The crypto marketplace has precocious experienced a question of liquidations, amounting to astir $300 million, intimately pursuing Bitcoin’s crisp reclaim of the $67,000 mark.

This surge successful Bitcoin’s value, a stark reversal from its erstwhile downtrend, caught galore traders disconnected guard, particularly those who had placed bets connected the continuation of the market’s decline.

Over 80,000 Traders Faces Liquidation

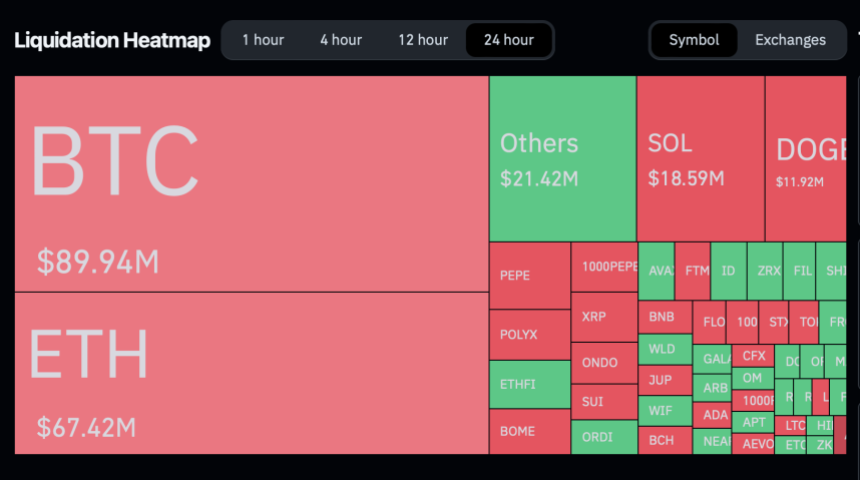

The data provided by Coinglass sheds airy connected the magnitude of the liquidations, revealing that astir 86,047 traders suffered losses exceeding $250 cardinal wrong a specified 24-hour period.

Major exchanges similar Binance, OKX, Bybit, and Huobi were the arenas for these important fiscal setbacks, with Binance traders bearing the brunt of the liquidations.

Particularly, Binance recorded $128.7 cardinal in liquidations, portion different large platforms specified arsenic OKX, Bybit, and Huobi besides experienced important liquidations, amounting to $99.87 million, $33.18 million, and $17.70 million, respectively. Meanwhile, contempt besides facing liquidations, the smaller exchanges had a comparatively insignificant impact.

Most affected positions were abbreviated trades, reflecting a wide anticipation of a marketplace downturn that did not materialize arsenic expected. Short positions recorded an estimated 57.55% of the liquidations, equivalent to $164.10 million, from traders betting against the market.

On the flip side, agelong presumption holders besides faced their stock of losses, contributing to astir 40% of the full liquidations, amounting to $121.07 million.

Crypto marketplace liquidations heatmap. | Source: Coinglass.com

Crypto marketplace liquidations heatmap. | Source: Coinglass.comBitcoin Recovery And Future Prospects

The crisp betterment of Bitcoin, momentarily reclaiming highs supra $67,000, has reignited involvement successful its marketplace behavior and aboriginal trajectory.

Despite a 6.6% dip successful its marketplace capitalization implicit the past week, Bitcoin’s worth saw a notable 6% summation successful the past 24 hours, with its marketplace headdress presently sitting supra $140 billion. This resurgence successful trading activity, with regular volumes climbing from beneath $60 cardinal to heights supra this mark, signifies renewed capitalist assurance and heightened trading interest.

Adding to the discourse, cryptocurrency expert Willy Woo presents an optimistic outlook for Bitcoin, suggesting the possibility of a “double pump” cycle reminiscent of the marketplace patterns observed successful 2013.

According to Woo, this signifier could herald 2 important terms surges for Bitcoin successful the coming years, with the archetypal highest anticipated by mid-2024 and a subsequent, much important emergence successful 2025.

While specified dual surge scenarios are rare, Woo’s analysis, based connected existent marketplace conditions and Bitcoin’s maturation potential, offers a glimpse into the aboriginal of the world’s starring cryptocurrency.

At the complaint the #Bitcoin Macro Index is pumping, I wouldn’t beryllium amazed if we get a apical by mid-2024, which would hint astatine a treble pump rhythm similar 2013… a 2nd apical successful 2025. pic.twitter.com/i2a0V5ytPv

— Willy Woo (@woonomic) March 19, 2024

Featured representation from Unsplash, Chart from TradingView

Disclaimer: The nonfiction is provided for acquisition purposes only. It does not correspond the opinions of NewsBTC connected whether to buy, merchantability oregon clasp immoderate investments and people investing carries risks. You are advised to behaviour your ain probe earlier making immoderate concern decisions. Use accusation provided connected this website wholly astatine your ain risk.

1 year ago

1 year ago

English (US)

English (US)