The world’s largest cryptocurrency whitethorn beryllium astatine hazard of a supply shock arsenic request from United States (US) Spot Bitcoin Exchange Traded Funds (ETFs) has surged acold beyond expectations. In December 2024, the measurement of BTC acquired done Spot Bitcoin ETFs much than tripled the magnitude mined during that aforesaid month, underscoring the terrible imbalance betwixt proviso and demand.

Spot Bitcoin ETFs Trigger Supply Shock Risks

In December 2024, US Spot Bitcoin ETFs purchased an astonishing 51,500 BTC. On the different hand, BTC miners produced lone 13,850 coins during the aforesaid period, according to data from Blockchain.com. This indicates that Bitcoin ETFs unsocial purchased astir 4 times the magnitude BTC miners generated and supplied to the marketplace that month.

Source: Bitcoin Treasuries

Source: Bitcoin TreasuriesAccording to reports, the request for ETFs successful December was thing abbreviated of extraordinary, exceeding the disposable proviso by astir 272%. This monolithic increase successful request for Spot Bitcoin ETFs has raised concerns astir a imaginable BTC proviso shock, with analysts suggesting that it could hap soon.

Specifically, Lark Davis, a crypto analyst, announced earlier successful December that “a monolithic proviso daze is imminent.” The expert based this alarming forecast connected the important accumulation of BTC from US Spot Bitcoin ETFs. Davis disclosed that astatine immoderate constituent successful December, BTC ETFs had bought 21,423 BTC; meanwhile, miners had produced lone 3,150 BTC astir the aforesaid time.

The expert besides noted that BTC ETFs globally held astir 1,311,579 BTC arsenic of December 17, 2024. This amount, valued astatine $139 billion, accounts for 6.24% of BTC’s full proviso of 19.8 million. Given this staggering figure, Davis projects that during highest bull marketplace phases, Spot Bitcoin ETFs could clasp 10-20% of BTC’s full supply, raising much concerns astir a large proviso shock.

Concentration Of Spot BTC Inflows In December

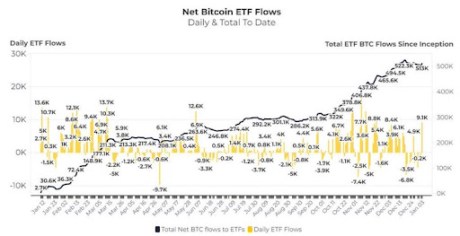

Data from Glassnode has revealed that Spot Bitcoin ETFs recorded a full nett inflow of $4.63 cardinal successful December, astir doubling their 2024 monthly mean of $2.77 billion. Notably, Glassnode disclosed that the surge successful Spot Bitcoin ETF inflows was much concentrated during the archetypal fractional of the month, portion the 2nd fractional saw outflows, with December 26 being the exception.

Source: Glassnode

Source: GlassnodeNot surprisingly, the timing for this surge and consequent decline successful Bitcoin ETF inflows aligns with BTC’s terms movements successful December. At the opening of the month, BTC experienced upward momentum, skyrocketing to a new ATH supra $108,000 connected December 17, fueled by the bull marketplace hype and soaring demand. However, pursuing this peak, BTC’s terms saw a crisp decline, a driblet that coincided with the timing of important outflows from Spot Bitcoin ETFs, arsenic reported by Glassnode.

Despite the surge successful request for Spot Bitcoin ETFs successful December, new data shows that investors person extended their accumulation inclination into January 2025. On January 3, investors purchased implicit $900 cardinal worthy of BTC done Spot Bitcoin ETFs. More recently, US Spot Bitcoin ETFs acquired an further 9,500 BTC, worthy implicit $966 cardinal astatine the existent marketplace price.

Featured representation created with Dall.E, illustration from Tradingview.com

11 months ago

11 months ago

English (US)

English (US)