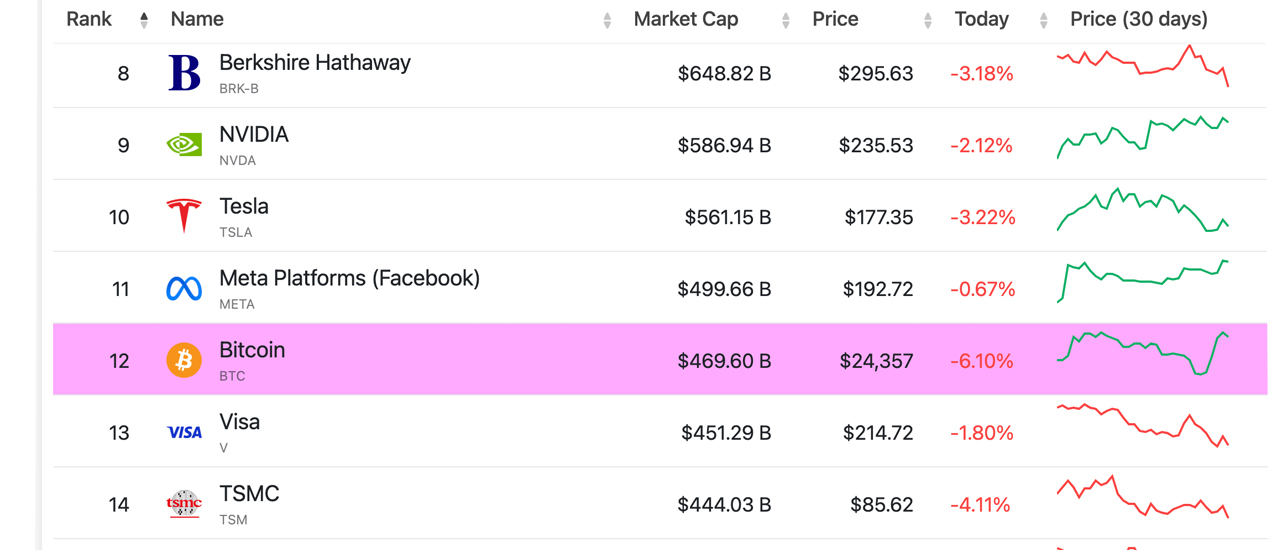

After dropping beneath $26,000 per unit, the terms of bitcoin, the starring integer plus by marketplace capitalization, is inactive up 9.6% since past week. However, its terms has decreased by 6.5% successful the past 24 hours. Out of the 7,316 companies, crypto assets, precious metals, and exchange-traded funds worthy much than $82 trillion successful value, bitcoin is the 12th largest plus worldwide by valuation.

Bitcoin’s Market Capitalization Compared to Other Top Assets: Leading Crypto Climbs Above Visa, But Lags Behind Meta

