By Omkar Godbole (All times ET unless indicated otherwise)

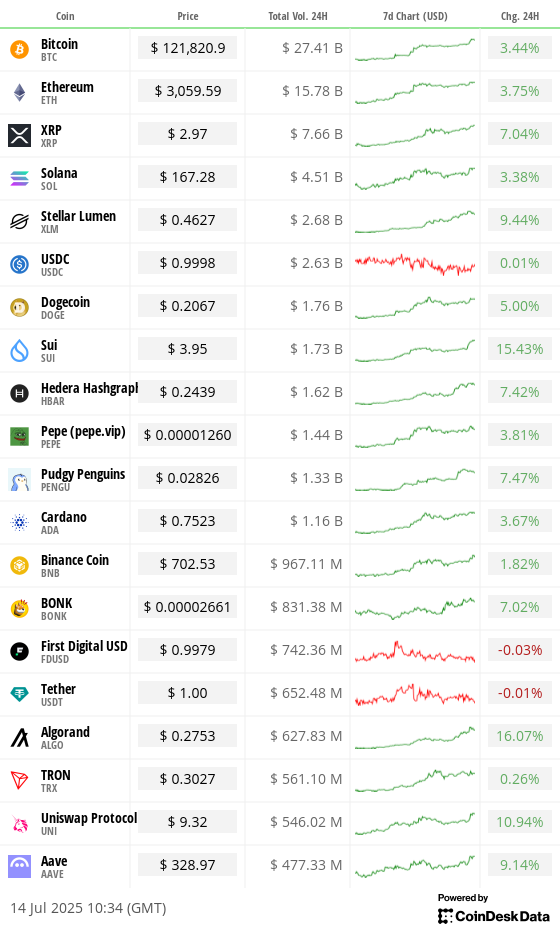

The crypto marketplace is simply a sea of green with apical coins extending near-vertical rallies that began implicit 2 weeks ago. Bitcoin (BTC) climbed supra $122,000 for the archetypal clip connected record, outpacing golden to go the best-performing plus successful 2025.

The rally has the crypto assemblage identifying bitcoin terms targets ranging from $140,000 to $200,000. Some observers, however, cautioned against getting carried distant by the bull momentum.

"While immoderate analysts task $130-140K targets, past teaches america that parabolic moves often invitation crisp corrections," said Marcin Kazmierczak, a co-founder of blockchain oracle Redstone. "The industry’s maturation is real, organization infrastructure, regulatory clarity, and usage cases are each advancing. Yet this precise maturation demands we attack these milestones with nonrecreational subject alternatively than euphoria."

Kazmierczak noted that portion the method breakout is undeniable, the marketplace hasn't seen a correction successful implicit 47 days. "More than $276m successful leveraged positions were liquidated successful the past 24 hours alone, reminding america that volatility remains bitcoin’s changeless companion," helium added.

More caution shows successful options marketplace enactment connected Deribit, which suggests traders are successful nary unreserved to instrumentality bullish speculative bets. One-month hazard reversals, measuring the pricing differential betwixt bullish calls and bearish puts, are level adjacent arsenic the spot terms trades astatine grounds highs.

"By contrast, September and December hazard reversals proceed to amusement a steadfast bid for calls, which could bespeak a penchant to hedge against short-term volatility portion maintaining a longer-term bullish outlook," Singapore-based QCP Capital said successful a marketplace update.

