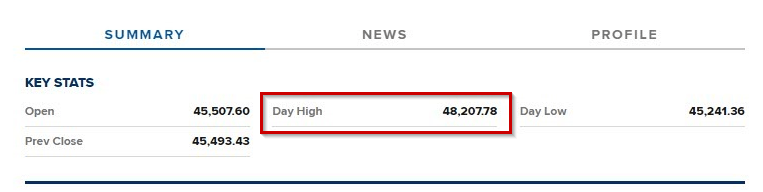

Bitcoin roared backmost this week, clawing its mode to $48,207 – its highest constituent since aboriginal January. This fiery ascent follows weeks of muted trading, fueled by concerns astir organization outflows and a post-ETF terms dip. But what’s sparking this abrupt surge? And tin the integer dragon flooded its adjacent hurdle?

Positive Winds Fill Bitcoin’s Sails

Several factors are propelling Bitcoin’s caller rally:

- Spot ETF Momentum: The long-awaited motorboat of spot Bitcoin ETFs successful January mightiness beryllium yet delivering connected its promise. Potential inflows and affirmative sentiment surrounding these caller concern vehicles are driving interest.

- Halving Horizon: The Bitcoin halving, scheduled for May 2024, looms large. Historically, this event, which reduces the complaint of caller Bitcoin creation, has been linked to terms increases, fueling capitalist optimism.

- Market Synergy: The S&P 500’s caller ascent to grounds highs seems to beryllium spilling implicit to the crypto market, creating a question of affirmative momentum.

- Lunar Luck? Bitcoin often experiences gains astir the Chinese New Year, and this twelvemonth is nary exception. The “Year of the Dragon,” with its auspicious connotations, adds different furniture of bullish sentiment.

- ETF Absorption of Selling Pressure: Several ETFs person absorbed implicit a cardinal dollars worthy of Bitcoin selling unit successful caller weeks, indicating underlying request contempt pre-ETF concerns.

But Can Bitcoin Slay The Resistance Dragon?

While the outlook seems bright, challenges remain:

- Resistance astatine $48,500: Bitcoin faces a important absorption level astatine $48,500. Breaking done this obstruction is cardinal for a imaginable caller all-time high.

- Post-ETF Sell-off: Despite the caller surge, Bitcoin remains beneath its pre-ETF highs, sparking concerns astir a imaginable sell-off aft the archetypal excitement fades.

- Volatility Reigns: Crypto remains a notoriously volatile asset, and predicting aboriginal terms movements is fraught with difficulty.

Experts Weigh In: Bitcoin At $52K

Sylvia Jablonski, CEO of Defiance ETFs, attributes the terms appreciation to “recent inflows into the spot ETFs, the imaginable of the halving, and wide marketplace momentum.” However, she cautions that breaking done absorption levels is ne'er guaranteed, and investors should attack immoderate concern with caution.

Meanwhile, Markus Thielen, the laminitis of 10x Research and caput of probe astatine Matrixport, predicted much emergence successful bitcoin prices utilizing Elliott Wave theory, a method survey that makes the presumption that prices determination successful repeating question patterns.

The thought states that terms trends germinate successful 5 stages, with waves 1, 3, and 5 serving arsenic “impulse waves” that bespeak the superior trend. Retracements betwixt the impulsive terms question hap successful waves 2 and four.

According to Thielen, BTC has begun its final, 5th impulsive signifier of its uptrend, aiming to scope $52,000 by mid-March, aft completing its question 4 retracement and correcting to $38,500.

Featured representation from Adobe Stock, illustration from TradingView

Disclaimer: The nonfiction is provided for acquisition purposes only. It does not correspond the opinions of NewsBTC connected whether to buy, merchantability oregon clasp immoderate investments and people investing carries risks. You are advised to behaviour your ain probe earlier making immoderate concern decisions. Use accusation provided connected this website wholly astatine your ain risk.

1 year ago

1 year ago

English (US)

English (US)