David Puell, an on-chain researcher astatine Ark Invest, contiguous shared his insights successful a elaborate report, offering a nuanced position connected Bitcoin’s existent lasting and aboriginal prospects. The report, titled “The Bitcoin Monthly: July 2023,” addresses respective cardinal topics that are cardinal to knowing the existent authorities of Bitcoin.

These topics see a broad marketplace summary, an investigation of Bitcoin’s debased volatility and whether it indicates a imaginable breakdown oregon breakout, arsenic good arsenic a treatment connected the interaction of the Federal Reserve’s tightening argumentation arsenic a starring indicator of terms deflation.

Ark Invest’s Near-Term Bitcoin Price Prediction

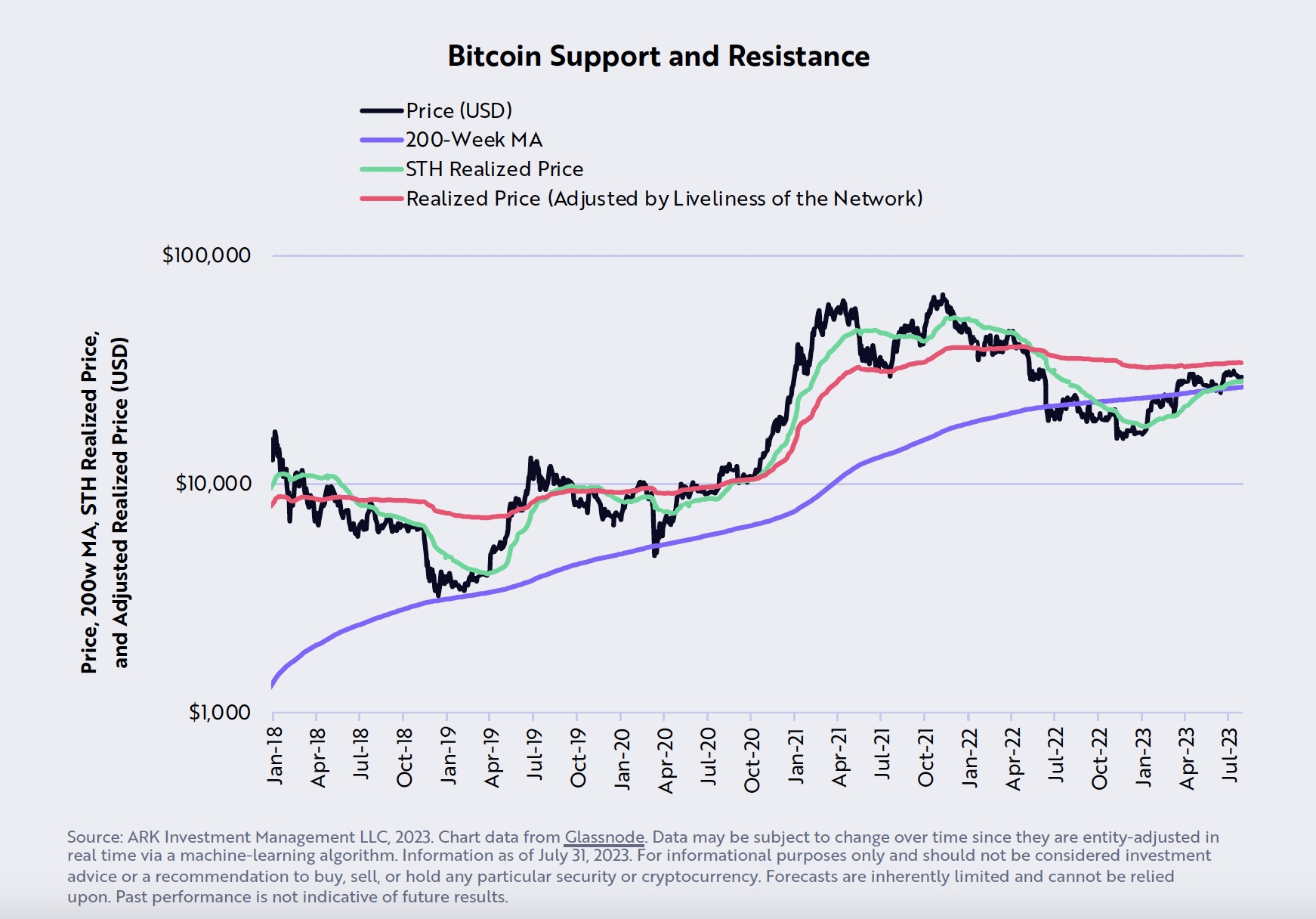

Puell’s investigation reveals a mixed, but chiefly bullish outlook for Bitcoin, with the cryptocurrency ending July astatine $29,230, supra its 200-week moving mean and its short-term-holder (STH) outgo ground of $28,328. This suggests a beardown enactment level for Bitcoin, indicating a imaginable upward trend, notes Puell.

Bitcoin enactment and absorption | Source: Twitter @dpuellARK

Bitcoin enactment and absorption | Source: Twitter @dpuellARKHowever, Bitcoin’s 90-day volatility, which dropped to 36% successful July, a level not seen since January 2017, presents a neutral outlook. Puell explains, “Based connected its debased level of volatility, we judge the Bitcoin terms could beryllium mounting up to determination dramatically successful 1 absorption oregon the different during the adjacent fewer months.” This could mean a important terms movement, but the absorption – up oregon down – is uncertain.