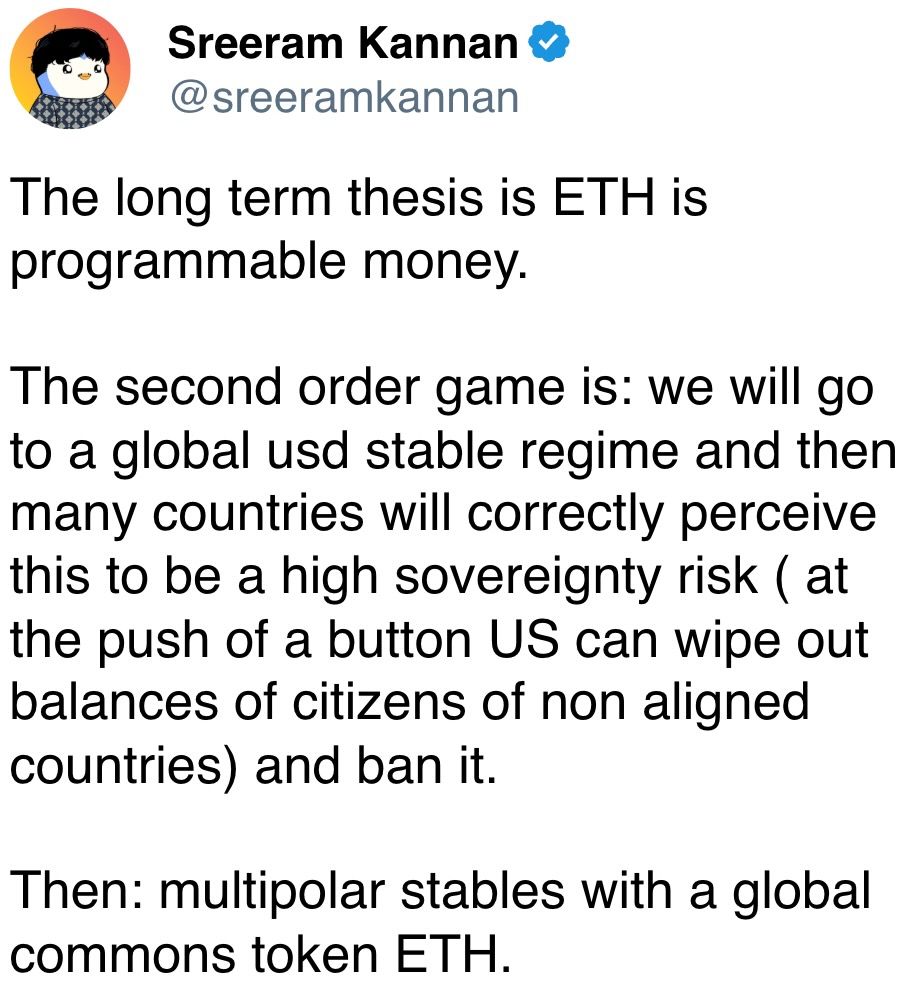

Looking ahead, Congress' alleged Crypto Week could spot lawmakers sermon the CLARITY Act, the GENUIS Act and the Anti-CBDC Surveillance Act. Clarity connected the regulatory beforehand could bode good for apical tokens, stablecoins and, especially, tokenization. As Kazmierczak said successful his analysis, the existent accidental lies not successful speculative trading, but successful gathering the infrastructure for programmable wealth and plus tokenization.

Tuesday's U.S. ostentation information is apt to amusement a renewed uptick successful ostentation successful June. According to analysts, it whitethorn not substance overmuch to crypto, which is being driven higher by factors different than Fed rate-cut odds. Nevertheless, imaginable dollar spot connected the backmost of ostentation information could impact the crypto market. Stay alert!

What to Watch

- Crypto

- July 14, 10 p.m.: Singapore High Court hearing connected WazirX’s Scheme of Arrangement, marking a captious measurement successful the exchange's restructuring aft the $234 cardinal hack connected July 18, 2024.

- July 15: Alchemist staking update launches, allowing token holders to involvement ALCH for entree to precocious features, premium benefits and ecosystem rewards, perchance boosting token inferior and demand.

- July 15: Lynq is expected to debut its real-time, interest-bearing digital-asset colony web for institutions. Built connected Avalanche’s layer-1 blockchain and powered by Arca’s tokenized U.S. Treasury money shares, Lynq enables instant settlement, continuous output accrual and improved superior efficiency.

- July 15, 6 a.m.: Layer 1 blockchain Alephium (ALPH) activates the "Danube" hard fork upgrade connected its mainnet, promising 8-second artifact times, 20,000+ TPS, groupless addresses, passkey login, chained transaction and enhanced developer tools.

- July 15, 1 p.m.: Caffeine, an AI-powered level that lets anyone physique Web3 decentralized apps (dapps) utilizing earthy language, launches publically astatine the “Hello, Self-Writing Internet” event successful San Francisco. Caffeine uses Internet Computer (ICP) exertion to make afloat on-chain, production-ready apps. Livestream link.

