The terms of bitcoin has shattered records by concisely surging past the $70,000 mark earlier today, signaling a renewed question of enthusiasm among investors. The apical cryptocurrency experienced a dependable ascent passim the week with a sustained 12% rally, aided by the instauration of spot bitcoin exchange-traded funds (ETFs) successful the United States.

At the clip of writing, Bitcoin has settled wrong the $69K level, and trading astatine $69,436 with a 2% summation the past 24 hours, information from Coingecko shows. Bitcoin reached a highest of $70,171, surpassing its erstwhile grounds acceptable earlier successful the week.

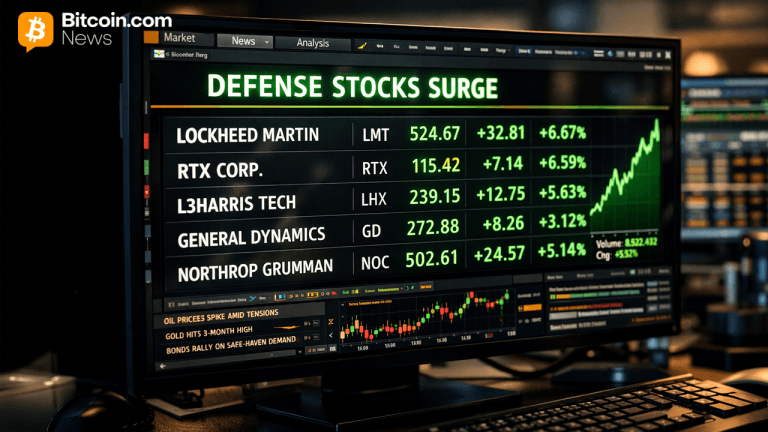

Notably, the upswing aligns with the opening of the US banal market, indicating a synchronization of important crypto movements with accepted banal trading hours. This milestone comes arsenic a effect of increasing marketplace optimism and anticipation surrounding the upcoming halving event.

ETF Surge And Investor Sentiment

The caller instauration of Bitcoin ETFs by salient fiscal institutions specified arsenic BlackRock and Fidelity has undoubtedly played a important relation successful the latest terms surge. These ETFs person garnered immense attraction and capitalist interest, with a staggering inflow of $900 cardinal recorded this week alone.

Despite the highly volatile marketplace conditions, the palmy motorboat and functioning of these ETFs person instilled assurance successful crypto marketplace enthusiasts, reinforcing their content successful the imaginable of bitcoin.

Bitcoin Halving Event And Supply Cap

Bitcoin’s upcoming halving lawsuit has been a large taxable of treatment among cryptocurrency enthusiasts. This event, which occurs astir each 4 years, involves cutting the reward for mining caller blocks successful half.

The intent of this process is to gradually trim the complaint astatine which caller bitcoins are generated, yet capping the full proviso astatine 21 million, arsenic outlined successful the cryptocurrency’s archetypal achromatic paper. The anticipation surrounding the halving lawsuit has contributed to the affirmative sentiment and gradual ascent of bitcoin’s price.

Volatility And Market Corrections

While bitcoin’s caller surge to caller heights is undoubtedly impressive, it is indispensable to admit the inherent volatility of the cryptocurrency market. As Antoni Trenchev, co-founder of crypto speech Nexo, aptly puts it, “Navigating aged highs is notoriously tricky, and the bitcoin dam doesn’t thin to burst astatine the archetypal clip of asking.”

The caller sell-off successful bitcoin, characterized by abrupt terms drops, is considered by Trenchev arsenic a steadfast and indispensable correction earlier further gains tin beryllium achieved. This volatility is simply a defining diagnostic of bitcoin bull markets, and investors should brace themselves for imaginable abrupt fluctuations.

Bitcoin’s Impact On Traditional Markets

It is worthy noting that bitcoin’s terms movements are progressively intertwined with accepted banal trading hours, peculiarly successful the United States. The instauration of spot bitcoin ETFs has led to a convergence of crypto and banal marketplace activities during regular trading hours.

This displacement has important implications for investors and traders, arsenic it expands the opportunities for synchronized trading strategies and perchance increases marketplace liquidity.

Looking Ahead

With bitcoin’s caller surge beyond $70,000, the cryptocurrency marketplace is buzzing with anticipation. As the world’s first-ever integer currency continues to reflector optimism and gradually approaches caller heights, investors and enthusiasts support a adjacent oculus connected the progress..

Featured representation from Pexels, illustration from TradingView

Disclaimer: The nonfiction is provided for acquisition purposes only. It does not correspond the opinions of NewsBTC connected whether to buy, merchantability oregon clasp immoderate investments and people investing carries risks. You are advised to behaviour your ain probe earlier making immoderate concern decisions. Use accusation provided connected this website wholly astatine your ain risk.

1 year ago

1 year ago

English (US)

English (US)