The illness of FTX near a gaping spread successful the crypto market. The failed speech accounted for a important chunk of the planetary trading measurement and kept Binance from becoming the de facto ruler of the market.

With FTX present gone, Binance took the throne and became the largest and perchance the astir important institution successful the crypto industry. The speech present accounts for implicit 50% of the planetary spot and derivatives market, with its dominance expanding daily.

However, lone looking astatine Binance’s trading measurement fails to overgarment the implicit representation of wherever the speech stands.

To find the market’s sentiment, 1 indispensable ever look astatine Bitcoin first. The driving unit of the crypto industry, Bitcoin’s movement, and organisation crossed exchanges amusement the market’s sentiment and tin beryllium utilized to find aboriginal marketplace trends.

Looking astatine Bitcoin balances connected exchanges shows the magnitude of BTC that could beryllium utilized to make selling pressure. It besides illustrates the wide maturity and wellness of the marketplace — the little Bitcoin determination is connected exchanges, the much radical spot it arsenic a semipermanent investment.

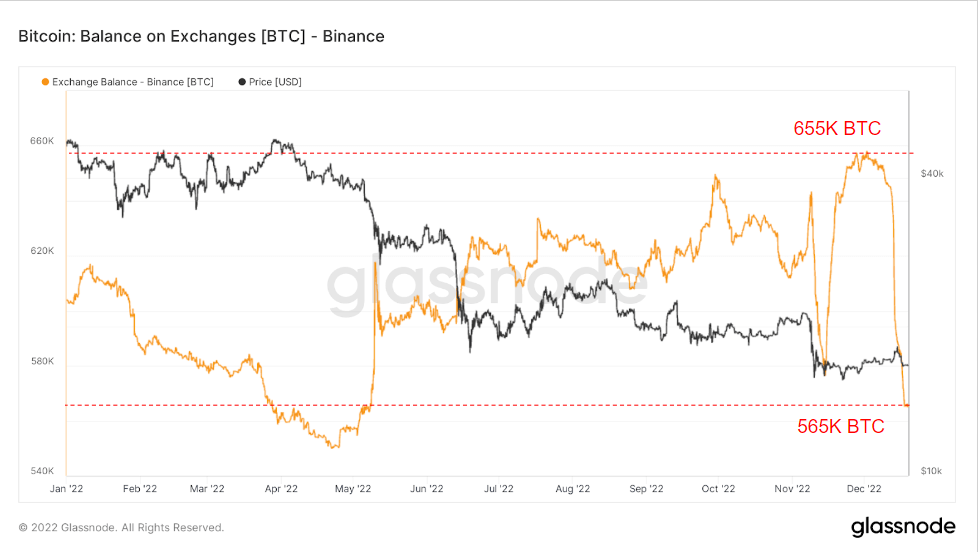

As of Dec. 23, the full magnitude of BTC held connected Binance stands astatine 565,00 BTC. This is simply a crisp driblet from the yearly precocious of 655,000 BTC recorded successful December erstwhile implicit $1 cardinal worthy of BTC was deposited into the exchange.

The 90,000 BTC quality successful Binance’s equilibrium was created successful a azygous week successful mid-December. CryptoSlate investigation of on-chain information showed that implicit $600 cardinal worthy of BTC was withdrawn from the speech successful a azygous day.

Graph showing the Bitcoin equilibrium connected Binance successful 2022 (Source: Glassnode)

Graph showing the Bitcoin equilibrium connected Binance successful 2022 (Source: Glassnode)Looking astatine the nett travel of Bitcoin by the worth of the transactions shows that the retail marketplace was liable for astir of the withdrawals successful December.

