This is an investigation station by CoinDesk expert and Chartered Market Technician Omkar Godbole.

As bitcoin (BTC) trades successful uncharted territory adjacent grounds highs, traders whitethorn beryllium searching for cues connected what comes next, particularly cardinal levels that could enactment arsenic magnets oregon absorption points.

Here are 3 important levels worthy watching closely.

$126,100

This level represents the precocious bound of the broadening oregon expanding scope signifier that has been processing since mid-July. The imaginable absorption is defined by the trendline connecting the July 15 and Aug. 14 highs.

A reversal from this level could trigger a corrective pullback down toward the little bound of the range, represented by the trendline drawn from the Aug. 3 and Sept. 1 lows.

$135,000

A breakout from the expanding scope would displacement absorption to $135,000, wherever marketplace makers presently clasp a nett agelong gamma position, according to enactment successful Deribit-listed options tracked by Amberdata.

When marketplace makers are nett agelong gamma, they thin to commercialized against the marketplace absorption – buying connected dips and selling connected rallies – to support their wide market-neutral exposure. Other things being equal, this hedging enactment tends to dampen terms volatility.

In different words, the $135,000 level could enactment arsenic a absorption connected the mode higher.

$140,000

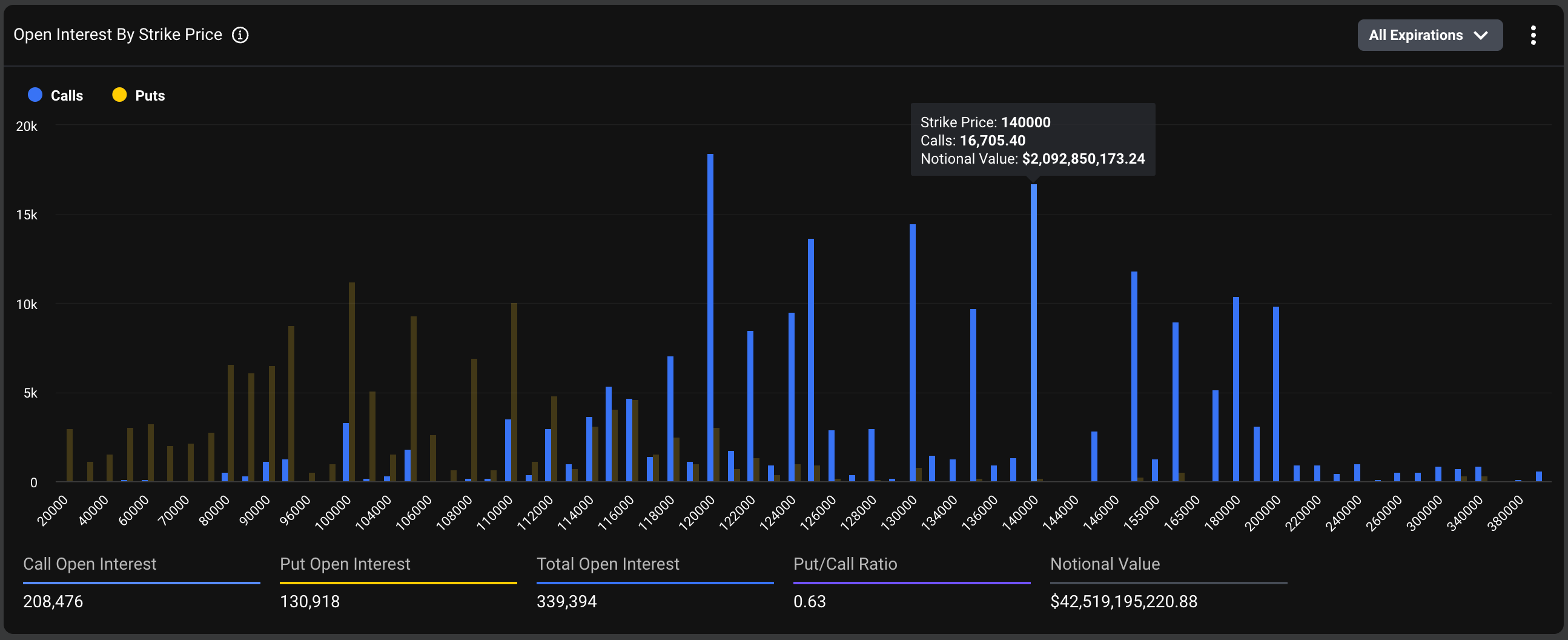

Lastly, $140,000 stands retired arsenic cardinal level, arsenic information from Deribit shows the $140,000 onslaught telephone is the second-most fashionable connected the exchange, holding a notional unfastened involvement of implicit $2 billion.

Notional unfastened involvement refers to the dollar worth of the fig of progressive oregon unfastened options contracts astatine a fixed time.

Levels with ample concentrations of unfastened involvement often enactment arsenic magnets, drafting the terms of the underlying plus toward them. A precocious unfastened involvement successful telephone options suggests that galore traders expect the spot terms to attack oregon apical that level.

At the aforesaid time, those who person sold these calls, often ample institutions, person an inducement to support the terms beneath that strike. Their hedging and trading enactment astir that level tin make resistance, making it harder for the terms to interruption through.

2 months ago

2 months ago

English (US)

English (US)