Bitcoin has had its just stock of carnivore markets successful the past. Let’s concisely recap the astir important ones and spot what we tin larn from them.

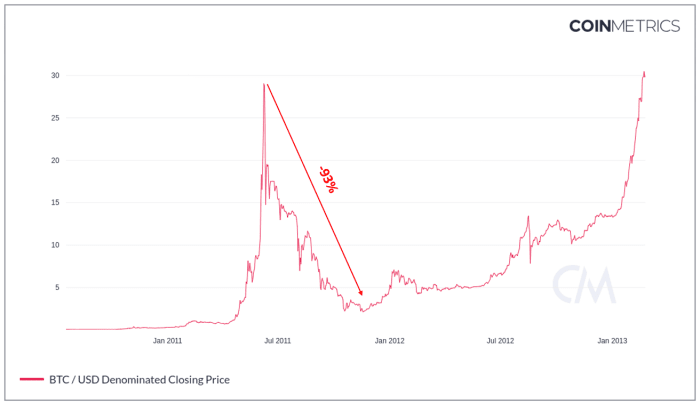

The 2011-2012 Bear Market

The bitcoin terms fell from $29 connected June 8, 2011 to $2.10 connected November 18, 2011, followed by months of sideways action:

The archetypal carnivore market, 2011-2012. Chart information source: CoinMetrics.io

The astir achy carnivore marketplace happened earlier astir of america were adjacent alert that thing similar bitcoin existed. More than 10 years ago, the terms of bitcoin reached astir $30 connected the then-popular Mt. Gox exchange, lone to beryllium followed by a “stairway to hell” signifier that would instrumentality the terms to $2.10 successful a respective months’ time.

Bitcoin dumped 93%! But see this: buying bitcoin adjacent astatine the all-time precocious (ATH) terms of $30 would inactive person been a bargain from today’s perspective. Who wouldn’t privation to stack immoderate bitcoin astatine $30 dollars, right? Of people fewer backmost past could expect that successful 10 years, bitcoin would beryllium astir $50,000; that’s wherefore aft that archetypal drop, it took much than a twelvemonth for the terms to retrieve and ascent to caller heights. The cognition of what bitcoin really is evolved implicit the decennary arsenic it went from a geeky experimentation to darknet currency to an ostentation hedge, and perchance the ground of the aboriginal planetary monetary system.

When the terms breached the erstwhile ATH successful aboriginal 2013, it ne'er dipped beneath that terms level again.

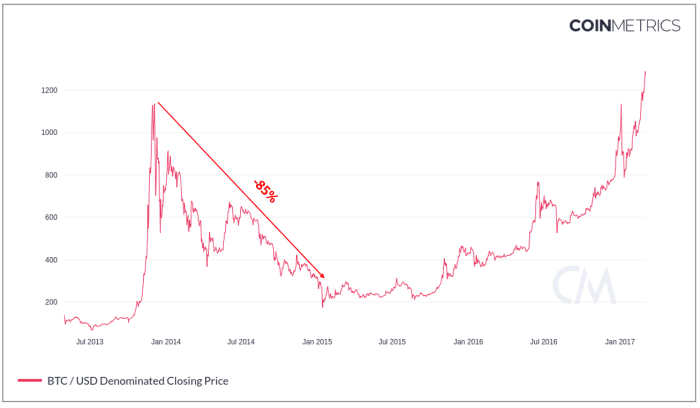

The 2014-2016 Bear Market

Bitcoin’s terms aboriginal tumbled from $1,135 connected December 4, 2013 to $175 connected January 14, 2015, followed by months of sideways action:

The 2nd carnivore market, 2014-2016. Chart information source: CoinMetrics.io

At the crook of 2013/2014, 2 large things happened: the Silk Road marketplace was unopen down (Ross Ulbricht is present serving a treble beingness condemnation without the anticipation of parole), and the Mt. Gox speech collapsed. These were the 2 astir apt causes of the consequent carnivore market. With 2 large bitcoin venues unopen down and large losses sustained by their users, it seemed to immoderate similar bitcoin was dormant and useless.