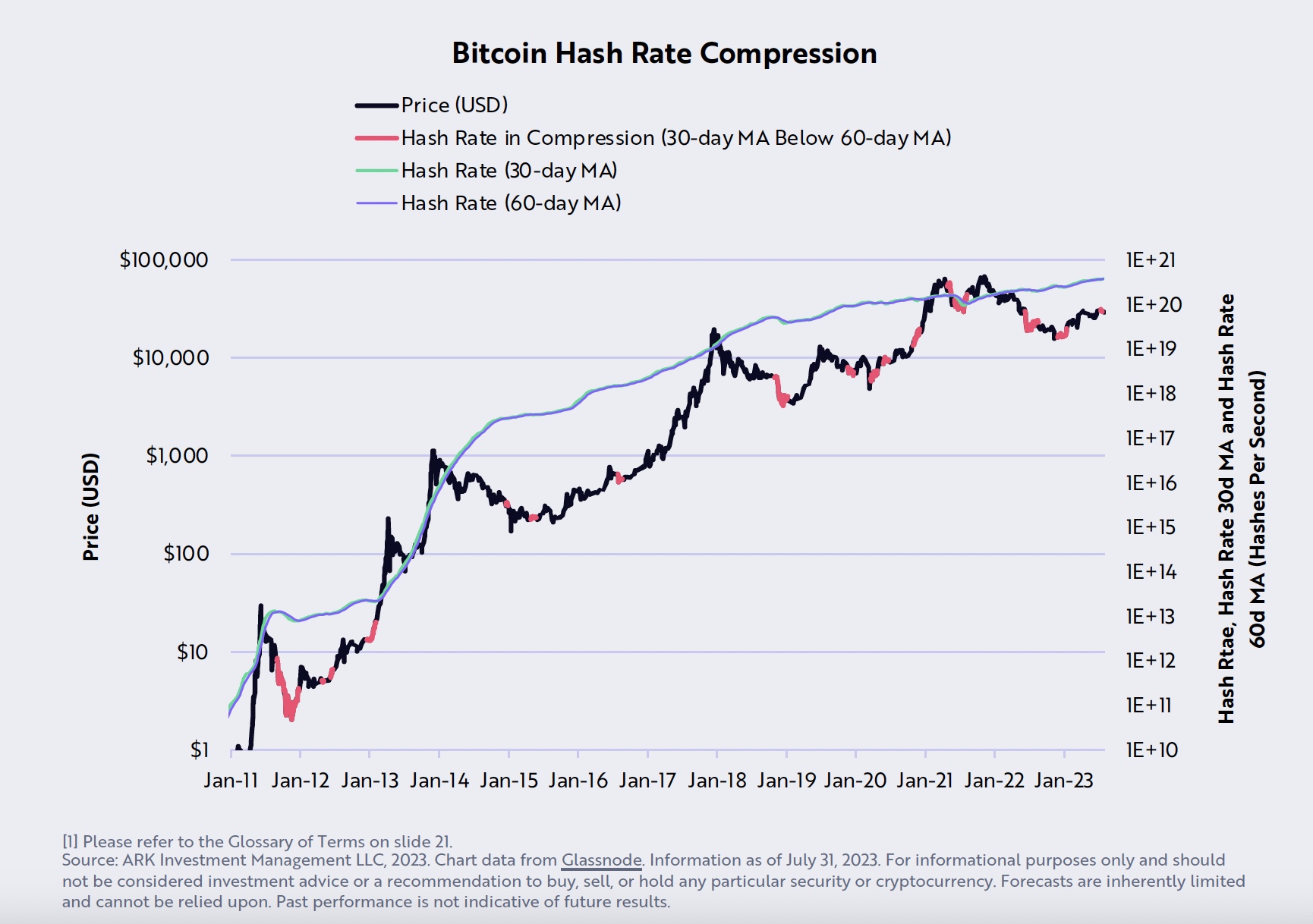

Puell besides points to signs of miner capitulation arsenic a bullish indicator. “During July, the 30-day moving mean of Bitcoin’s hash complaint dropped beneath its 60-day moving average, suggesting that miner enactment had capitulated,” helium states. Miner capitulation is typically associated with oversold conditions successful BTC price, hinting astatine a imaginable bullish reversal.

Bitcoin hash complaint compression | Source: Twitter @dpuellARK

Bitcoin hash complaint compression | Source: Twitter @dpuellARKThe “liveliness” metric, which measures imaginable selling unit comparative to existent holding behavior, besides suggests a bullish trend. The expert notes, “In July, liveliness dropped beneath 60%, suggesting the strongest semipermanent holding behaviour since the past 4th of 2020.” This indicates that much holders are keeping their coins alternatively than selling them, which could thrust the terms up.

