetermination rhythm puts crypto and the blockchain astatine the halfway of debates. Both candidates person shared their thoughts connected crypto, with Trump offering much crypto-friendly solutions.

Initially, Democrat Harris was reluctant to connection argumentation proposals, but she shifted her code arsenic the run moved forward.

Featured representation from Invezz, illustration from TradingView

1 year ago

1 year ago

English (US)

English (US)