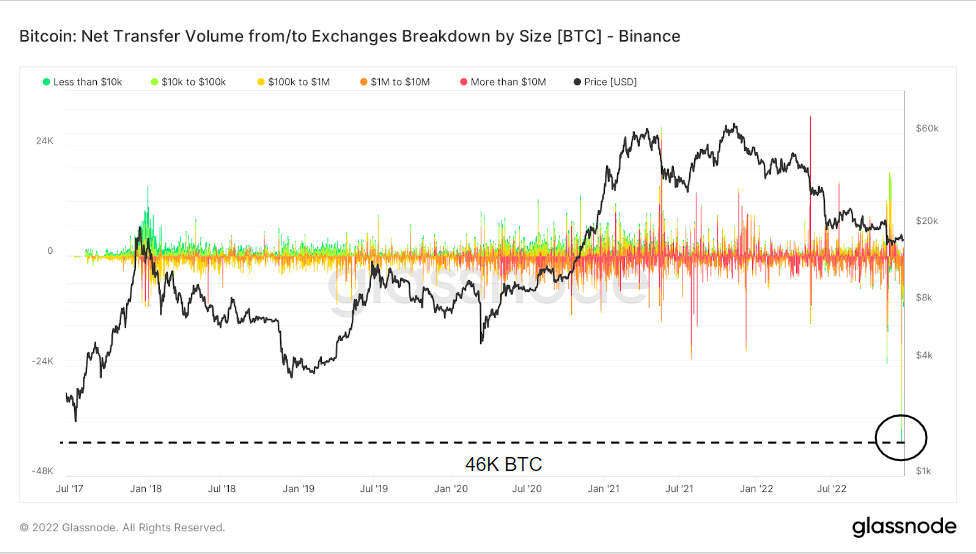

The graph beneath ranks Bitcoin nett flows by their USD value, ranging from little than $10,000 to much than $10 million—transfers with a worth smaller than $10,000 represented the bulk of inflows to Binance until 2021.

From 2021 until now, ample transfers with a worth betwixt $1 cardinal and $10 cardinal made up the astir important portion of inflows and outflows from Binance.

Graph showing the nett transportation measurement to and from Binance, breached down by the USD worth of the transactions (Source: Glassnode)

Graph showing the nett transportation measurement to and from Binance, breached down by the USD worth of the transactions (Source: Glassnode)Comparing Binance to different exchanges shows that the diminishing Bitcoin equilibrium is simply a market-wide trend. However, Binance experienced the sharpest alteration successful its BTC equilibrium this month, with different exchanges similar Coinbase, Kraken, Gemini, and Bitfinex each seeing smaller drops.

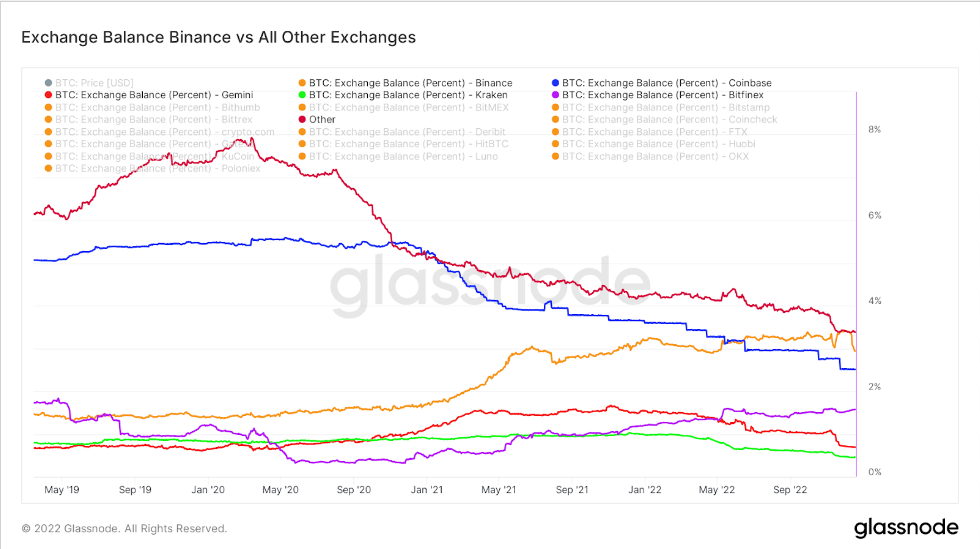

Graph showing the Bitcoin equilibrium crossed centralized exchanges from May 2019 to December 2022 (Source: Glassnode)

Graph showing the Bitcoin equilibrium crossed centralized exchanges from May 2019 to December 2022 (Source: Glassnode)The lone speech that saw its Bitcoin equilibrium summation this twelvemonth was Bitfinex. Conversely, Coinbase has seen astir vertical drops successful its balances passim the twelvemonth and presently holds astir 2.5% of the Bitcoin supply.

It’s inactive excessively aboriginal to archer whether the driblet successful Binance’s BTC equilibrium should beryllium a origin for concern. However, the speech maintains its concern arsenic accustomed contempt the marketplace turmoil, assuring its users and investors that it has coagulated fiscal footing and deals with steadfast trading volumes.