As bitcoin dropped 85% from the apical to bottom, galore “bitcoin obituaries” were written, usually with smug told-you-so undertones.

But those that were determination during the 2011-2012 play learned their lesson: Bitcoin comes backmost - with vengeance! Builders kept connected building, and immoderate of the astir pivotal tech was created during the 2nd carnivore market: Trezor One, the world’s archetypal hardware wallet, was released successful aboriginal 2014, and the Lightning Network whitepaper was published successful January 2016.

And erstwhile the terms yet breached the erstwhile ATH successful aboriginal 2017, it ne'er dipped beneath $1000 ever again.

The 2018-2020 Bear Market

One of the astir celebrated “crashes” of Bitcoin’s vocation was a terms autumn from $19,640 connected December 16, 2017 to $3,185 connected December 15, 2018, followed, again, by months of sideways action:

The 3rd carnivore market, 2018-2020. Chart information source: CoinMetrics.io

The astir caller carnivore marketplace is sometimes dubbed “the crypto-winter,” mostly due to the fact that the large shakeout and a driblet to the debased adjacent $3,000 came successful the wintertime of 2018/2019. This carnivore marketplace was rather pugnacious due to the fact that of the fake rally of spring/summer 2019 erstwhile the terms reached $12,000, lone to driblet backmost to $4,000 erstwhile the COVID-19 panic struck successful afloat unit successful March 2020.

But again, bitcoin recovered with vengeance and whitethorn ne'er instrumentality beneath its erstwhile ATH of $20k again. Many indispensable ecosystem projects took disconnected during this play - Trezor Model T and the Shamir Backup, BTCPay Server, astir Lightning Network wallets and tooling, Jack Dorsey’s Spiral, Jack Mallers’ Strike, and galore different tools and services we usage today.

Can We Spot A Bear Coming For Us?

Per traditional definition, a carnivore marketplace occurs erstwhile “prices autumn 20% oregon much from caller highs, amid wide pessimism and antagonistic capitalist sentiment.” While the archetypal portion of this explanation is casual to quantify — yes, bitcoin has dropped by that overmuch from caller highs — the second is precise subjective.

A full manufacture of on-chain metrics trying to find the prevailing sentiment has been built implicit the years. But the occupation with specified metrics is that they themselves are built connected subjective interpretations of what’s going on:

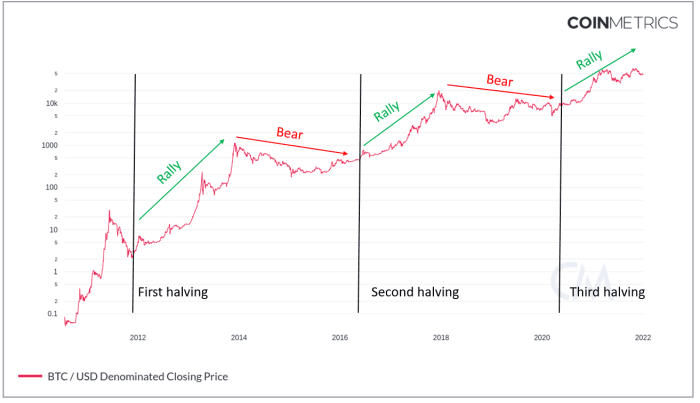

Some analysts effort to foretell the abbreviated and agelong word terms enactment by pointing retired a correlation betwixt terms rallies and the artifact reward halving rhythm - a 4-year rhythm which halves the complaint astatine which the bitcoin proviso increases. And it does look convincing:

Block reward halvings and terms enactment 2010 - 2022, log scale. Chart information source: CoinMetrics.io

The occupation with the halving-cycle proposal is that truthful far, we lone person 2 afloat information points: the periods aft the archetypal and 2nd halvings. We are presently successful the 3rd play and adjacent if the terms enactment followed a akin signifier this clip around, this inactive doesn’t person to mean anything. Per the efficient marketplace hypothesis, predictable and widely-known facts specified arsenic bitcoin halvings cannot impact the terms successful specified a monolithic mode - determination are different unseen factors successful spot (such arsenic fiat currencies failing arsenic a reliable store of value). The quality caput likes to find patterns successful the noise, and the volatile, upward-trending illustration similar bitcoin’s is precise seductive successful this regard.

