Bitcoin has soared past the $98,000 connected Thursday, fueling aggravated statement among traders implicit whether the $100K milestone is again wrong scope oregon if the existent rally is susceptible to a swift correction. Behind the scenes, marketplace observers constituent to surging unfastened involvement (OI) and accrued leverage, spotlighting the anticipation of a leverage-driven push.

Bitcoin Rally Or Trap?

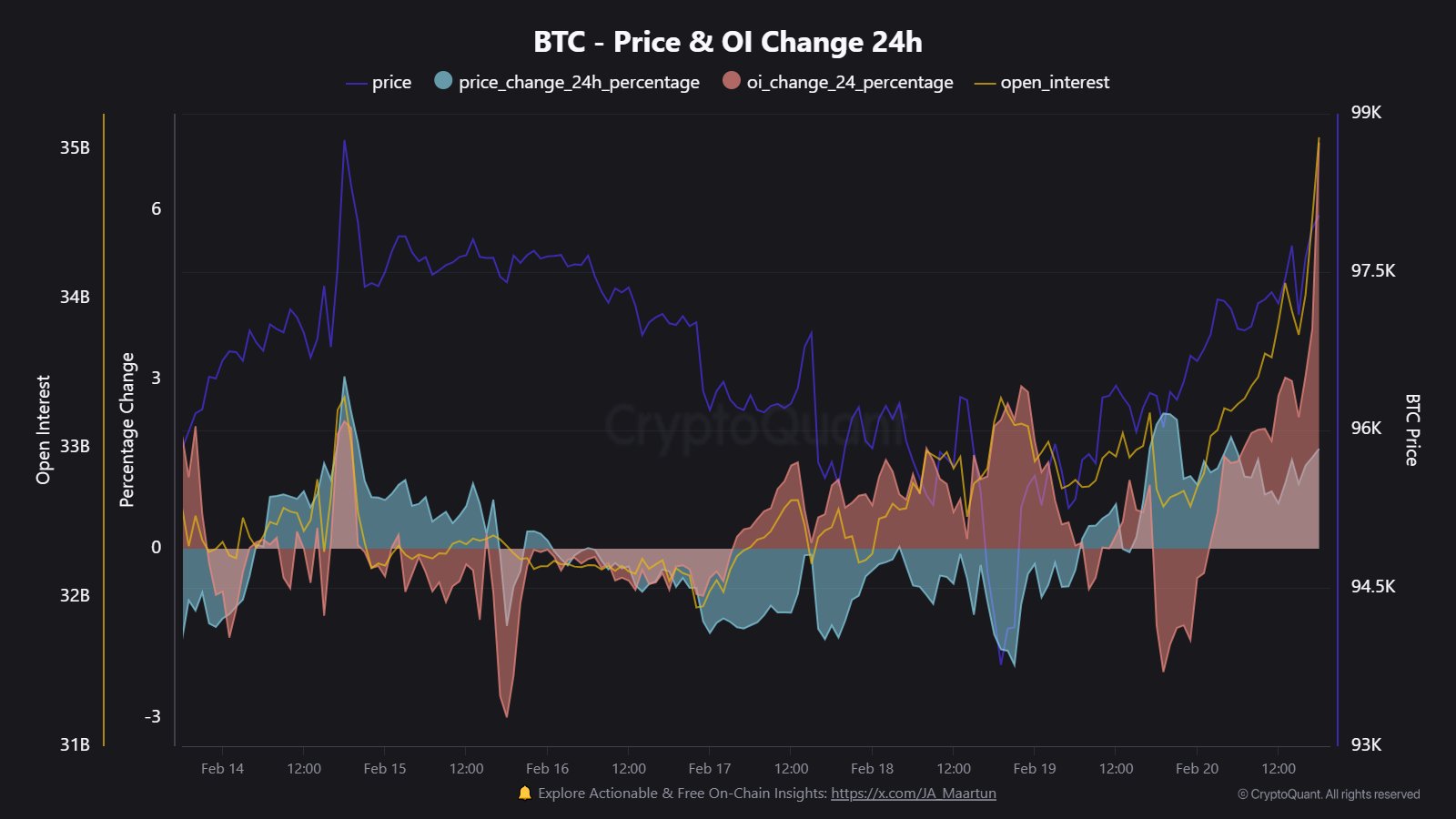

CryptoQuant assemblage expert Maartunn (@JA_Maartun) warned of a “leverage driven pump,” noting a $2.4B leap successful Bitcoin’s OI wrong 24 hours. Via X, helium wrote: “Leverage Driven Pump: $2.4B (7.2%) summation successful Open Interest successful Bitcoin implicit the past 24 hours.”

Bitcoin terms and unfastened involvement alteration | Source: X @JA_Maartun

Bitcoin terms and unfastened involvement alteration | Source: X @JA_MaartunConfirming these observations, well-known crypto commentator Byzantine General (@ByzGeneral) highlighted the important relation of caller agelong positions successful propelling prices higher: “Lots of caller longs coming successful present connected BTC which is shoving terms higher. Kinda comic that the full marketplace is getting lifted close present disconnected the backmost of these degen longs here.”

Analysts from alpha dojo (@alphadojo_net) echoed sentiments of caution, underscoring a notable spread betwixt futures-based unfastened involvement and spot-driven purchases: “BTC continues to grind upwards, portion the OI rises steadily, but determination is small spot buying. BTC is present approaching the precocious extremity of the scope again. It seems that immoderate marketplace participants person tried to frontrun Saylor‘s planned $2 cardinal bid.”

Though the imaginable of a ample bargain could propel the market, they pass that without caller catalysts similar a “short-term communicative oregon affirmative news, it presently looks similar BTC volition conflict to sustainably pump supra the $100k mark.”

