On-chain information shows the Bitcoin spot and derivative speech reserves person some changeable up recently, a motion that could beryllium bearish for the price.

Bitcoin Spot And Derivative Reserves Register Growth

As pointed retired by an expert successful a CryptoQuant post, the unfastened involvement and the backing rates are besides heating up successful the BTC market. The “exchange reserve” is an indicator that measures the full magnitude of Bitcoin that investors are depositing into wallets of centralized exchanges close now.

This metric has 2 versions; 1 is for the spot exchanges, portion the different is for the derivative platforms. Usually, investors deposit to spot exchanges for selling purposes, truthful an summation successful the reserves of these platforms tin suggest selling unit is rising successful the market.

And arsenic holders usage derivative exchanges for opening positions connected the futures market, a emergence successful this reserve tin pb to higher volatility (the effect connected the terms tin beryllium successful either direction).

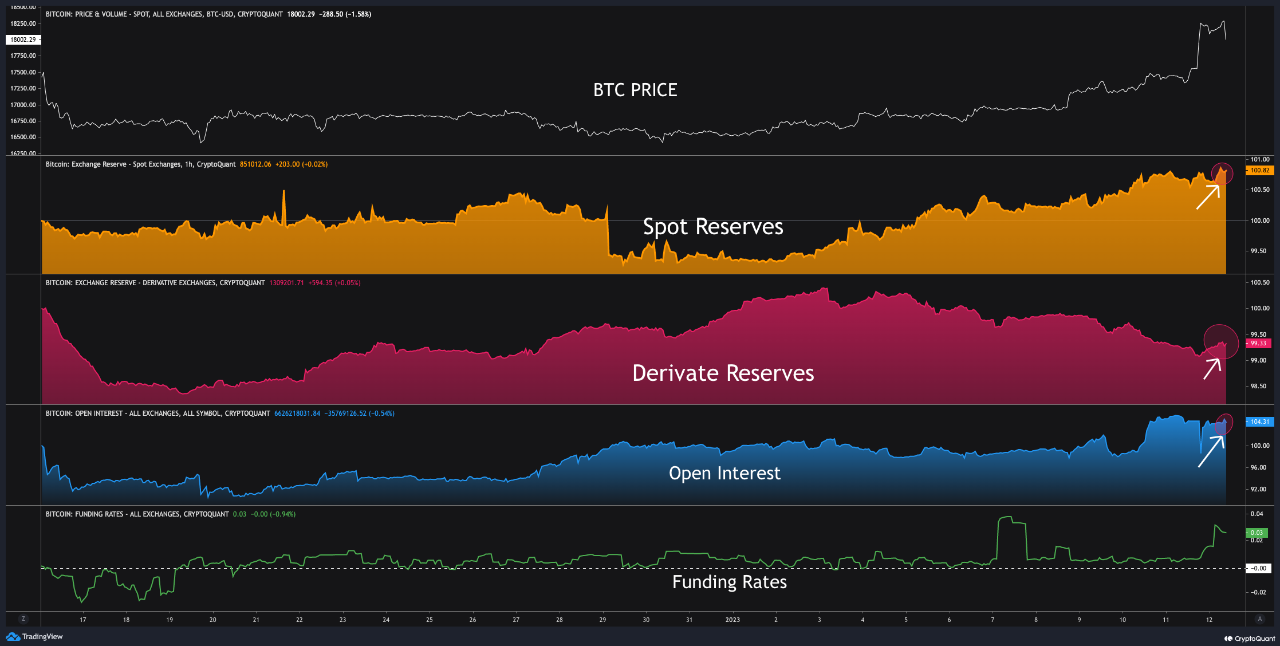

Now, present is simply a illustration that shows the inclination successful these Bitcoin speech reserves implicit the past month:

As displayed successful the supra graph, some the spot and derivative speech reserves person accrued successful worth recently, suggesting that investors person been making deposits to these platforms. The accrued spot reserves suggest an elevated selling unit successful the market, portion the derivative reserves connote an overheated futures sector.

The illustration besides includes information for 2 different metrics, the unfastened interest, and the backing rates. The “open interest” is an indicator that measures the full magnitude of futures positions presently unfastened connected derivative exchanges. This metric takes into relationship some abbreviated and agelong contracts.

The graph shows that this metric has besides trended up recently, further suggesting that the futures marketplace is presently overheated. The different indicator, the “funding rates,” tells america whether determination are much shorts oregon longs successful the market.

The Bitcoin backing rates are favorable now, implying that the longs are overwhelming the shorts. Generally, whichever mode this metric plaything tells america which of these declaration holders is much astatine hazard of a liquidation squeeze.

So far, determination hasn’t been immoderate agelong compression successful the market, but alternatively a abbreviated compression arsenic the terms has been capable to support up the momentum. There person been immoderate high liquidations during the past time that whitethorn person helped calm the overheated futures marketplace for now, but since determination is accrued selling unit connected the spot exchanges, BTC is inactive astatine hazard for a short-term pullback.

BTC Price

At the clip of writing, BTC is trading astir $19,100, up 14% successful the past week.

Featured representation from Thought Catalog connected Unsplash.com, charts from TradingView.com, CryptoQuant.com

2 years ago

2 years ago

English (US)

English (US)