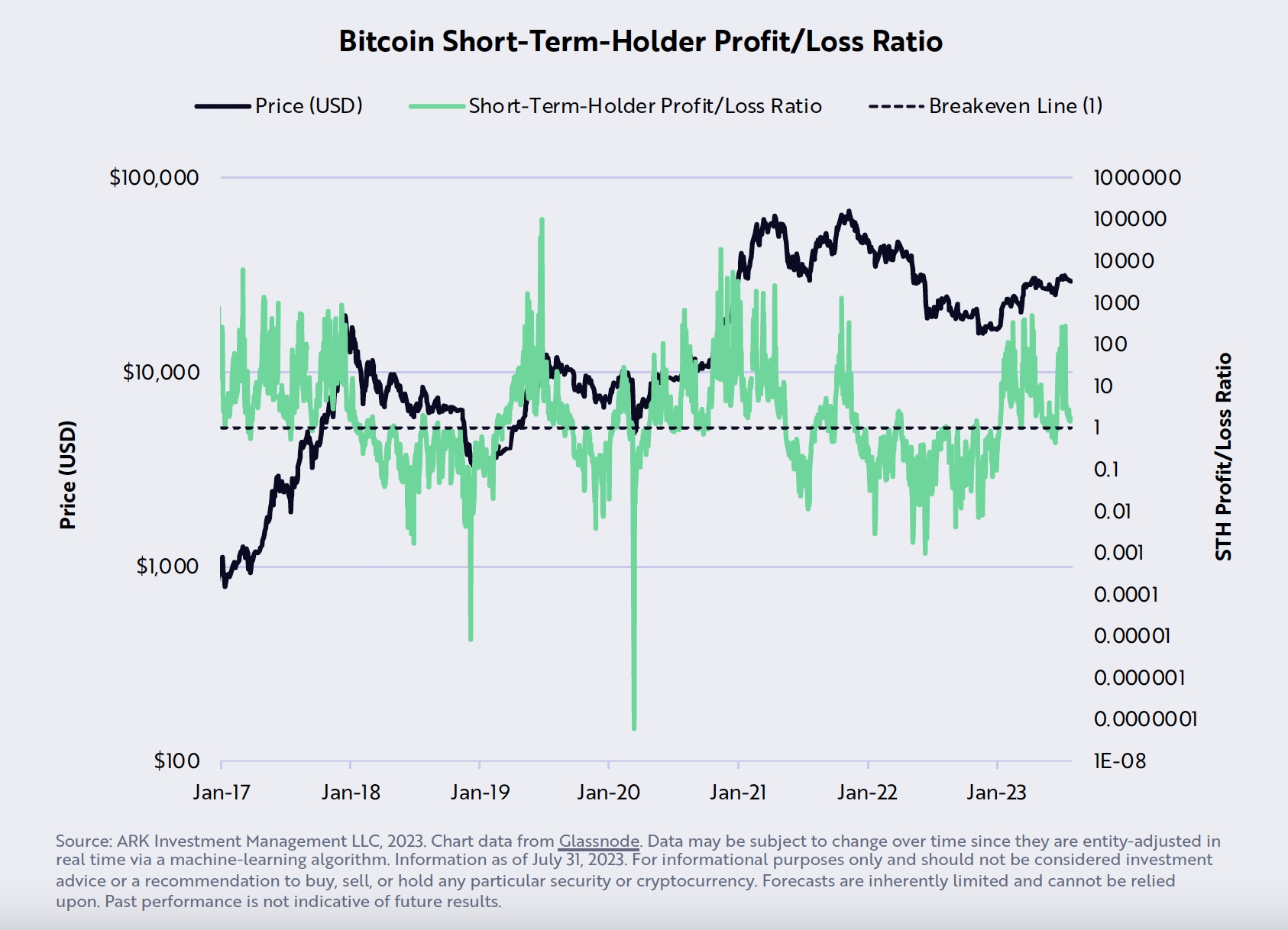

ARK’s ain short-term-holder profit/loss ratio, which ended July astatine ~1, is besides seen arsenic a bullish sign. Puell explains, “This breakeven level correlates some with section bottoms during superior bull markets and with section tops during carnivore marketplace environments.”

Bitcoin STH profit/loss ratio | Source: Twitter @dpuellARK

Bitcoin STH profit/loss ratio | Source: Twitter @dpuellARKHowever, the aboriginal of Binance’s BNB token, which is facing accrued regulatory pressure, looks bearish according to Puell. He warns, “As regulatory pressure increases connected crypto speech Binance, its autochthonal token, BNB, could beryllium connected the threshold of important turbulence.” If BNB breaks down, it could perchance interaction the wide stableness of the crypto market, including BTC.

Macro Outlook

On the macroeconomic front, Puell discusses the imaginable interaction of the Fed’s 22-fold summation successful involvement rates, which helium views arsenic bearish for Bitcoin and the broader economy. He states, “According to renowned economist Milton Friedman, monetary argumentation works with ‘long and adaptable lags’ that past 12-18 months, suggesting that the afloat interaction of the Fed’s 22-fold summation successful involvement rates has yet to hit.”

The Zillow Rent Index, which leads the Owners’ Equivalent Rent (OER) by astir 9 months, suggests that Consumer Price Index (CPI) inflation could decelerate importantly beneath 2% by year-end. Puell views this arsenic a bullish motion for Bitcoin, arsenic it could perchance summation the attractiveness of non-inflationary assets similar Bitcoin.

Lastly, Ark Invest takes a neutral stance connected the falling US import prices from China, contempt the yuan’s depreciation by ~12% since February 2022. He notes, “All other equal, China exporters should person accrued prices to offset the depreciation of the yuan. Instead, they person chopped prices, harming their profitability.”

In conclusion, Puell’s study presents a analyzable representation for Bitcoin. While determination are a batch of signs for a imaginable bullish trend, determination are besides important risks and uncertainties that could pb to bearish outcomes.

