Bitcoin Attacks The Ultimate Ponzi Scheme

Who Is Running The Ultimate Ponzi Scheme, And How Do We Stop It?

The Ponzi scheme is simply a elemental concept.

“A Ponzi strategy is an concern fraud that pays existing investors with funds collected from caller investors. Ponzi strategy organizers often committedness to put your wealth and make precocious returns with small oregon nary risk. But successful galore Ponzi schemes, the fraudsters bash not put the money. Instead, they usage it to wage those who invested earlier and whitethorn support immoderate for themselves.

“With small oregon nary morganatic earnings, Ponzi schemes necessitate a changeless travel of caller wealth to survive. When it becomes hard to enlistee caller investors, oregon erstwhile ample numbers of existing investors currency out, these schemes thin to collapse.”

If we regenerate investors with lenders, we tin look astatine a akin benignant of Ponzi. Let’s look astatine an example: Let’s accidental Acme Corp takes retired a $1 cardinal indebtedness for 1 twelvemonth against their $10 cardinal successful assets. They walk that $1 million, but they inactive request to wage backmost the slope $1 cardinal positive 5% interest. So, Acme takes retired different indebtedness for $2 cardinal plus, pays backmost the archetypal loan, and keeps different $1 cardinal to walk successful the 2nd year. In the 3rd year, Acme owes that $2 cardinal positive with interest, truthful they instrumentality retired $3 million, positive capable to screen past year’s indebtedness payment, with $1 cardinal to walk successful the 3rd year.

As agelong arsenic a lender is inactive consenting to lend to Acme, this tin technically spell connected arsenic agelong arsenic Acme’s involvement complaint is little than the maturation complaint of their assets. Acme tin adjacent usage borrowed wealth to bargain much assets, further fueling this machine.

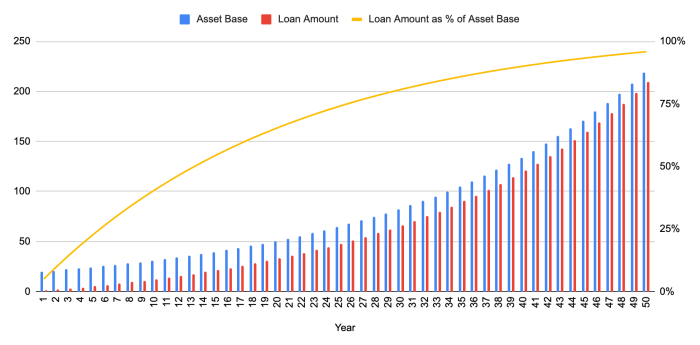

As you tin spot from the chart, the downside is that each clip Acme takes retired a caller loan, their full indebtedness load grows and approaches the full worth of their assets. If Acme’s indebtedness load ever exceeds the worth of Acme’s assets, Acme’s creditors volition request their wealth backmost and Acme’s worth — their full beingness and each investments successful them — volition spell to zero overnight. This could hap due to the fact that of involvement rates rising oregon plus values falling, adjacent if the second is implicit a abbreviated clip during immoderate calamity.

For Acme’s infinite wealth instrumentality to support operating steadily, the interest rate connected loans indispensable beryllium little than the growth complaint of assets. If this continues, aged debts tin beryllium paid with caller loans. All the while, however, Acme faces hazard from a downturn. If plus values spell beneath Acme’s indebtedness burden, creditors volition travel calling — and Acme amended person a beauteous bully mentation to support creditors from pulling retired and leaving Acme penniless.

The longer Acme is capable to tally the infinite wealth machine, the higher the nominal worth of Acme and its assets goes, and the harder they and their investors autumn erstwhile a abrupt drawdown triggers a borderline telephone from creditors. For a existent satellite example, spot 1 of China’s biggest companies, Evergrande:

From the nonfiction successful the Financial Times: “‘There is nary mode we tin repay truthful galore creditors with our constricted resources,’ said an Evergrande executive, who asked not to beryllium identified. ‘We volition fto judges determine who gets paid and however much.’”

Seems similar a unsafe crippled to play, but Acme is conscionable 1 company. Can we look astatine this benignant of Ponzi behaviour crossed an full economy?

The Global Infinite Money Machine

The Acme illustration illustrates however the infinite wealth instrumentality Ponzi works and gives america a mode to spot it from the outside: debt-to-asset ratios.

