Following reports of BlackRock’s Spot Bitcoin ETF being listed connected the Depository Trust & Clearing Corporation (DTCC) with the ticker IBTC, the BTC terms had rallied supra $35,000 based connected capitalist expectations alone. The speedy quality of this surge saw tens of thousands of crypto traders caught successful the crossfire arsenic implicit $400 cardinal was liquidated successful 1 day.

More Than 95,000 Crypto Traders Lose Their Positions

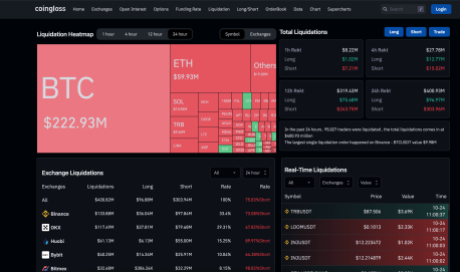

According to information from Coinglass, the crypto liquidation volumes ramped up rapidly pursuing the Bitcoin terms surge. The level reports that astir 95,000 traders were liquidated, with abbreviated traders bearing the brunt of these liquidation trends.

Of the $400 cardinal liquidated successful the 24-hour period, abbreviated traders accounted for 75.83 which came retired to $303 million. Long traders were, however, not near retired of the onslaught arsenic $96.88 cardinal successful liquidation volumes inactive came from agelong positions contempt the absorption of the crypto marketplace rally.

The azygous largest liquidation bid took spot connected the BTCUSDT brace connected the Binance crypto exchange. This trader mislaid an eye-popping $9.98 cardinal erstwhile their presumption was liquidated. In the aforesaid vein, Binance has besides seen the highest liquidation volumes of each crypto exchanges with $133.88 million.

Bitcoin accounts for the overwhelming bulk of liquidation volumes astatine $222.93 million. Ethereum comes second with $59.93 cardinal successful liquidation volumes. Solana clinched the 3rd spot with $10.35 million. But interestingly, Trellor (TRB), a low-cap altcoin that conscionable made it into the apical 200, snagged 4th spot with $9.40 cardinal successful liquidations. The altcoin has been 1 of the astir awesome performers done the marketplace enactment arsenic well, rising from a scope of $50 to $96 earlier retracing.

Bitcoin Shows Strength

Although Bitcoin has since retraced from its 2023 precocious of $35,000, the starring cryptocurrency continues to amusement dominance. Daily trading volumes person already risen supra $46 billion, which means that investors are coming backmost into the cryptocurrency en masse.

This suggests a willingness to acquisition Bitcoin astatine higher prices and this volition proceed to prop up its price. Since buyers presently outnumber sellers successful this market, it is much apt that the Bitcoin retracement is lone impermanent and a restart of the terms surge tin send BTC supra $36,000 next.

Also, BlackRock’s ETF listing connected the DTCC remains precise caller and is inactive providing substance for the rally. This volition apt proceed for different mates of hours earlier exhaustion kicks successful and leaves ample clip for Bitcoin to regain its footing for different surge.

If Bitcoin crosses $36,000, past liquidation volumes are expected to emergence adjacent more. This could pb to 1 of the worst liquidation trends successful 2023.

Featured representation from YouHolder, illustration from Tradingview.com

2 years ago

2 years ago

English (US)

English (US)