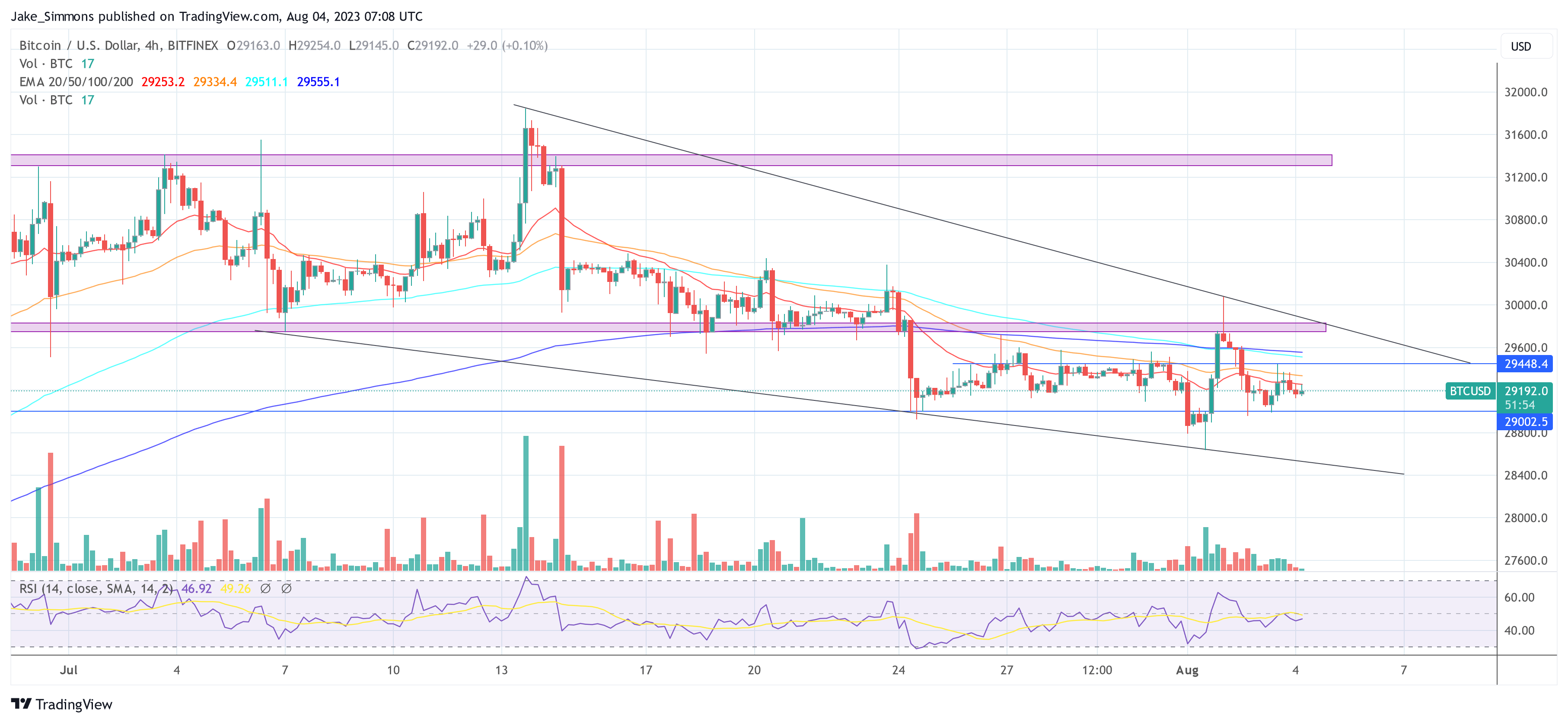

At property time, the BTC terms was astatine $29.152. The astir important absorption astatine the infinitesimal lies astatine $29.450. If BTC tin flooded this resistance, a breakout from the multi-week downtrend mightiness beryllium possible.

BTC beneath cardinal resistance, 4-hour illustration | Source BTCUSD connected TradingView.com

BTC beneath cardinal resistance, 4-hour illustration | Source BTCUSD connected TradingView.comFeatured representation from Kanchanara / Unsplash, illustration from TradingView.com

2 years ago

2 years ago

English (US)

English (US)