If the satellite were 1 company, gross home merchandise (GDP) would beryllium akin to the “assets” of that institution — the sum of each its superior and productive activities. Thanks to the International Monetary Fund (IMF), we tin cheque connected the authorities of our planetary debt-to-GDP ratio.

Just similar Acme, the debt-to-GDP ratio is precocious astir the satellite — sometimes adjacent supra 100%! This means the full planetary system is exposed to monolithic systemic risk, and the concern is lone getting worse.

Why are we seeing systemic hazard increasing, and what tin we bash astir it?

To reply these questions, we request to commencement with involvement rates.

The Interest Rate Gods

An involvement complaint tin beryllium thought of arsenic the clip worth of wealth — the magnitude a borrower pays to get wealth for a acceptable play of time. This is akin to immoderate different rental service, similar a car rental; the full loaned magnitude is the car, and the involvement complaint is simply a mode to explicit the magnitude you wage to rent the car. Just similar immoderate different bully oregon service, the contention of work providers implicit customers and repeated transactions whitethorn pb to a “market price” for a loan, conscionable similar prices for akin services crossed antithetic car rental companies thin to converge.

In our modern economy, however, we person endowed involvement rates with a divine status, allowing cardinal bankers to acceptable these rates alternatively of participants successful a escaped market. Central banks similar the Federal Reserve alteration rates utilizing their monopoly connected the instauration and demolition of reserve money, which they usage to bargain and merchantability assets wrong the commercialized banking system. These actions are convoluted, but their stated intent is to power each different involvement rates successful the system to determination up oregon down.

Central banks frankincense power a cardinal lever of the infinite wealth instrumentality Ponzi: involvement rates.

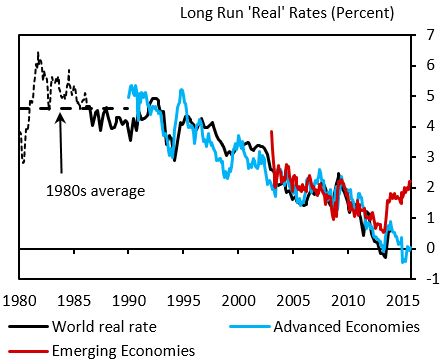

What are they doing with this lever? Lowering involvement rates steadily.

Source: VoxEU.

As we retrieve from the Acme example, little involvement rates makes infinite wealth instrumentality Ponzis easier to run, which means much companies and the full planetary system look systemic risk. However, an infinite wealth instrumentality besides requires plus values to steadily emergence faster than involvement rates with lone contained downturns.

What’s going connected with assets?

The Everything Rally

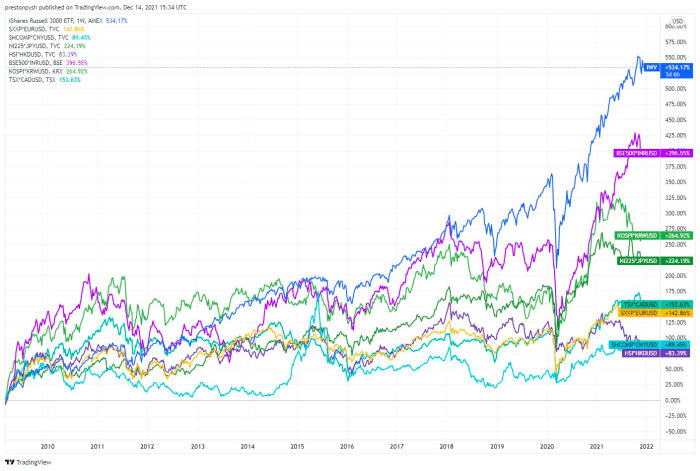

Asset values, connected paper, are skyrocketing. Looks fantastic, until you see that this means tons of country for infinite wealth instrumentality Ponzis and the systemic hazard that comes with them.

Major banal indices successful dollar presumption (Source: Preston Pysh).

The communicative down plus values reveals the basal of this meteoric rise. As cardinal bankers and governments enactment unneurotic to little involvement rates and marque recognition much available, they are incentivizing savers to determination their savings retired of low-risk assets — similar savings accounts — and into higher hazard assets — similar stocks of companies.

Over time, this makes the S&P 500 and akin indices into the caller savings accounts. Younger generations cognize this, and arsenic a result, we spot record-high information successful the banal marketplace done apps similar Robinhood. Passive investing strategies — similar ETFs — spot record popularity arsenic well.