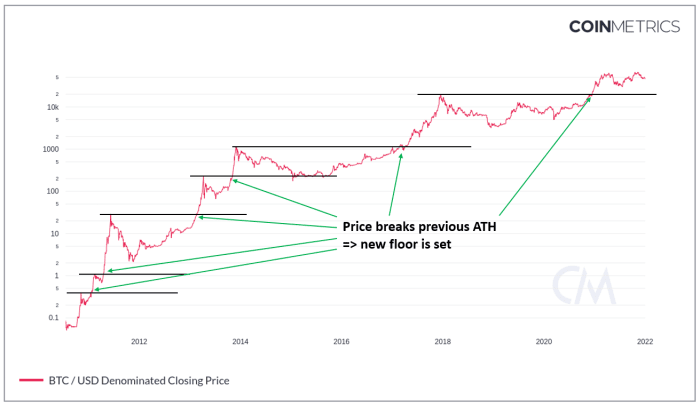

I judge the semipermanent bitcoin terms illustration tells america thing overmuch much absorbing than the alleged halving cycle. This is what we spot erstwhile we look astatine the aforesaid illustration from a antithetic perspective:

Price enactment 2010 - 2022, log scale. Chart information source: CoinMetrics.io

Instead of 2 halving cycles, we get six historical ATHs and find that the terms doesn’t look to dip beneath the erstwhile ATH erstwhile it has been breached for the 2nd time. If this holds existent successful the future, it would mean that terms wouldn’t spell beneath $20k if we were to participate a carnivore marketplace now, and it wouldn’t spell beneath $69,000 if we breached that terms level for a 2nd time. The mentation for this terms enactment whitethorn beryllium psychological: those yet undecided astir bitcoin usually instrumentality the archetypal steps erstwhile bitcoin is confirmed “not dead,” i.e., erstwhile it breaches the erstwhile ATH, resulting successful regular aged fearfulness of missing retired (FOMO). Admittedly, this reflection isn’t bulletproof, arsenic the terms concisely dipped beneath the $230 ATH acceptable successful April 2013, and is presently beneath the twice-breached ATH of $50,000 from 2021. I instrumentality this optimistic exemplary arsenic a idiosyncratic regularisation of thumb truthful I tin stack decisively if we were to dip adjacent to $20,000 levels. That said, I bash not hold for specified magical opportunities that whitethorn ne'er come, and I truthful stack sats regularly, nary substance the price.

Overall, I don’t deliberation anyone tin spot a carnivore marketplace forming. Bitcoin is traded 24/7 each astir the world, some connected centralized exchanges arsenic good arsenic peer-to-peer. The marketplace is continuously influenced by some section and planetary effects, specified arsenic the illness of the Lebanese lb oregon COVID-19-related restrictions. The champion you tin bash is prime your favourite rule-of-thumb metric and instrumentality to immoderate basal rules.

Rules For Navigating A Bear Market

“Hey Joseph, what is this - conscionable a clump of humanities charts and immoderate hardly moving rules of thumb?” I know, I know. But this is the unvarnished truth: cipher has a crystal ball, and method investigation doesn’t enactment amended than a coin flip — this applies adjacent if you paid large bucks for it.

Sometimes it’s amended to admit the chaotic quality of the marketplace and hole alternatively of predicting. Having a mates of carnivore markets nether my belt, these are my idiosyncratic rules for surviving the adjacent crypto winter, whenever it comes:

Do not trade. First-time traders usually purpose for “buy low, merchantability high.” But somehow, they extremity up doing the opposite, due to the fact that their emotions get successful the way. Trading is simply a precise stressful zero-sum game, wherever astir radical suffer their money: a recent Business Insider article pointed retired that betwixt 70-97% of time traders extremity up losing their money! Only experienced traders (who learned their lessons the hard way) and exchanges extremity up successful profit.

Do not usage leverage. There are 2 types of leveraged traders: those who person experienced the soul-crushing liquidation notice, and the naive who deliberation they person everything nether control. Trading bitcoin with leverage is an casual mode to extremity up successful a poorhouse oregon an asylum.