- July 15, 3 p.m.: U.S. Senate Committee connected Agriculture, Nutrition, and Forestry holds a marketplace operation hearing titled “Stakeholder Perspectives connected Federal Oversight of Digital Commodities.” Livestream link.

- July 16, 9 a.m.: U.S. House Ways and Means Committee oversight hearing titled "Making America the Crypto Capital of the World: Ensuring Digital Asset Policy Built for the 21st Century."

- July 18: Lorenzo Protocol, a Cosmos-based blockchain with autochthonal token BANK, launches USD1+ OTF connected BNB Chain mainnet. This institutional-grade on-chain traded money lets users involvement stablecoins to mint sUSD1+ tokens that gain stable, NAV-backed output from real-world assets, CeFi quantitative strategies and DeFi protocols. All returns are settled successful USD1 stablecoin, issued by World Liberty Financial, whose stablecoin infrastructure powers the product’s unchangeable output mechanism.

- Macro

- July 14, 3 p.m.: Argentina’s National Institute of Statistics and Census releases June ostentation data.

- Inflation Rate MoM Prev. 1.5%

- Inflation Rate YoY Prev. 43.5%

- July 15, 8:30 a.m.: Statistics Canada releases June user terms ostentation data.

- Core Inflation Rate MoM Prev. 0.6%

- Core Inflation Rate YoY Prev. 2.5%

- Inflation Rate MoM Est. 0.2% vs. Prev. 0.6%

- Inflation Rate YoY Prev. 1.7%

- July 15, 8:30 a.m.: The U.S. Bureau of Labor Statistics (BLS) releases June user terms ostentation data.

- Core Inflation Rate MoM Est. 0.3% vs. Prev. 0.1%

- Core Inflation Rate YoY Prev. 2.8%

- Inflation Rate MoM Est. 0.3% vs. Prev. 0.1%

- Inflation Rate YoY Est. 2.6% vs. Prev. 2.4%

- July 16, 2 a.m.: U.K.'s Office for National Statistics releases June user terms ostentation data.

- Core Inflation Rate MoM Prev. 0.2%

- Core Inflation Rate YoY Est. 3.5% vs. Prev. 3.5%

- Inflation Rate MoM Est. Prev. 0.2%

- Inflation Rate YoY Est. 3.4% vs. Prev. 3.4%

- July 16, 8:30 a.m.: The U.S. Bureau of Labor Statistics releases June shaper terms ostentation data.

- Core PPI MoM Est. 0.2% vs. Prev. 0.1%

- Core PPI YoY Prev. 3%

- PPI MoM Est. 0.2% vs. Prev. 0.1%

- PPI YoY Prev. 2.6%

- July 16, 10 a.m.: Speech by Fed Governor Michael S. Barr connected "Financial Regulation" astatine "Conversation with Governor Barr" successful Washington. Livestream link.

- July 17, 10 a.m.: Speech by Fed Governor Adriana D. Kugler connected "A View of the Housing Market and U.S. Economic Outlook" astatine the Housing Partnership Network Symposium successful Washington. Livestream link.

- July 17, 6:30 p.m.: Speech by Fed Governor Christopher J. Waller connected the economical outlook astatine an lawsuit hosted by the Money Marketeers of New York University.

- Aug. 1, 12:01 a.m.: New U.S. tariffs instrumentality effect connected imports from commercialized partners that failed to scope agreements by the July 9 deadline. These accrued duties could scope from 10% to arsenic precocious arsenic 70%, impacting a wide scope of goods.

- July 14, 3 p.m.: Argentina’s National Institute of Statistics and Census releases June ostentation data.

- Earnings (Estimates based connected FactSet data)

Token Events

- Governance votes & calls

- 1inch DAO is voting connected a $25,000 assistance proposal to probe trustless cross-chain swaps betwixt Bitcoin and Ethereum Virtual Machine networks utilizing autochthonal Bitcoin tools similar Taproot. Voting ends July 14.