Savers who bargain a institution banal contiguous are widening the disagreement betwixt involvement rates and plus worth maturation for that company, making it easier for them to commencement and prolong an infinite wealth machine. If we look astatine the full American economy, we tin spot however involvement rates and plus values are diverging, opening the accidental for individuals and businesses to infinitely get against their assets.

So involvement rates are held low, and arsenic a result, plus values are pushed higher, solving 2 of the 3 pieces of our infinite wealth machine. However, volatility inactive represents a beardown cheque connected the infinite wealth machine, fixed that a capable drawdown tin extremity the full ruse successful an instant. How travel the enactment isn’t implicit yet?

Eliminating Downturns

A downturn successful plus values endangers the debt-fueled enactment of infinite wealth machines. This makes downturns a deterrent to adjacent embarking connected an infinite wealth instrumentality Ponzi. Unfortunately, that deterrent is present but a relic of past owed to the readiness of cardinal banks and governments to intervene successful downturns.

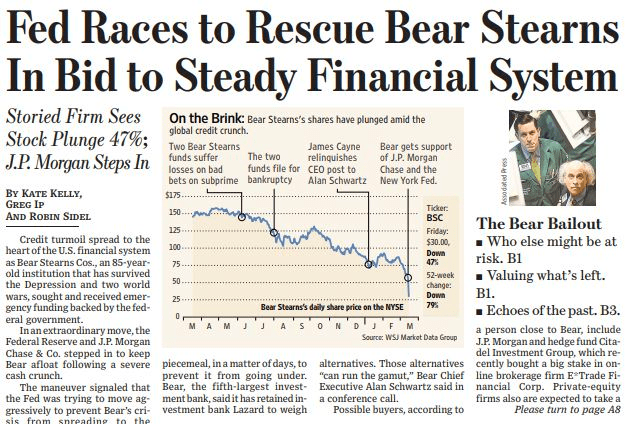

When downturns arrive, cardinal banks and governments enactment unneurotic to usage authorities indebtedness and recently printed currency to support plus values afloat. “Ensuring solvency” of a bank, for instance, means keeping its indebtedness load from exceeding its plus worth — keeping its infinite wealth instrumentality successful operation.

When debts transcend plus values for a company, that company’s worth rapidly goes to zero - unless they get a bailout (Source: Wall Street Journal).

Banks are often the archetypal beneficiaries of authorities bailouts but not the last. With each crisis, cardinal banks and governments are injecting much wealth adjacent further crossed the economy.

So, debased involvement rates thrust precocious maturation successful plus prices, widening the fertile crushed connected which infinite wealth instrumentality Ponzis turn and develop. Downturns usually chopped these Ponzis down, yet we spot governments stepping successful to bail them retired with yet much credit. This, successful turn, feeds plus prices, and connected and connected the rhythm goes.

Can we inquire our elected officials to simply halt pushing down involvement rates, bailing retired those who took connected excessively overmuch debt, and alternatively fto downturns tally their course?

Let’s Just Stop

If cardinal banks and governments stopped making recognition easier and easier to get done little involvement rates and indebtedness monetization, we could enactment an extremity to this Ponzi strategy behaviour and get backmost to an system wherever we merchantability utile goods and services to each other.

Where’s the problem?

Central banks and governments cannot halt taking connected indebtedness and printing money, due to the fact that our currencies themselves are a cardinal portion of a monolithic infinite wealth instrumentality Ponzi.

The U.S. dollar and each different large currencies successful circulation contiguous are fiat currencies, with cardinal banks and governments capable to enactment unneurotic to make much units of the currency. In practice, caller units of currency are created done loans by cardinal banks to banks oregon the government, and by banks to radical and businesses. The currencies we usage each time are really debt held by people, businesses and governments.

The root of this infinite wealth instrumentality is cardinal banking. A corp oregon idiosyncratic needs to amusement a lender that they are creditworthy, but the cardinal slope is simply a peculiar benignant of lender. This lender bears nary outgo to lend their currency, truthful they tin lend to anyone, anytime, astatine immoderate rate. Governments utilize this peculiar lender arsenic their literal infinite wealth machine. And they adjacent admit it’s an infinite wealth machine!

Central banks and their wealth printers alteration the illusion of some little involvement rates and GDP growth. When cardinal banks propulsion involvement rates down, they are injecting caller currency into the economy. This currency circulates and pushes prices for everything up, each astatine antithetic rates and times. As a result, GDP floats upward.