Do not permission your coins connected exchanges. During a tumultuous clip specified arsenic a raging carnivore market, exchanges tin extremity up insolvent. This has happened galore times successful the past, with Mt. Gox, Quadriga, and Cryptopia being lone the largest ones. “Not your keys, not your coins” ever - always - applies.

Do not effort to prime “solid crypto projects.” Go to Coinmarketcap.com’s humanities information snapshots and cheque retired the pre-bear marketplace rankings. Then spot however galore of those coins person stayed successful the apical 20 until now. Not many, right? The occupation with betting connected altcoins is determination are conscionable excessively galore of them, and much and much projects are created connected a regular ground with small much than sleek selling going for them. Bitcoin is planetary stateless money, and is becoming perceived arsenic specified by much and much investors, governmental leaders, and mean radical astir the world. Bitcoin is the coagulated crypto task with monolithic imaginable you are looking for!

"You Are Not Too Late Too Become Wildly Wealthy With Bitcoin."

Zoom out. Both successful presumption of terms charts and fundamentals, it pays to instrumentality a measurement backmost and see things from a broader perspective. Bitcoin has been doing its happening for 13 years and nary substance however atrocious it sometimes looked, it ever recovered. Bitcoin is antifragile — volatility, attacks, schisms, and attempts to prohibition oregon modulate it marque Bitcoin stronger successful the end. But successful bid to reap the afloat benefits, you person to person the condemnation to clasp (or adjacent stack more) successful the hard times arsenic good arsenic the bully times. That’s wherefore you request to…

Study. Seminal works specified arsenic Vijay Boyapati’s “The Bullish Case For Bitcoin,” Saifedean Ammous’ “The Bitcoin Standard,” oregon Parker Lewis’ “Gradually, Then Suddenly” were mostly written during the 2018-2020 carnivore market. And they stay large reads successful just and stormy upwind alike. Studying these works volition assistance you spot past the short-term slump and assistance you marque the close determination for your future.

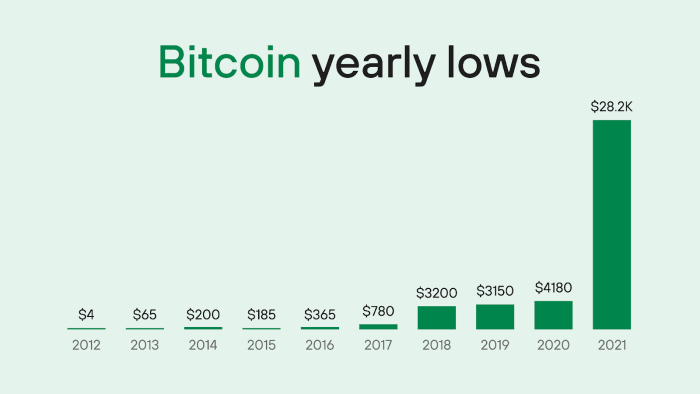

And finally, don’t obsess over ATHs - look astatine the yearly lows for a change:

It’s All About The Sats

When you fto spell of the fiat mindset and alternatively tune successful to the imaginable of hyperbitcoinization, carnivore markets really go enjoyable: you get to stack much sats astatine a relaxed pace, buzzword-fueled mania dies down, and cardinal tech gets built without the unit to merchandise early.

Bear markets connection a life-changing accidental for many. Bitcoin is perchance 1 of the biggest breakthroughs successful quality history, and having the quality to get a capable magnitude of bitcoin astatine debased terms levels tin mean an flight from poorness and the 9-5 grind for millions.

There’s thing unexpected oregon scary astir carnivore markets. They’re portion of the process of bitcoin becoming a planetary neutral monetary standard. So adjacent clip the carnivore strikes, beryllium prepared and invited it with unfastened arms.

This is simply a impermanent station by Josef Tětek. Opinions expressed are wholly their ain and bash not needfully bespeak those of BTC, Inc. oregon Bitcoin Magazine.

3 years ago

3 years ago

English (US)

English (US)