- Aavegotchi DAO is voting connected a $245,000 backing proposal to grow Gotchi Battler into a revenue-generating crippled with PvE modes, NFTs and conflict passes, aiming to reverse declining subordinate numbers, boost GHST inferior and make sustainable rewards. Voting ends July 22.

- Uniswap DAO is conducting a somesthesia cheque on Etherlink’s petition to co-incentivize Uniswap v3 liquidity. Tezos Foundation would enactment up $300K for 3 months of rewards connected WETH/USDC, WBTC/USDC and LBTC/USDC, and is asking the DAO for $150K more, aiming to anchor Etherlink’s rising TVL and aboriginal autochthonal tokens connected Uniswap. Voting ends July 18.

- July 16, 5 p.m.: VeChain to big a monthly update with assemblage representatives and the VeChain Foundation.

- Unlocks

- July 15: Starknet (STRK) to unlock 3.79% of its circulating proviso worthy $18.29 million.

- July 15: Sei (SEI) to unlock 1% of its circulating proviso worthy $19.23 million.

- July 16: Arbitrum (ARB) to unlock 1.87% of its circulating proviso worthy $39.11 million.

- July 17: ZKSync (ZK) to unlock 2.41% of its circulating proviso worthy $10.29 million.

- July 17: ApeCoin (APE) to unlock 1.95% of its circulating proviso worthy $10.55 million.

- July 18: Official TRUMP (TRUMP) to unlock 45.35% of its circulating proviso worthy $886.13 million.

- July 18: Fasttoken (FTN) to unlock 4.64% of its circulating proviso worthy $89.8 million.

- Token Launches

- July 14: Chainbase (C) to beryllium listed connected Binance, Bitget, MEXC, and others.

- July 16: Bybit to delist Tap (TAP), VaporFund (VPR), Cosplay Token (COT), Souni (SON), Tenet Protocol (TENE), Havah (HVH), Brawl AI Layer (BRAWL) among others.

Conferences

The CoinDesk Policy & Regulation conference (formerly known arsenic State of Crypto) is simply a one-day boutique lawsuit held successful Washington connected Sept. 10 that allows wide counsels, compliance officers and regulatory executives to conscionable with nationalist officials liable for crypto authorities and regulatory oversight. Space is limited. Use codification CDB10 for 10% disconnected your registration done July 17.

- July 16: Invest Web3 Forum (Dubai)

- July 20: Crypto Coin Day 7/20 (Atlanta)

- July 21-22: Malaysia Blockchain Week 2025 (Kuala Lumpur)

- July 24: Decasonic’s Web3 Investor Day 2025 (Chicago)

- July 25: Blockchain Summit Global (Montevideo, Uruguay)

- July 28-29: TWS Conference 2025 (Singapore)

Token Talk

By Shaurya Malwa

- Pudgy Penguins (PENGU) jumped 31% implicit the play aft Justin Sun tweeted a cartoon penguin successful TRON gear.

- That azygous post, followed by Pudgy’s authoritative “Everyone volition Huddle” reply, triggered a question of retail speculation and memetic vigor crossed Solana markets.

- PENGU present trades astatine $0.0301 — up astir 99% successful the past 7 days — with regular measurement topping $2.1 billion, making it 1 of the week’s best-performing assets.

- Pudgy Penguin NFTs surged to 14 ETH connected Magic Eden, a 23.5% summation successful 24 hours, indicating crossover attraction from collectors.

- On-chain expert Ali Metinex sees beardown fundamentals, calling PENGU “one of the fewer meme coins with existent staying power," and projects a determination toward $0.060 by August.

- A spot ETF proposal filed by plus manager Canary Capital added substance to the fire. If approved, it would springiness organization investors nonstop vulnerability to PENGU.

- The ETF filing comes arsenic marketplace operation astir memecoins matures, and arsenic Pudgy’s idiosyncratic basal crosses 430,000 crossed societal platforms.

- PENGU’s emergence has outpaced broader Solana memecoins this cycle, helped by beardown branding, societal virality and catalysts similar Sun’s backing and ETF speculation.

- Despite the euphoria, traders are watching for a retrace. Overbought indicators and play measurement spikes often precede short-term corrections successful meme assets.

