On-chain information shows exchanges person received a immense Bitcoin inflow spike from semipermanent holders, a motion that could beryllium bearish for the terms of the crypto.

Investors Holding Bitcoin Since 12 Months To 18 Months Ago Transfer A Huge Amount To Exchanges

As pointed retired by an expert successful a CryptoQuant post, immoderate semipermanent investors holding connected to their coins since betwixt a twelvemonth to a twelvemonth and a fractional precocious sent large inflows to exchanges.

The applicable indicator present is the “exchange inflow,” which measures the full magnitude of Bitcoin moving to centralized speech wallets.

When the worth of this indicator shows a ample spike, it means investors person conscionable deposited a batch of coins to exchanges. Such a inclination is usually bearish for the terms of the crypto arsenic holders usually transportation to exchanges for selling purposes.

On the different hand, tiny values of the metric whitethorn amusement mean marketplace behaviour and that determination isn’t largescale dumping going connected astatine the moment.

Related Reading | Bitcoin Taker Buy/Sell Volume Shows “Buy” Signal As BTC Gears Up For Rally

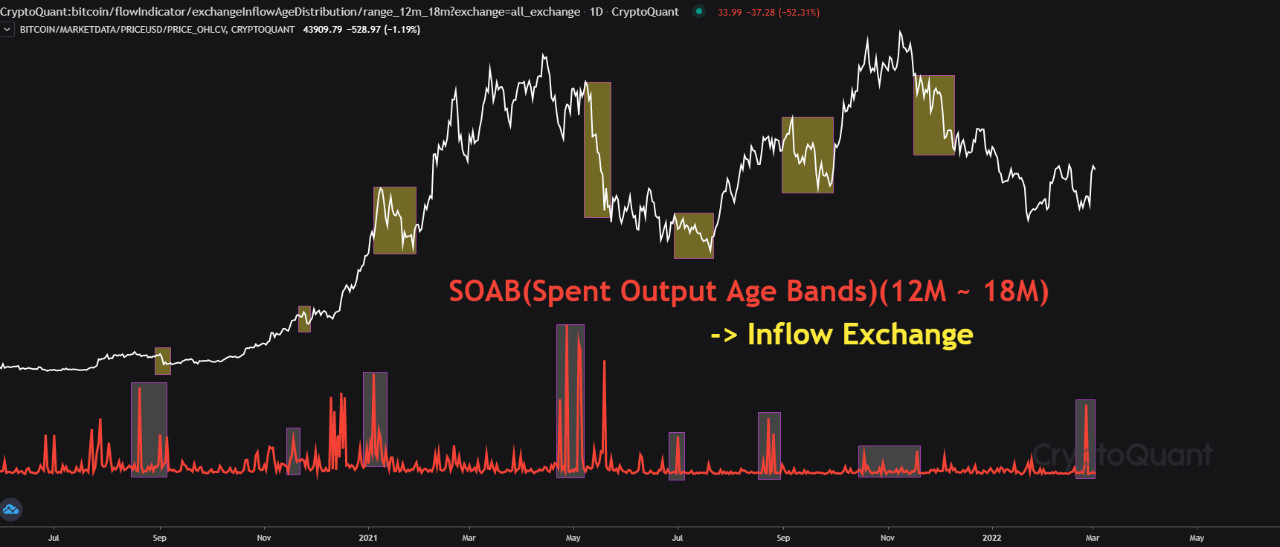

A modified mentation of the Bitcoin speech inflow shows lone transfers from those investors who had been holding connected their coins since 12 months to 18 months ago. Here is the illustration for it:

As you tin spot successful the supra graph, the worth of the indicator observed a immense spike conscionable recently. This means that long-term holders wrong the property scope of 12 to 18 months transferred a large fig of coins to exchanges, perchance for selling them.

In the chart, the quant has besides marked the erstwhile times this benignant of inclination took place. It looks similar soon pursuing specified a spike, the terms has ever observed a decline.

Related Reading |Bitcoin Closes 1st Green Month After 3 Reds, What History Says May Happen

Since a spike has besides occurred recently, the terms of Bitcoin whitethorn beryllium successful for a akin plunge soon, if the signifier continues to hold.

However, successful definite cases, it’s besides imaginable the worth of the coin doesn’t spot immoderate effects from this. An illustration of specified a concern would beryllium if an outflow of akin oregon larger magnitude took spot soon.

BTC Price

At the clip of writing, Bitcoin’s price floats astir $43.3k, up 23% successful the past 7 days. Over the past month, the crypto has gained 17% successful value.

The beneath illustration shows the inclination successful the terms of the coin implicit the past 5 days.

3 years ago

3 years ago

English (US)

English (US)