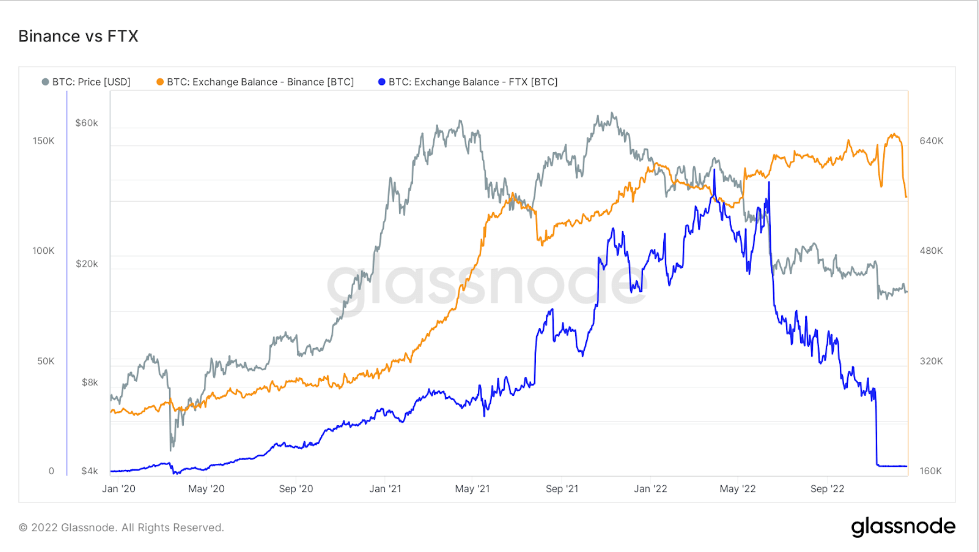

However, comparing Binance’s outflows to the outflows seen connected FTX shows that they could beryllium origin for concern.

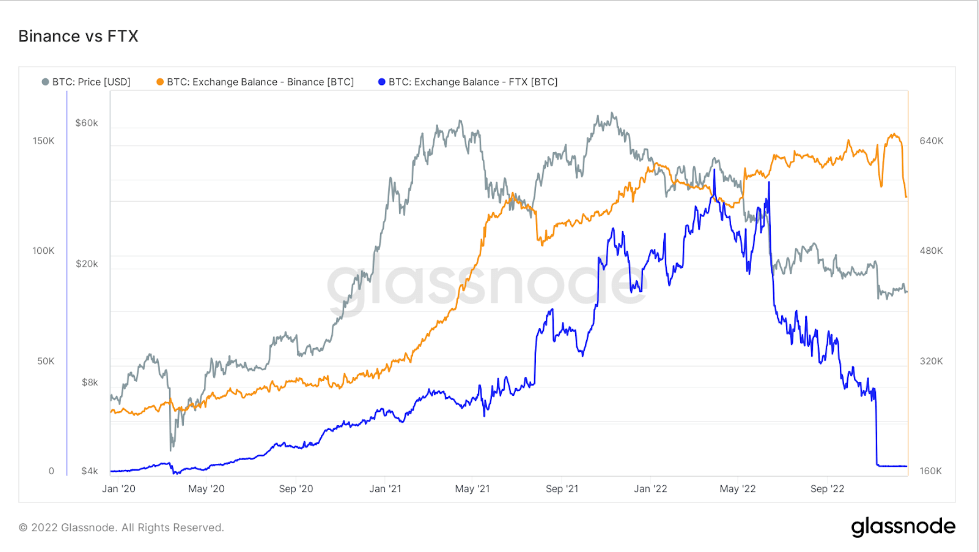

At the opening of the year, FTX had astir 150,000 BTC. After that, the speech saw its Bitcoin equilibrium summation until a crisp correction successful the spring, but it returned to the yearly precocious close astatine the opening of the summer. Then, successful June 2022, implicit 70,000 BTC near FTX successful 2 weeks.

Graph comparing the Bitcoin equilibrium connected Binance and FTX (Source: Glassnode)

Graph comparing the Bitcoin equilibrium connected Binance and FTX (Source: Glassnode)The crisp outflow triggered a downward spiral until November and saw FTX’s Bitcoin equilibrium scope a two-year low. The speech past collapsed and triggered a planetary marketplace meltdown, the consequences of which are inactive being felt.

The 70,000 BTC outflow triggered FTX’s Bitcoin equilibrium occupation is overmuch smaller than the 90,000 BTC outflow Binance saw successful a week. However, we are yet to spot whether the exchange’s Bitcoin equilibrium volition amended oregon whether the downward spiral volition proceed into 2023.

Graph comparing the Bitcoin equilibrium connected Binance and FTX (Source: Glassnode)

Graph comparing the Bitcoin equilibrium connected Binance and FTX (Source: Glassnode)The station Bitcoin balances connected exchanges are shrinking and Binance is nary exception appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)