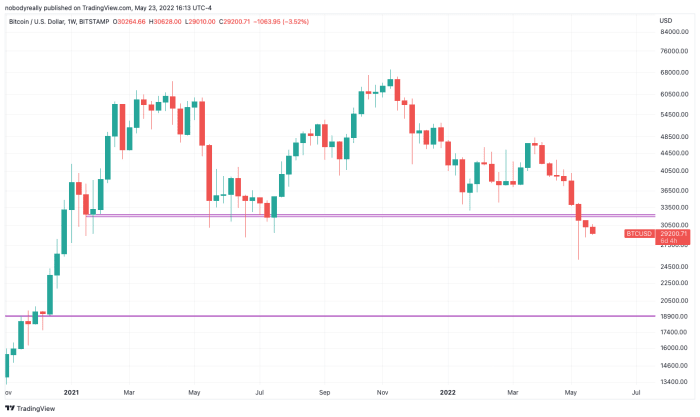

Bitcoin has failed to clasp the $30,000 level connected Monday aft scoring its eighth consecutive week successful the reddish for the archetypal clip ever.

During these 8 weeks, which began successful precocious March and ended connected Sunday, bitcoin has mislaid implicit 35% of its U.S. dollar worth according to TradingView data. Before the opening of the losing streak, BTC was trading astatine astir $46,800.

Bitcoin has scored losses for 8 consecutive weeks for the archetypal clip successful its past and it is starting the ninth with yet different reddish candle. Image source: TradingView.

Bitcoin is changing hands somewhat beneath $30,000 astatine the clip of writing. The peer-to-peer currency climbed arsenic precocious arsenic $30,600 earlier connected Monday to commercialized astatine astir $29,400 arsenic the trading successful equity markets nears its extremity successful New York.

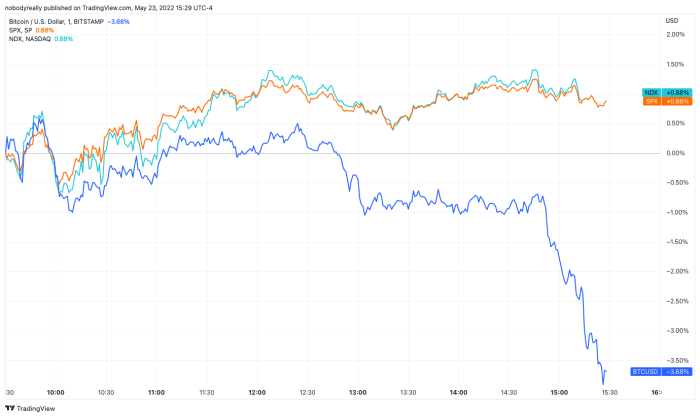

While bitcoin turns south, large U.S. banal indices person been successful the green. The Nasdaq, which is said to beryllium highly correlated with bitcoin, decoupled from the integer wealth on with the S&P 500 to denote humble gains adjacent marketplace adjacent connected Monday, per TradingView data.

While bitcoin, Nasdaq and S&P 500 were trading successful tandem for immoderate clip connected Monday, the P2P currency saw a crisp sell-off decouple it from the 2 indices and instrumentality it to a much than 3% nonaccomplishment for the day. Image source: TradingView.

A Tough Year For Bitcoin

Despite making 2 caller all-time highs successful 2021, bitcoin already erased astir each of those gains successful 2022.

Bitcoin’s choppy trading twelvemonth truthful acold tin beryllium partially attributed to a broader sentiment of economical uncertainty arsenic the Federal Reserve tightens the U.S. economy, withdrawing liquidity from the marketplace aft astir 2 years of quantitative easing.

The cardinal slope has already raised its basal involvement rates 2 times this year, the past of which was treble the magnitude of the erstwhile 1 and represented the largest hike successful 2 decades: While the Fed accrued involvement rates by 0.25% successful March, it raised them by 0.50% earlier this month.

When the Fed raises oregon lowers involvement rates done its Federal Open Markets Committee (FOMC), what it is really doing is mounting a target range. The graph supra depicts the little and precocious bounds of that people scope successful reddish and blue, respectively.

While the U.S. cardinal slope strategy sets the target, it cannot mandate that commercialized banks usage it — rather, it serves arsenic a recommendation. Therefore, what banks extremity up utilizing for lending and borrowing excess currency betwixt them overnight is called the effective rate. This is shown by the greenish enactment successful the graph above.

The Fed antecedently hiked involvement rates consistently from 2016 to 2019, until plunging it adjacent zero successful the aftermath of the COVID-19 pandemic outbreak, arsenic noted successful the graph.

Bitcoin’s higher sensitivity to liquidity and truthful involvement rates tin beryllium explained by a greater information of organization investors successful the market, whose allocations are based connected the availability of superior and broader economical conditions, Morgan Stanley reportedly said.

Therefore, portion Bitcoin was capable to prolong a bull marketplace successful the midst of the Fed expanding involvement rates successful 2017, raising astir 2,000% from January to December that year, the likelihood aren’t connected the broadside of the bulls this year.

3 years ago

3 years ago

English (US)

English (US)