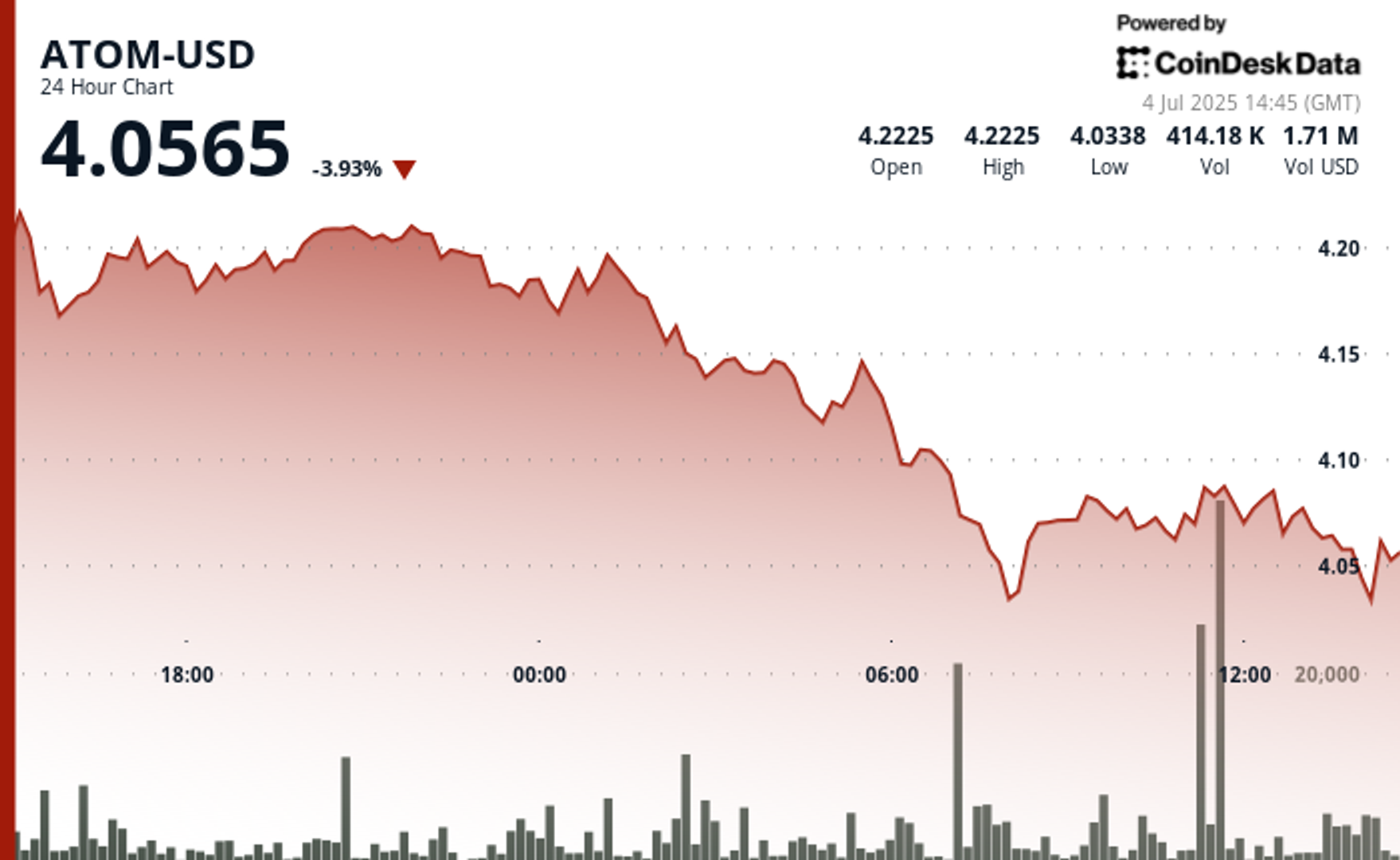

Crypto assets, specifically bitcoin (BTC), person accrued successful worth this week pursuing the illness of 3 large U.S. banks. Over the past 24 hours, bitcoin (BTC) has dropped 6.5% against the U.S. dollar. However, play metrics bespeak that BTC is up 9.6% week implicit week. Most of BTC’s summation occurred connected March 14, erstwhile it jumped supra the $26K portion to precisely $26,533 astatine astir 9 a.m. (ET) connected Tuesday. As of 2:35 p.m. connected March 15, bitcoin is exchanging hands for $24,357 per unit.

Despite the alteration successful worth against the U.S. dollar, bitcoin has go the 12th largest valuation successful the world, surpassing the marketplace capitalization of payments elephantine Visa. On Wednesday afternoon, BTC had a marketplace valuation of $469.60 billion, which is $18.31 cardinal much than Visa’s. However, the crypto asset’s marketplace valuation is inactive beneath that of Meta (formerly Facebook), which is presently astatine $499.66 billion. For bitcoin to go the 11th largest plus by valuation successful the world, its marketplace capitalization needs to summation by $30.06 billion, surpassing that of Meta.

Currently, the apical 10 assets by marketplace valuation see gold, Apple, Microsoft, Saudi Aramco, silver, Alphabet (Google), Amazon, Berkshire Hathaway, Nvidia, and Tesla. Gold, the person of the group, has a marketplace capitalization of astir $12.81 trillion. While BTC represents 42.7% of the crypto economy’s $1.1 trillion successful value, it lone accounts for 3.67% of gold’s wide marketplace valuation. Bitcoin’s marketplace valuation would request to summation by astir $12.34 trillion to surpass gold’s marketplace capitalization. However, bitcoin’s marketplace valuation is presently person to silver, which is valued astatine $1.245 trillion arsenic of Wednesday afternoon.

Therefore, arsenic of today, bitcoin’s marketplace capitalization is astir 37.7% of silver’s marketplace valuation. To surpass silver’s marketplace capitalization, bitcoin’s marketplace valuation would request to summation by astir $775.4 billion. In October 2021, BTC’s marketplace capitalization ran up against silver’s wide valuation, but astatine that time, silver’s capitalization was $1.31 trillion. Regarding contending with tech elephantine Apple’s nett worth, BTC’s marketplace valuation accounts for 19.69% of Apple’s. For bitcoin to transcend the California tech giant’s nett worth, it would request to summation its marketplace valuation by different $1.917 trillion.

Tags successful this story

12th largest, aapl, Alphabet, Alphabet (Google), Amazon, Apple, Assets, Berkshire Hathaway, Bitcoin, Bitcoin (BTC), Bitcoin and Gold, bitcoin silver, BTC, Crypto asset, Crypto Asset Markets, Cryptocurrency, Digital Assets, Facebook, Finance, Global Economy, gold, gold (Au), Google, investment, Market Capitalization, Market Update, Market Valuation, market value, Meta, Microsoft, Nvidia, payment systems, Satoshi Nakamoto, Saudi Aramco, silver, Stock Market, technology, Tesla, trading, U.S banks, USD, valuation, VISA, worldwide assets

What bash you deliberation astir bitcoin’s 7 time marketplace show and the crypto plus becoming the 12th largest plus by marketplace headdress worldwide? Share your thoughts astir this taxable successful the comments conception below.

Jamie Redman

Jamie Redman is the News Lead astatine Bitcoin.com News and a fiscal tech writer surviving successful Florida. Redman has been an progressive subordinate of the cryptocurrency assemblage since 2011. He has a passionateness for Bitcoin, open-source code, and decentralized applications. Since September 2015, Redman has written much than 6,000 articles for Bitcoin.com News astir the disruptive protocols emerging today.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This nonfiction is for informational purposes only. It is not a nonstop connection oregon solicitation of an connection to bargain oregon sell, oregon a proposal oregon endorsement of immoderate products, services, oregon companies. Bitcoin.com does not supply investment, tax, legal, oregon accounting advice. Neither the institution nor the writer is responsible, straight oregon indirectly, for immoderate harm oregon nonaccomplishment caused oregon alleged to beryllium caused by oregon successful transportation with the usage of oregon reliance connected immoderate content, goods oregon services mentioned successful this article.

2 years ago

2 years ago

English (US)

English (US)