Renowned crypto expert Bob Loukas provided a cyclical model for interpreting Bitcoin’s terms movements, noting that the marketplace whitethorn beryllium approaching the extremity of 1 multi-week rhythm and the commencement of another: “We’re connected verge of completing a Bitcoin Weekly Cycle, arsenic I’ve been sharing past 6 weeks. For context, determination person been conscionable 5 play Cycles since the 2022 carnivore marketplace lows. (Avg 6month events). 4 of these cycles had 90-105% moves. One failed to bash overmuch (June-Sept 23).”

When asked if this signals an imminent marketplace top, Loukas clarified:“I’m saying we’re astir to statesman a caller one. Cycles ever statesman from the lows.” His comments suggest that portion a rhythm modulation is imminent, it does not needfully equate to a marketplace peak—rather, it could people the commencement of a caller uptrend.

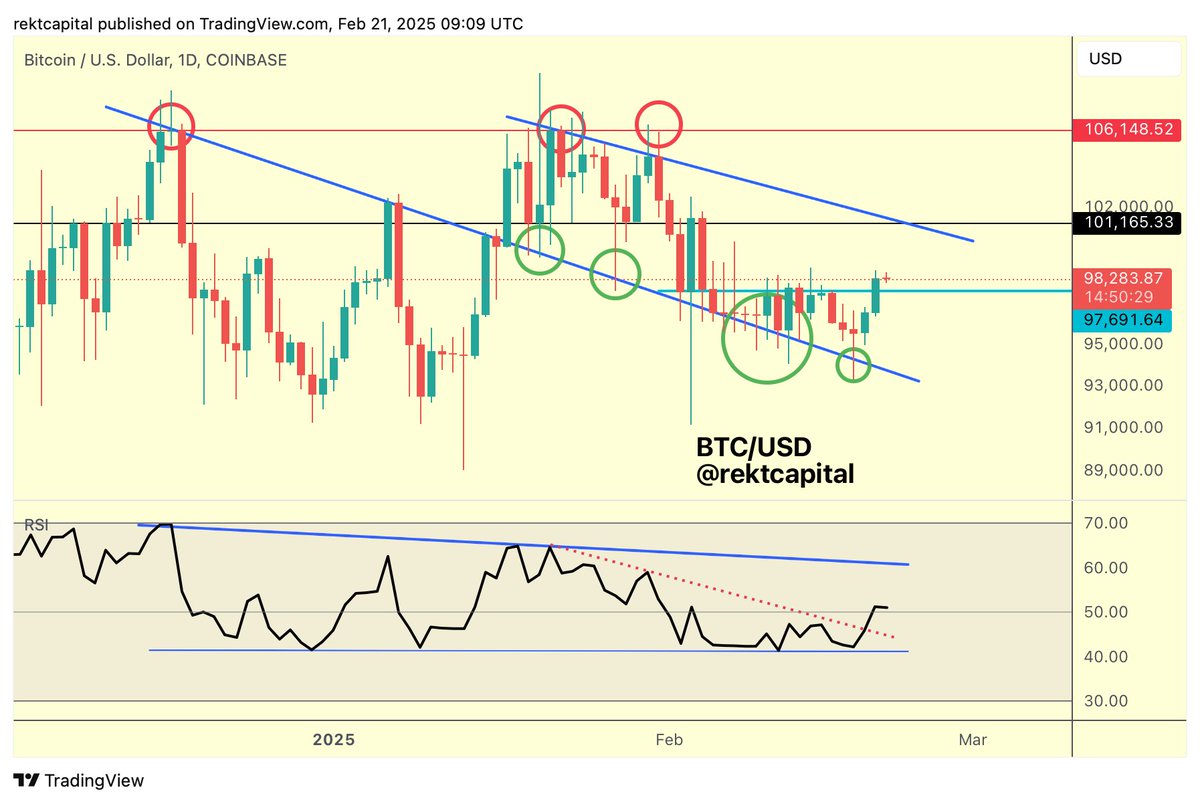

Technical expert Rekt Capital (@rektcapital) emphasized the value of Bitcoin’s regular adjacent supra the $97,700 threshold, suggesting that a palmy retest of this portion could pave the mode for a determination beyond $100,000: “The early-stage momentum generated by the Bullish Divergence has translated itself into this caller breakout move. And with the caller Daily Close supra ~$97700, Bitcoin volition present effort to retest said level arsenic enactment to alteration inclination continuation.”

He further elaborated connected Bitcoin’s comparative spot scale (RSI) channel, implying that the interruption supra a bid of little highs whitethorn awesome the adjacent limb up: “Over time, Bitcoin’s terms continued to retest the bluish trendline arsenic support. And the RSI continued to clasp its Channel Bottom. Lately, the RSI broke its bid of Lower Highs, indicating that the RSI whitethorn beryllium acceptable to uptrend to the Channel Top.”

Bitcoin terms investigation | Source: X @rektcapital

Bitcoin terms investigation | Source: X @rektcapitalLooking ahead, a wide retest of $97,700 arsenic enactment could corroborate Rekt Capital’s bullish outlook: “Daily Close supra $97700 has been palmy (light blue). Any dips into $97700 would represent a retest attempt. A post-breakout retest of $97700 into caller enactment would afloat corroborate the breakout to presumption BTC for a rally to $101k resistance.”

At property time, BTC traded astatine $98,645.

BTC price, 4-hour illustration | Source: BTCUSDT connected TradingView.com

BTC price, 4-hour illustration | Source: BTCUSDT connected TradingView.comFeatured representation created with DALL.E, illustration from TradingView.com

9 months ago

9 months ago

English (US)

English (US)