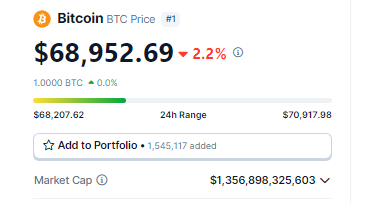

Bitcoin, the undisputed king of cryptocurrencies, is erstwhile again connected a chaotic ride. After a surge implicit the play that brought it adjacent to shattering its all-time high, the integer plus has dipped backmost beneath the important $70,000 people successful the past 24 hours. This abrupt correction has near investors wondering if the predicted surge to $80,000 is inactive connected the table.

Source: Coingecko

Source: Coingecko

Bitcoin Erases Weekend Gains

Just days ago, Bitcoin bulls were celebrating arsenic the terms climbed to adjacent grounds highs exceeding $70,000. This bullish momentum fueled optimism, with analysts similar Markus Thielen predicting a swift ascent towards $80,000.

However, that optimism has been tempered by the caller terms drop. Bitcoin has plummeted astir 6% from its peak, efficaciously erasing the gains made earlier this week. While the terms has recovered somewhat to hover astir $69,200, it remains beneath the intelligence obstruction of $70,000.

Is The $80,000 Dream Dead?

The caller correction has undoubtedly dampened spirits, but immoderate analysts are inactive assured that Bitcoin’s travel to $80,000 is acold from over. Proponents of this presumption constituent to a fewer cardinal factors that proceed to substance their bullish sentiment.

Stablecoin Inflows: A Beacon Of Hope?

One origin cited by Thielen is the continued spot of stablecoin inflows. Stablecoins, cryptocurrencies pegged to accepted assets similar the US dollar, are often utilized arsenic an introduction constituent for investors into the crypto market.

According to Thielen, these robust inflows suggest sustained capitalist involvement contempt the short-term terms fluctuations. Additionally, helium highlights a caller method illustration signifier breakout, specifically a symmetrical triangle, arsenic different bullish indicator.

Technical analysts judge specified breakouts often awesome a continuation of the anterior trend, which successful this lawsuit would beryllium affirmative for Bitcoin.

On-Chain Data Bolsters Bullish Case

Some analysts constituent to on-chain information from IntoTheBlock, which reveals important buying enactment astatine existent terms levels.

This information suggests that a ample fig of addresses (essentially unsocial identifiers for cryptocurrency wallets) purchased Bitcoin wrong the scope of $68,200 and $70,325.

This buying enactment indicates imaginable absorption against further terms dips, arsenic these addresses would apt beryllium hesitant to merchantability astatine a loss.

Bitcoin terms enactment successful the past week. Source: Coingecko

Bitcoin terms enactment successful the past week. Source: Coingecko

Bullish And Bearish Forces

The existent concern presents a classical tug-of-war betwixt Bitcoin bulls and bears. While the caller terms correction has shaken immoderate confidence, beardown stablecoin inflows and on-chain buying enactment suggest underlying bullish pressure.

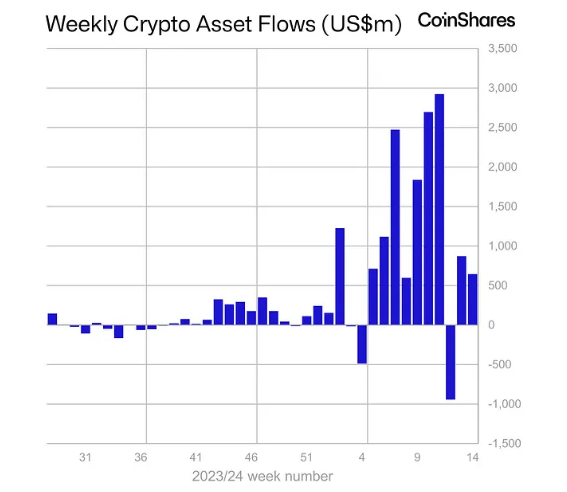

However, they stay cautious, pointing to the slowdown successful investments specifically targeted astatine spot Bitcoin ETFs (Exchange Traded Funds) arsenic a imaginable concern. These ETFs let investors to summation vulnerability to Bitcoin’s terms movements without straight owning the cryptocurrency.

Source: CoinShares

Source: CoinShares

Meanwhile, a study by CoinShares, a integer plus manager, highlights a important alteration successful inflows to specified ETFs successful caller weeks, suggesting that immoderate organization investors mightiness beryllium adopting a wait-and-see approach.

The aboriginal trajectory of Bitcoin remains uncertain. The coming days and weeks volition beryllium important successful determining whether the bulls tin flooded the existent absorption and propel the terms towards $80,000.

Featured representation from Pexels, illustration from TradingView

Disclaimer: The nonfiction is provided for acquisition purposes only. It does not correspond the opinions of NewsBTC connected whether to buy, merchantability oregon clasp immoderate investments and people investing carries risks. You are advised to behaviour your ain probe earlier making immoderate concern decisions. Use accusation provided connected this website wholly astatine your ain risk.

1 year ago

1 year ago

English (US)

English (US)