Can we not set GDP for this inflation? Sadly, no. No economist oregon supercomputer is susceptible of parsing the complexity of terms movements successful markets to accidental what percent of a emergence successful GDP came from existent productivity versus simply much currency units floating around, pushing up prices. If idiosyncratic could, they’d beryllium the richest idiosyncratic successful the satellite overnight by perfectly trading the fiscal markets.

However, a cardinal slope and its fiat currency person the aforesaid Achilles bottommost arsenic a Ponzi scheme:

“With small oregon nary morganatic earnings, Ponzi schemes necessitate a changeless travel of caller wealth to survive. When it becomes hard to enlistee caller investors, oregon erstwhile ample numbers of existing investors currency out, these schemes thin to collapse.”

If cardinal banks and governments halt printing money, oregon if request for their indebtedness oregon currency falls, the full ruse volition collapse.

How does a authorities guarantee request for their indebtedness oregon currency?

Dictating Demand to Keep the Ponzi Going

A corp oregon idiosyncratic who lets their debts surpass their assets indispensable peaceably record for bankruptcy and unwind the full folly. A authorities would spell down conscionable the aforesaid erstwhile radical began to recognize the inanity of the fiat currency system. However, we person fixed governments our blessing to usage force, and successful galore cases fixed up our ain capableness arsenic citizens to defy that force.

To support their Ponzi currency going erstwhile radical go alert of it, governments indispensable restrict freedoms oregon usage violence.

Legal tender laws and taxation are 1 mode successful which governments restrict freedoms and employment unit successful bid to prop up their currency system. By demanding taxes beryllium paid successful their ain currency, governments are capable to prop up request for citizens to get their currency and past instrumentality that currency retired of circulation. Proponents of modern monetary mentation are precise nonstop astir this, believing that the intent of taxation is to control inflation by sucking liquidity retired of the system. The backstop to guarantee these strategies work? That government’s constabulary volition gladly fastener you up if you bash not comply.

Imagine you decided not to proceed lending to a institution due to the fact that you didn’t deliberation they were solvent, and an worker of that institution handcuffed you and threw you successful a cell. Who would beryllium successful the incorrect here?

Governments whitethorn besides employment subject unit connected the planetary signifier to tackle threats to its Ponzi scheme. The U.S. authorities is peculiarly adept astatine utilizing subject powerfulness — oregon simply a projection of it — to support the U.S. dollar strategy from threats. When different nations situation request for dollars connected the planetary market, accidental for usage successful lipid markets, the missiles commencement flying. This is the information down the meme below.

As the authorities goes deeper into debt, it volition request to instrumentality much drastic measures to guarantee the fiat currency Ponzi continues. That volition mean much inflation, higher taxation, stricter controls, and strategical usage of the government’s backstop of violence. They volition summation taxes, prehend assets, tighten surveillance and adjacent “debiting FedAccounts” erstwhile ostentation inevitably accelerates. All the while, the severity of the eventual illness volition grow.

If the authorities won’t assistance america get retired of a strategy that is hurting america all, what tin we bash by ourselves?

Ending The Ponzi Ourselves

Thankfully, we, collectively, arsenic citizens of the Earth, tin hole this occupation — not done votes oregon UN resolutions but done idiosyncratic actions to cease participating successful the instrumentality governments person built astir us.

We are already bombarded by messages that it is the greedy affluent and capitalism itself which is to blasted for our societal ills, but present we cognize they are lone pursuing a playbook and strategy enabled and encouraged by a government-led Ponzi scheme.

Source: CNN.

Ironically, these messages thrust radical to manus much powerfulness to governments, who are seen arsenic the lone reply to controlling the excesses of the backstage sector. The effect is exacerbation of the problem, not resolution, arsenic government-centric monetary systems are the basal of those problems.

Thankfully, defunding the fiat currency Ponzis and ridding our satellite of their catastrophic systemic risks is already successful progress. Day by day, individuals are opting retired of a breached fiscal strategy and into a caller one, retired of authorities scope and fixed successful supply: Bitcoin.

The beingness and maturation of the Bitcoin web represents a situation to a strategy which indispensable exert much controls and summation systemic risks successful bid to survive. That strategy would person america enactment harder for little conscionable to support the Ponzi strategy ticking. Each idiosyncratic who chooses to clasp bitcoin alternatively of assets which governments tin prehend oregon devalue is doing their portion to dismantle that scheme.

Will you beryllium 1 of them?

This is simply a impermanent station by Captain Sidd. Opinions expressed are wholly their ain and bash not needfully bespeak those of BTC Inc oregon Bitcoin Magazine.

3 years ago

3 years ago

English (US)

English (US)