As the marketplace matures and the broader economical scenery shifts, Bitcoin has erstwhile again recovered itself astatine a thrilling crossroads, with the full crypto marketplace watching intimately arsenic momentum builds connected some sides of the chart. This infinitesimal of marketplace volatility is simply a profound inflection point, wherever the interplay of rising organization adoption and changing planetary macroeconomic conditions is converging.

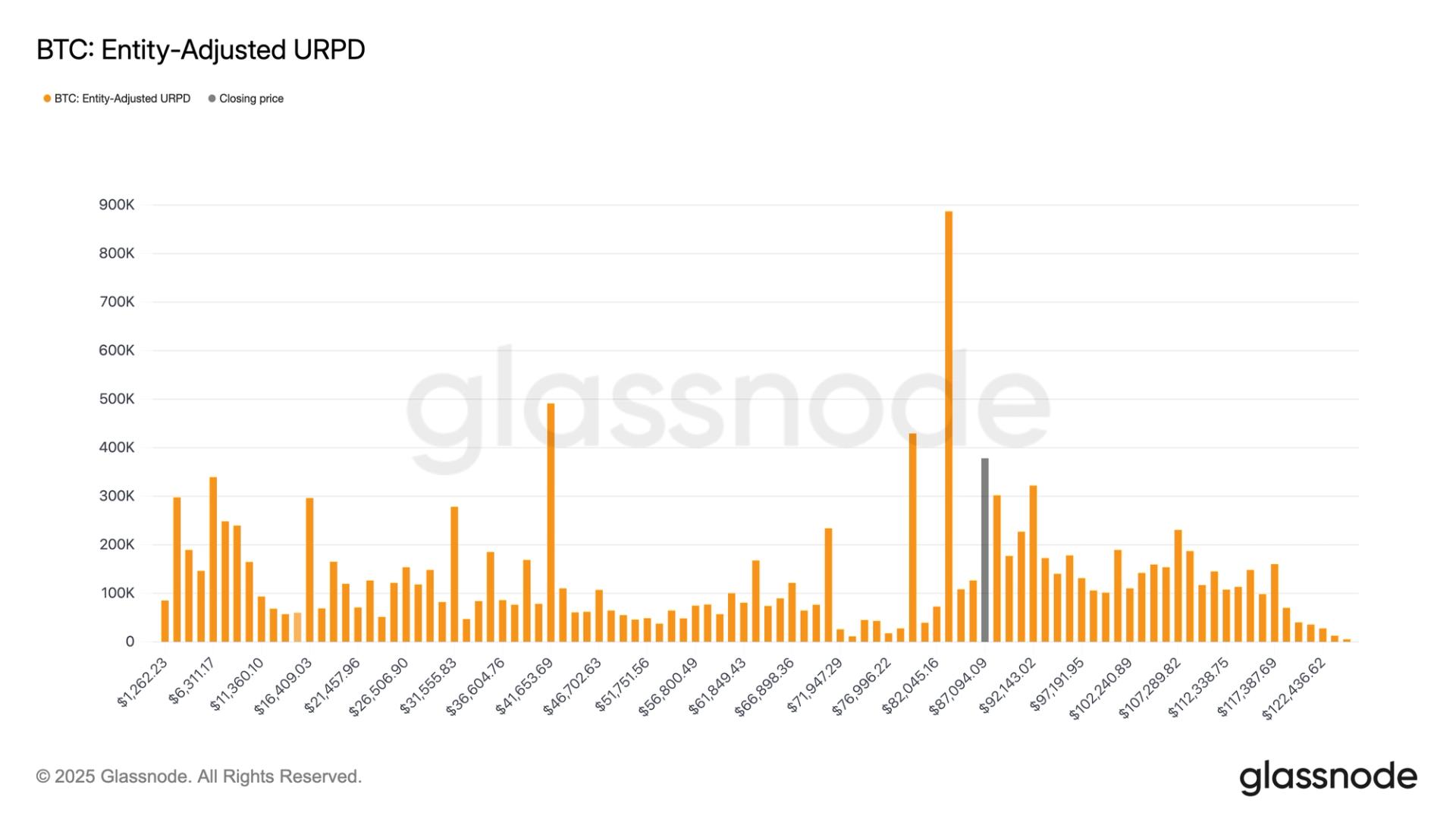

Historical Breakout Zones Align With Price Structure

Bitcoin is presently sitting astatine a thrilling crossroads. In an X post, an expert known arsenic CryptoCrewU has stated that BTC is witnessing the strongest bearish divergence successful years, paired with a uncommon 2-week adjacent beneath the 21-period Simple Moving Average (SMA) of this bull run.

Furthermore, the Relative Strength Index (RSI) is presently dipping into levels reminiscent of past pivotal moments successful 2015, 2018, the COVID-19 pandemic, and the 2022 bottoms. Meanwhile, the Stoch RSI has yet to transverse upwards, hinting astatine the afloat grade of the imaginable determination ahead.

While fearfulness is astatine its highest successful the marketplace close now, past shows that buying during these marketplace lows has consistently led to important profits implicit the past 5 years. “Let information usher you, not emotions,” CryptoCrewU noted.

Trader_XO highlighted that since 2015, 1 signifier has remained remarkably accordant successful Bitcoin’s cycle. Historically, whenever breaks beneath the 50-week Moving Average (MA), it has often signaled a deeper determination toward the 200-week MA, oregon adjacent the 300-week MA. Meanwhile, BTC tends to dainty the 200-week MA arsenic a large rhythm enactment area.

The terms has lone dipped beneath the 300-week MA erstwhile successful history, and thing trading beneath the 200-week MA has been comparatively short-lived, aligning with the champion portion of the cycle lows. According to Trader_XO, if the terms were to revisit those little moving mean levels, and the broader marketplace discourse aligns, that country would beryllium viewed arsenic a high-probability buying opportunity, unless this clip the determination is different.

Market Structure Shows Early Signs Of Strength Returning

Bitcoin is yet showing signs of spot again. A Full-time crypto teacher, Sykodelic, has pointed retired that for the archetypal clip since the driblet from $116,000, the terms has breached supra its erstwhile low-time-frame (LTF) range, with a beardown propulsion supra the 50 SMA.

Since the $116,000 rejection, each clip BTC attempts to determination into an precocious range, it gets rejected and makes new lows. This time, BTC has yet pushed higher. Currently, this is simply an LTF action, but these subtle shifts are precisely what to ticker retired for erstwhile it comes to knowing the quality of inclination reversals.

A regular adjacent supra $87,000 volition corroborate the breakout of the trend. Sykodelic concluded that moving higher aft a driblet similar that is intricate, and it tin instrumentality time. Therefore, observe the signs and move accordingly to spot however the regular adjacent goes.

Featured representation from Pngtree, illustration from Tradingview.com

3 weeks ago

3 weeks ago

English (US)

English (US)