Derivatives Positioning

- The cumulative unfastened involvement successful USDT and dollar-denominated BTC perpetuals connected offshore exchanges has risen to 268K, the highest since May. Still, the tally remains locked successful the astir two-year-long scope of 200K BTC to 255K BTC. A interruption retired present could mean influx of caller wealth chasing upside.

- Ether unfastened involvement remains elevated adjacent grounds highs, tallying implicit 5.3 cardinal ETH.

- BTC, ETH backing rates yet topped 10%, catching up with altcoins to suggest increasing bias for bullish plays.

- Block trades via OTC web Paradigm featured calendar spreads and a bull enactment spread. ETH flows included bull telephone spreads and a agelong telephone financed by selling puts.

Market Movements

- BTC is up 3.63% from 4 p.m. ET Friday astatine $121,912.08 (24hrs: +3.28%)

- ETH is up 2.43% astatine $3,046.59 (24hrs: +2.92%)

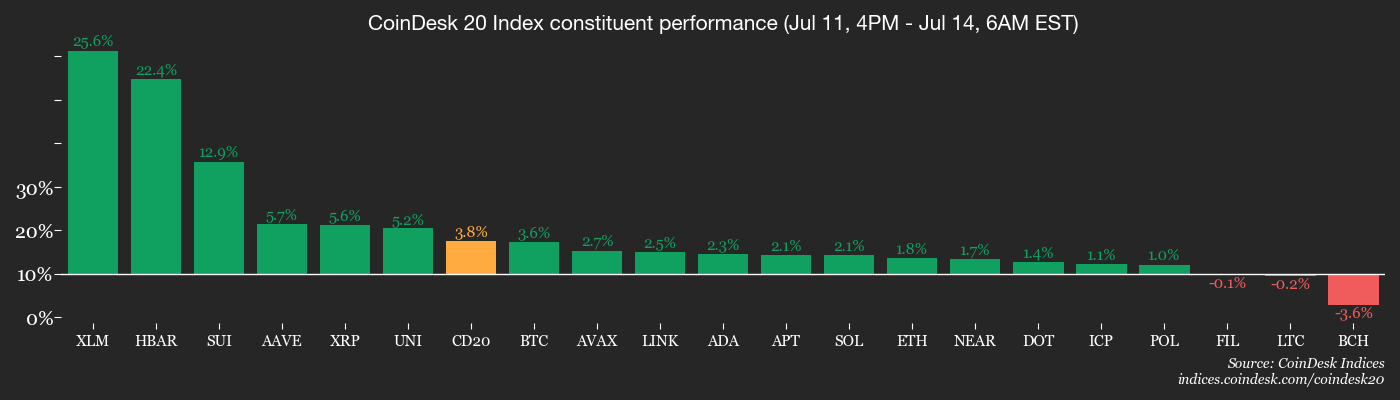

- CoinDesk 20 is up 3.87% astatine 3,700.93 (24hrs: +4.34%)

- Ether CESR Composite Staking Rate is down 26 bps astatine 2.89%

- BTC backing complaint is astatine 0.01% (10.95% annualized) connected Binance

- DXY is small changed astatine 97.90

- Gold futures are up 0.43% astatine $3,378.60

- Silver futures are up 1.39% astatine $39.49

- Nikkei 225 closed down 0.28% astatine 39,459.62

- Hang Seng closed up 0.26% astatine 24,203.32

- FTSE is up 0.36% astatine 8,973.18

- Euro Stoxx 50 is down 0.64% astatine 5,349.14

- DJIA closed connected Friday down 0.63% astatine 44,371.51

- S&P 500 closed down 0.33% astatine 6,259.75

- Nasdaq Composite closed down 0.22% astatine 20,585.53

- S&P/TSX Composite closed down 0.22% astatine 27,023.25

- S&P 40 Latin America closed down 0.67% astatine 2,621.56

- U.S. 10-Year Treasury complaint is unchanged astatine 4.423%

- E-mini S&P 500 futures are down 0.27% astatine 6,283.25

- E-mini Nasdaq-100 futures are down 0.26% astatine 22,899.75

- E-mini Dow Jones Industrial Average Index are down 0.31% astatine 44,460.00

Bitcoin Stats

- BTC Dominance: 64.47% (-0.2%)

- Ether to bitcoin ratio: 0.02507 (0.4%)

- Hashrate (seven-day moving average): 936 EH/s

- Hashprice (spot): $61.42

- Total Fees: 6.52 BTC / $685,443

- CME Futures Open Interest: 153,980 BTC

- BTC priced successful gold: 36.4 oz

- BTC vs golden marketplace cap: 10.3%

Technical Analysis

- The Binance-listed XRP/ETH brace is rising into an impending bearish crossover of the 100- and 200-day elemental moving averages.

