On-chain information shows the Bitcoin speech whale ratio has remained astatine a precocious worth recently, a motion that could beryllium bearish for the crypto’s price.

Bitcoin Exchange Whale Ratio On Verge Of Entering “Very High Risk” Zone

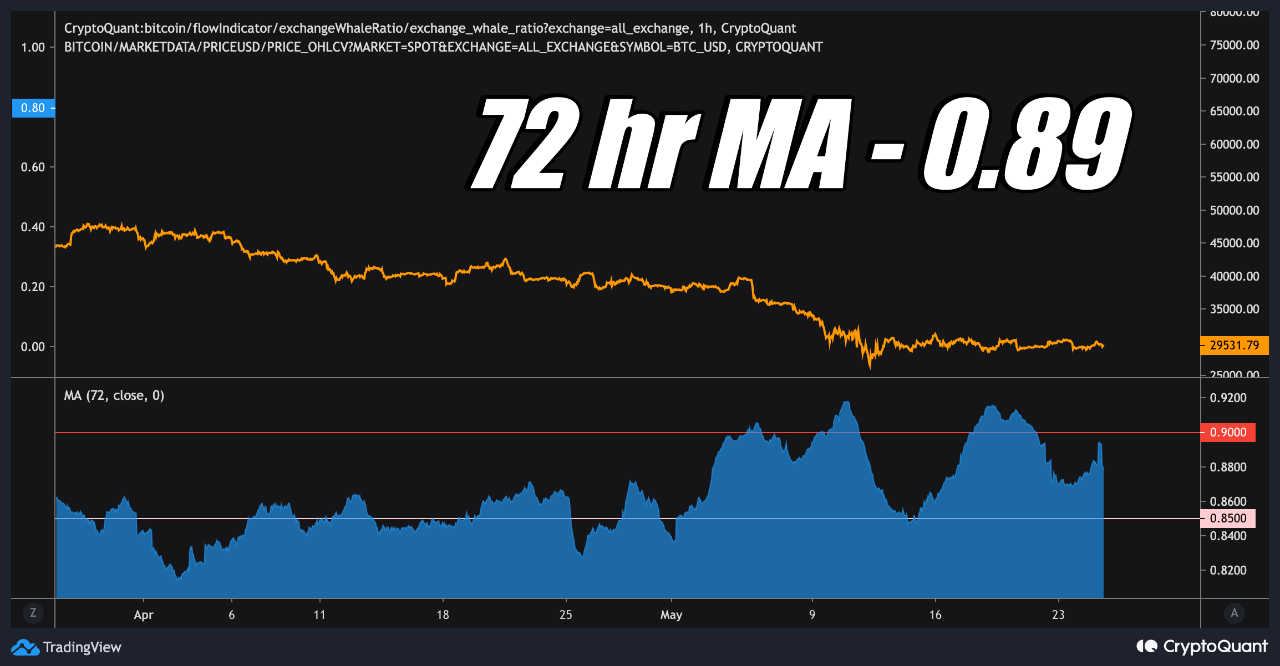

As explained by an expert successful a CryptoQuant post, the 72-hour MA whale ratio is adjacent 0.90, the precise precocious hazard zone.

The “exchange whale ratio” is an indicator that’s defined arsenic the sum of apical 10 inflows to exchanges divided by the full inflows.

In simpler terms, this metric tells america what portion of the full inflows are contributed by the 10 largest transactions, which typically beryllium to the whales.

When the worth of this indicator is supra 0.85, it means whales inhabit a precise ample percent of speech inflows close now.

As investors usually transportation their Bitcoin to exchanges for selling purposes, specified a inclination tin beryllium a motion that whales are dumping astatine the moment.

The indicator’s worth usually remains supra this threshold during BTC carnivore markets, oregon fake bull for wide dumping.

Related Reading | Bitcoin Trading Volume Plummets Down From Recent Top

On the different hand, values beneath the 0.85 people usually signify that whale inflows are presently successful a healthier equilibrium with the remainder of the market. The ratio’s worth usually remains successful this portion during bull runs.

Now, present is simply a illustration that shows the inclination successful the Bitcoin speech whale ratio (72-hour MA) implicit the past mates of months:

As you tin spot successful the supra graph, the Bitcoin speech whale ratio has a worth of astir 0.89 close now, supra the 0.85 threshold.

According to the quant successful the post, values supra 0.90 whitethorn beryllium considered the “very precocious risk” zone. So, the existent worth of the indicator is precise adjacent to that.

Related Reading | Investors May Expect Downside For Bitcoin And Ethereum Market For The Next 3 Months

In this period truthful far, the ratio’s worth has astir ever remained supra the 0.85 line, with a mates of spikes supra the 0.90 level.

The expert believes whales are progressive close present owed to the FED May Meeting Minutes, and if the ratio remains precocious successful the adjacent future, past it could spell occupation for Bitcoin.

BTC Price

At the clip of writing, Bitcoin’s price floats astir $28.8k, down 2% successful the past 7 days. Over the past 30 days, the crypto has mislaid 30% successful value.

The beneath illustration shows the inclination successful the terms of the coin implicit the past 5 days.

3 years ago

3 years ago

English (US)

English (US)