On-chain information shows a ample magnitude of aged Bitcoin proviso has moved successful the past fewer days, thing that could beryllium bearish for the crypto’s price.

Bitcoin Supply Older Than 2 Years Showed Movement In The Past Week

As pointed retired by an expert successful a CryptoQuant post, a full of 4 ample transfers with aged proviso person taken spot successful the past week. The applicable indicator present is the “Spent Output Age Bands” (SOAB), which tells america the full fig of coins that each property set is moving connected the concatenation close now.

The property bands notation to proviso groups divided based connected the criteria of the property of the coins (or much precisely, of the UTXOs). For example, the 1m-3m property set includes each coins that person been sitting dormant wrong the aforesaid addresses since astatine slightest 1 period agone and astatine astir 3 months ago. The SOAB metric for this radical would past measurement the full fig of these coins that person been transferred to different wallet.

Now, the property bands of involvement present are the 2y-3y and 3y-5y groups. Typically, investors that person been holding their coins since much than 155 days agone are said to beryllium the “long-term holders” (LTHs), truthful some these bands see coins belonging to 2 antithetic segments of the LTHs.

Also, it’s a statistical information that the longer investors clasp onto their BTC, the little probable they go to merchantability astatine immoderate point. This implies that the holders with specified aged proviso arsenic successful these bands would beryllium immoderate of the astir resolute HODLers successful the market.

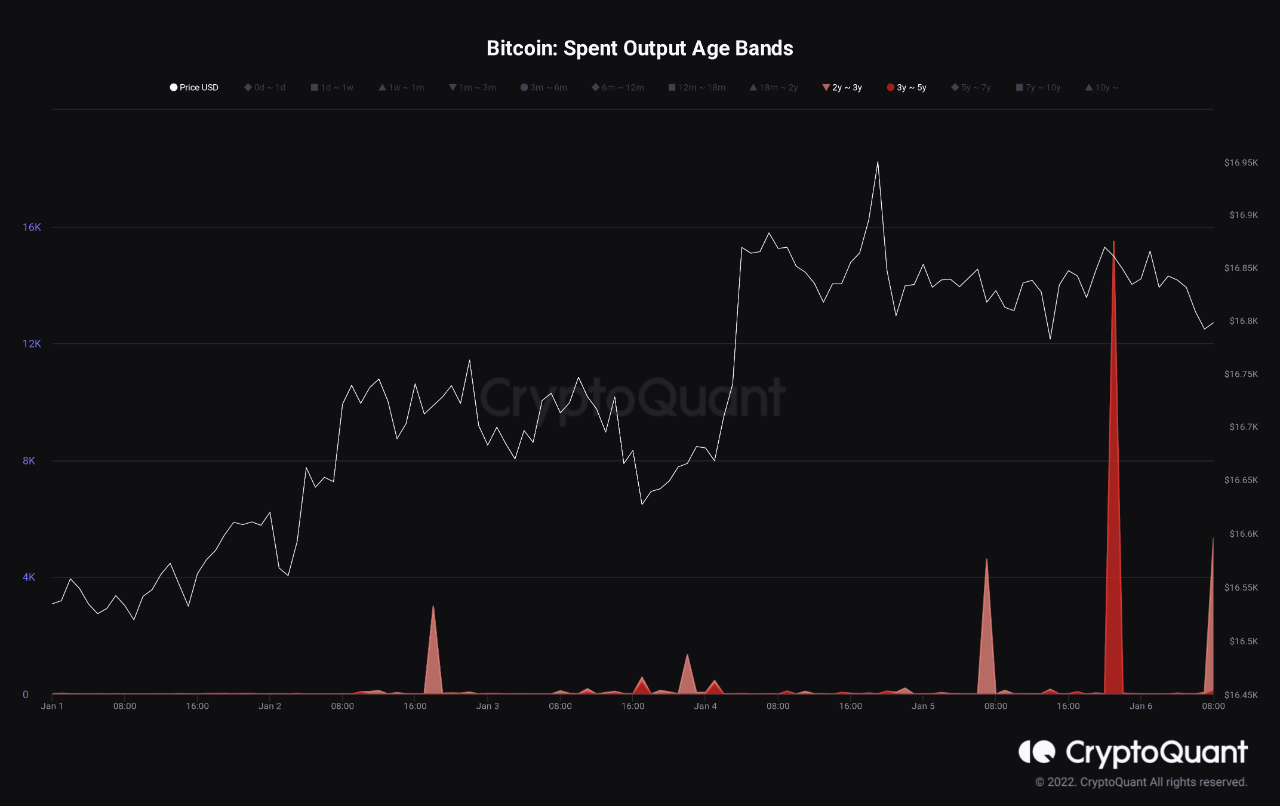

Here is simply a illustration that shows the SOAB information for these 2 Bitcoin property bands implicit the past week:

As the supra graph displays, determination person been 4 ample movements of coins belonging to these cohorts successful the past fewer days. Three of these transfers were from the 2y-3y property band, portion 1 was from the 3y-5y group.

The spike from the second cohort was importantly larger than the others, amounting to much than 15,000 BTC being moved. All the transfers from the 2y-3y property set combined came to astir 13,000 BTC, which is inactive little than the 3y-5y group’s transactions.

Generally, ample movements of specified aged Bitcoin proviso is simply a motion of dumping from the LTHs, and if it’s the lawsuit present arsenic well, past it would mean that the existent marketplace broke these alleged diamond hands into selling.

The quant notes that these transfers were astatine slightest not headed towards exchanges, which does trim the probability of these transactions being for selling purposes (but evidently doesn’t destruct the chances, arsenic these investors could conscionable person been selling done OTC deals).

Regardless of that, however, the expert cautions, “it is precise astonishing to spot FOUR of these transactions successful 1 week. It is decidedly worthy watching successful the adjacent period.”

BTC Price

At the clip of writing, Bitcoin is trading astir $16,700, up 1% successful the past week.

2 years ago

2 years ago

English (US)

English (US)