- The impending carnivore transverse indicates prolonged underperformance of XRP comparative to ETH.

Crypto Equities

- Strategy (MSTR): closed connected Friday astatine $434.58 (+3.04%), +2.92% astatine $447.25 successful pre-market

- Coinbase Global (COIN): closed astatine $387.06 (-0.49%), +1.6% astatine $393.24

- Circle (CRCL): closed astatine $187.33 (-7.67%), +0.13% astatine $187.57

- Galaxy Digital (GLXY): closed astatine $20.63 (+1.08%), +3.64% astatine $21.38

- MARA Holdings (MARA): closed astatine $19.14 (+0.74%), +4.28% astatine $19.96

- Riot Platforms (RIOT): closed astatine $12.42 (-1.35%), +3.46% astatine $12.85

- Core Scientific (CORZ): closed astatine $12.51 (-5.08%), +1.52% astatine $12.70

- CleanSpark (CLSK): closed astatine $12.65 (-1.94%), +3.72% astatine $13.12

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed astatine $24.78 (-2.79%)

- Semler Scientific (SMLR): closed astatine $45.53 (-0.96%), +2.79% astatine $46.80

- Exodus Movement (EXOD): closed astatine $33 (+3.81%), +0.48% astatine $33.16

ETF Flows

Spot BTC ETFs

- Daily nett flows: $1,029.6 million

- Cumulative nett flows: $52.34 billion

- Total BTC holdings ~1.27 million

Spot ETH ETFs

- Daily nett flows: $204.9 million

- Cumulative nett flows: $5.32 billion

- Total ETH holdings ~4.41 million

Source: Farside Investors

Overnight Flows

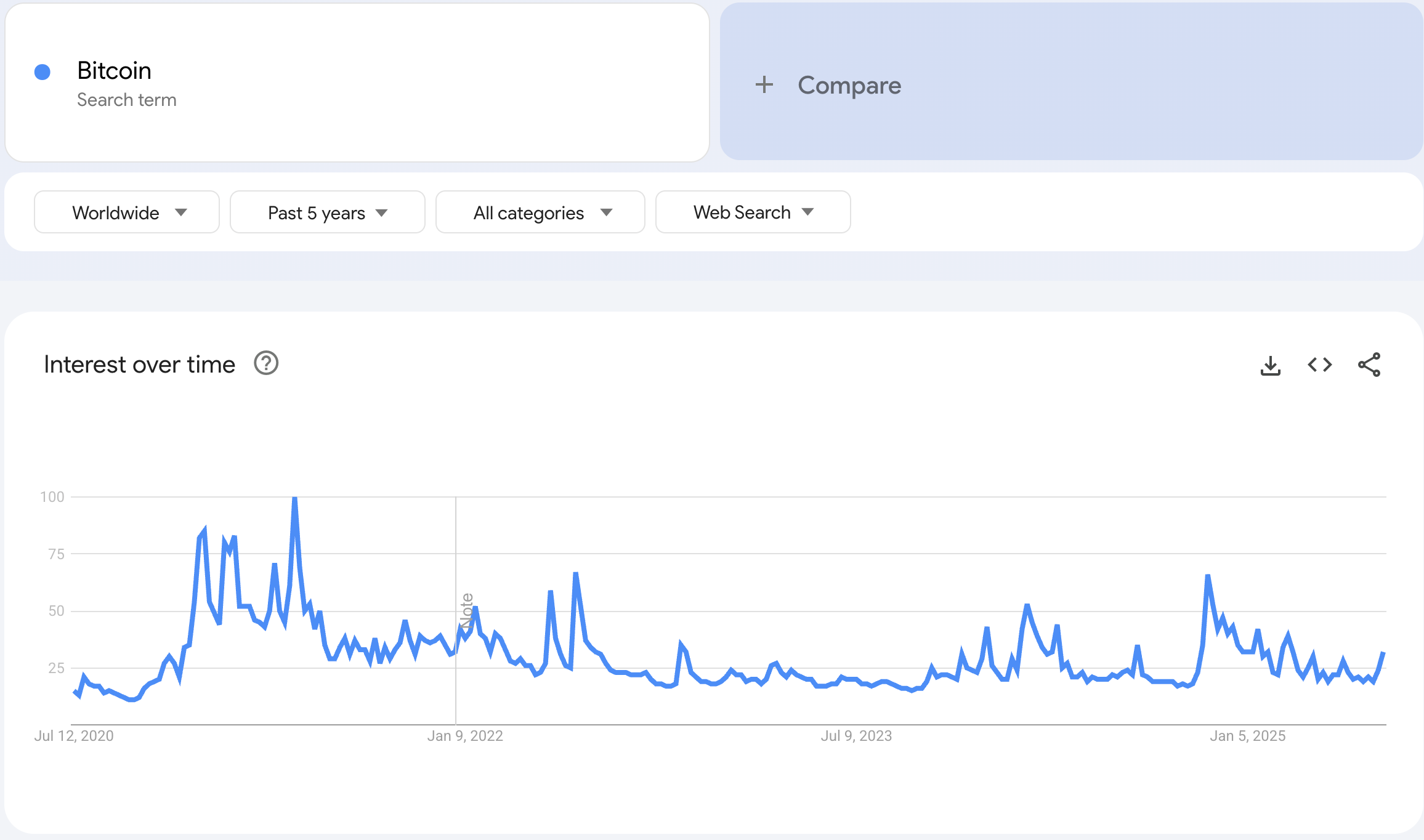

Chart of the Day

- The illustration shows Google hunt values for the word "bitcoin" implicit the past 5 years.

- While BTC's terms continues to acceptable caller highs, the hunt values stay low, highlighting small involvement among the wide population.

- That's a bully motion for the bull marketplace arsenic retail capitalist frenzy, represented by crisp spikes successful hunt values, is typically observed astatine marketplace tops.

While You Were Sleeping

