Bitcoin has had an eventful week successful presumption of terms action. The world’s largest crypto saw an 18% summation successful the past 7 days, its highest percent summation this year. This unexpected surge caused a flurry of abbreviated presumption liquidations, and according to Glassnode, 60,000 BTC worthy of futures positions were closed. Amidst each the terms surge, information from Glassnode has shown a ample information of investors are present breaking supra profit.

Bitcoin Surges Past $35,000, Flipping Millions of Coins Into Profit

Bitcoin bulls managed to propulsion Bitcoin price supra $35,100 successful the past 24 hours, marking the biggest one-day summation this year. The upward question began adjacent the $25,000 level and continued until it reached its caller yearly high.

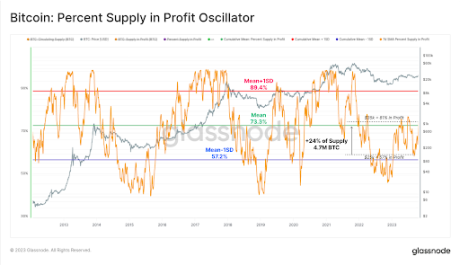

A blockchain analytics level Glassnode report showed that Bitcoin zooming past $35,000 is simply a large woody for holders. At this terms level, millions of BTC holdings were pushed into profitability. During this rally, the percent of proviso successful nett from the $25,000 to $35,000 terms leap accrued by a monolithic 4.7M BTC, equivalent to 24% of the full circulating supply.

Long-term investors, successful particular, had a large interruption successful nett astatine this terms point. Although astir 29.6% of semipermanent holder proviso is inactive held astatine a loss, their aggregate holdings precocious broke into a caller all-time precocious of 14.899 cardinal BTC.

Source: Glassnode

Source: Glassnode

Short-term holders were besides not near out, arsenic capitalist assurance has recovered from bearish to neutral connected the cost-basis models. We’re present astatine a crossover constituent to a affirmative bullish sentiment for short-term holders. A look into the mean bargain terms of short-term holders puts the bulk of introduction into the marketplace astatine $28,000, indicating a nett borderline for some abbreviated and semipermanent traders.

Source: Glassnode

Source: Glassnode

What’s Behind Bitcoin’s Sudden Price Surge?

The abrupt surge successful Bitcoin tin beryllium attributed to the excitement down the approval of BlackRock’s spot Bitcoin ETFs application. Bitcoin backers pointed to the listing of BlackRock’s iShares Bitcoin Trust connected the Depository Trust and Clearing Corporation (DTCC) website, suggesting that BlackRock had begun seeding wealth for the ETF.

Although Bitcoin has since shed disconnected immoderate of this terms gain and is present trading astatine $33,860 astatine the clip of this writing, metrics amusement that 80% of holders are making wealth astatine the existent price. Exchange signals besides point to bullish momentum, arsenic traders are present exchanging their assets for BTC connected crypto exchanges.

The emergence successful the worth of Bitcoin to $35,000 was reflected successful the banal prices of crypto-related companies similar Coinbase and MicroStrategy. At that price, MicroStrategy’s Bitcoin holdings would person generated a nett of $857 cardinal for the company.

Featured representation from Outlook India, illustration from Tradingview.com

2 years ago

2 years ago

English (US)

English (US)