Hardening authorities enslaved yields, particularly connected U.S. treasury notes, person traditionally been viewed arsenic a headwind for bitcoin (BTC) and different hazard assets.

However, caller persistent resilience successful treasury yields suggests a antithetic communicative — 1 driven by factors that could beryllium bullish for bitcoin, according to analysts.

The U.S. information released Tuesday showed the user terms scale (CPI) roseate 0.2% month-on-month for some header and halfway successful April, beneath the 0.3% readings expected. That resulted successful a header year-on-year ostentation speechmaking of 2.3%, the lowest since February 2021.

Still, prices for the 10-year treasury yield, which is influenced by inflation, dropped, pushing the output higher to 4.5%, the highest since April 11, according to information root TradingView.

The alleged benchmark output is up 30 ground points successful May unsocial and the 30-year output has accrued to 4.94%, sitting adjacent the highest levels of the past 18 years.

This has been the taxable of late: Yields stay elevated contempt each the quality astir tariff pause, the U.S.-China commercialized woody and slower inflation. (The 10-year output surged from 3.8% to 4.6% aboriginal past period arsenic commercialized tensions saw investors merchantability U.S. assets)

The uptick successful the alleged risk-free complaint usually sparks fears of rotation of wealth retired of stocks and different riskier investments specified arsenic crypto and into bonds.

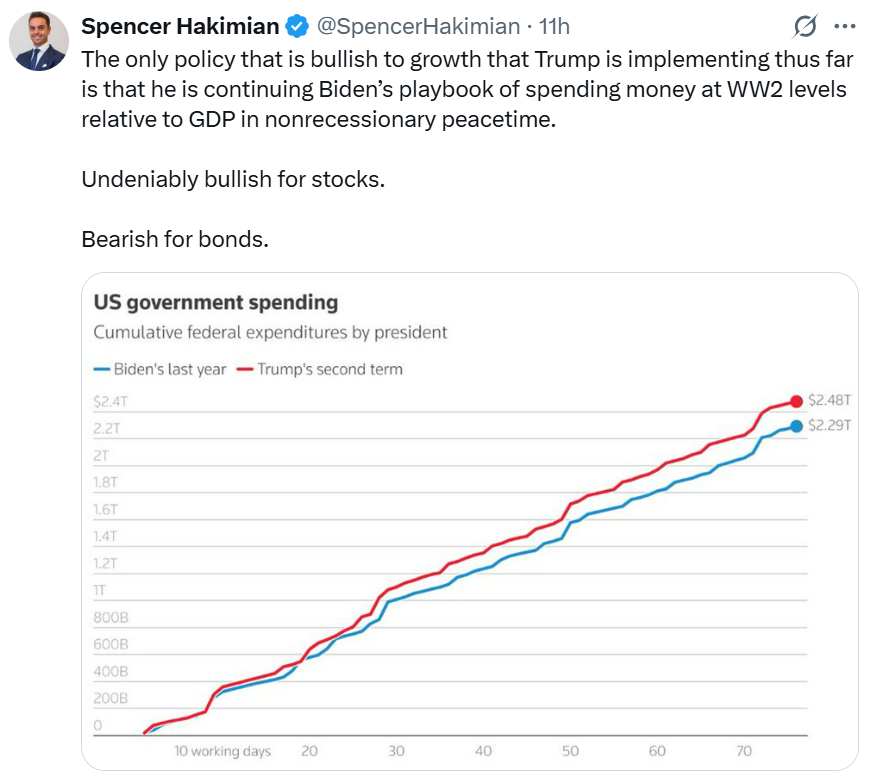

The latest output surge, however, stems from expectations for continued fiscal enlargement during President Donald Trump's tenure, according to Spencer Hakimian, laminitis of Tolou Capital Management.

"Bonds down connected a anemic CPI time is telling [of] fiscal enlargement similar crazy," Hakimian said connected X. "Everyone plays to triumph the midterm. Debt and deficits beryllium damned. It's large for Bitcoin, Gold, and Stocks. It's unspeakable for Bonds."

Hakimian explained that Trump's taxation plan would instantly adhd different $2.5 trillion to the fiscal deficit. In different words, the fiscal argumentation nether Trump volition apt beryllium conscionable arsenic expansionary arsenic nether Biden, acting arsenic a tailwind for hazard assets, including bitcoin.

The details of the taxation chopped program reported by Bloomberg aboriginal this week proposed $4 trillion successful taxation cuts and astir $1.5 trillion successful spending cuts, amounting to a fiscal enlargement of $2.5 trillion.

Arif Husain, caput of planetary fixed income and main concern serviceman of the fixed income part astatine T. Rowe Price, noted that fiscal enlargement volition soon go the overriding absorption for markets.

"Fiscal enlargement whitethorn beryllium maturation supportive, but astir importantly, it would apt enactment adjacent much unit connected the treasury market. I americium present adjacent much convinced that the 10‑year U.S. treasury output volition scope 6% successful the adjacent 12–18 months," Husain said successful a blog post.

Sovereign risk

Per Pseudonymous perceiver EndGame Macro, the persistent elevated Treasury yields correspond fiscal dominance, an thought archetypal discussed by economist Russel Napier a mates of years agone and Maelstrom's CIO and co-founder, Arthur Hayes, past year, and repricing of U.S. sovereign risk.

"When the enslaved marketplace demands higher yields adjacent arsenic ostentation falls, it’s not astir the ostentation rhythm it’s astir the sustainability of U.S. indebtedness issuance itself," EndGame Macro said connected X.

The perceiver explained that higher yields make a self-reinforcing spiral of higher indebtedness servicing costs, which telephone for much indebtedness issuance (more enslaved supply) and adjacent higher rates. All this ends up raising the hazard of a sovereign indebtedness crisis.

BTC, wide seen arsenic an anti-establishment plus and an alternate concern vehicle, could summation much worth successful this scenario.

Moreover, arsenic yields rise, the Fed and the U.S. authorities could instrumentality output curve control, oregon progressive buying of bonds to headdress the 10-year output from rising beyond a definite level, let's presume 5%.

The Fed, therefore, is committed to bargain much bonds each clip the output threatens to emergence beyond 5%, which inadvertently boosts liquidity successful the fiscal system, galvanizing request for assets similar bitcoin, golden and stocks.

4 months ago

4 months ago

English (US)

English (US)