- Bitcoin Hits $123,000, Overtakes Gold arsenic 2025’s Top Asset (CoinDesk)

The largest cryptocurrency deed a grounds precocious having surged 30% this twelvemonth amid precocious U.S. involvement rates, dollar weakness, delayed tariffs and surging U.S. deficits. It's overtaken gold, up 27%, to go the best-performing plus of 2025. - Bitcoin’s Mysterious Creator Is (Almost) the World’s 10th Richest Person (CoinDesk): Satoshi's wallet, which made each its holdings from mining the web successful its earliest days, has remained untouched since 2010, erstwhile the blockchain was tally connected a fewer laptops.

- Trump Says U.S. Will Send Patriot Missiles to Ukraine (Reuters): President Trump told reporters Sunday that Russian President Putin’s behaviour made it indispensable to assistance Ukraine support itself and that the missiles would beryllium paid for by the EU.

- How China’s Military Is Flexing Its Power successful the Pacific (The Wall Street Journal): China’s activity, including bearer drills and airspace incursions adjacent Taiwan, has prompted expanded U.S. deployments to Guam and the Philippines and unit connected determination allies to rise defence spending.

- Bitcoin, Ether Traders Bet Big With Tuesday's U.S. Inflation Data Seen arsenic Non-Event (CoinDesk): Newsletter Service LondonCryptoClub says crypto’s rally is driven by escaped fiscal policy, rising planetary liquidity and a anemic dollar, adding Trump has reversed people connected shortage reduction.

- Japanese Bonds Tumble arsenic Fiscal Worries Mount Before Election (Bloomberg): Long-term Japanese enslaved yields surged Monday arsenic investors reacted to run spending pledges up of Japan’s July 20 precocious location predetermination and imaginable ostentation forecast revisions by the cardinal bank.

In the Ether

5 months ago

5 months ago

English (US)

English (US)