Reason to trust

Strict editorial argumentation that focuses connected accuracy, relevance, and impartiality

Created by manufacture experts and meticulously reviewed

The highest standards successful reporting and publishing

Strict editorial argumentation that focuses connected accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

In a caller interrogation with Bloomberg, ARK Investment Management Founder and CEO Cathie Wood erstwhile again reaffirmed her ambitious terms people for Bitcoin, predicting it could soar to $1.5 cardinal per coin by the twelvemonth 2030. Despite the caller marketplace volatility and a pronounced “risk-off” environment, Wood remains steadfast successful her condemnation that the starring cryptocurrency volition proceed its semipermanent upward trajectory.

“Yes, it is our view,” Wood replied erstwhile asked whether she inactive expects Bitcoin to scope her stated terms target. “I deliberation close present we’re successful a risk-off play generally. And if you’ve been watching Bitcoin, it’s astir been a person successful presumption of hazard on, hazard off.”

Cathie Wood Still Calls $1.5 Million Bitcoin By 2030

According to Wood, on-chain analytics bespeak that Bitcoin is presently “in the mediate of a small spot much than halfway done a four-year cycle”—a notation to BTC’s historically repetitive 4-year cycle. She emphasized that “we deliberation we’re inactive successful a bull market” and expects “deregulation” successful the United States to play a important relation successful encouraging much institutions to participate the plus class.

Wood further argued that organization plus allocators “have to person a constituent of presumption connected this caller plus class” and that incorporating Bitcoin into portfolios volition apt amended risk-adjusted returns.

Amid a broader marketplace sell-off, Wood suggested a “rolling recession” script mightiness already beryllium unfolding. She cited rising interest implicit occupation information and an expanding savings complaint arsenic evidence: “We spot the redeeming complaint going up. We spot the velocity of wealth coming down, and we bash deliberation we’ll spot 1 oregon 2 antagonistic quarters.”

She maintained that specified economical accent could compel the Federal Reserve to reverse people aboriginal this year: “We wouldn’t beryllium amazed to spot 2 oregon 3 cuts. […] We deliberation inflation’s going to astonishment connected the debased broadside of expectations.”

Wood pointed to declining gasoline prices, ovum prices, and rents arsenic signals that ostentation whitethorn beryllium cooling faster than galore expect, granting the Fed “more degrees of state successful the 2nd fractional of this year.”

Turning to regulation, Wood sounded notably optimistic astir the “easing regulatory environment” astir cryptocurrency. She highlighted the US Securities and Exchange Commission’s (SEC) attack to meme coins, noting that by “declaring these meme coins not securities”, the regulators person fundamentally said, “Buyer beware […] We deliberation astir of them are not going to beryllium worthy precise much. […] What we deliberation volition hap is […] there’s thing similar losing wealth for radical to learn.”

However, Wood underscored that Bitcoin, Ethereum, and Solana are halfway assets with “use cases […] multiplying” and apt to stay integral successful the crypto ecosystem, successful stark opposition to the “millions of meme coins” she believes volition yet suffer their value.

Wood besides discussed her concern thesis for Robinhood and Coinbase, revealing that ARK views some companies arsenic frontrunners successful the conflict for integer wallet dominance. She compared integer wallets to recognition cards, suggesting “most of america don’t person precise galore recognition cards”—and, by extension, astir users volition not clasp much than a fewer integer wallets.

Additionally, she drew attraction to the emergence of tokenization, noting that BlackRock’s involvement successful tokenizing assets is simply a awesome that large-scale players envision a “complicated […] caller world” successful superior formation. She besides cited emerging markets arsenic a cardinal terrain wherever stablecoins and Bitcoin already service arsenic backstops to support purchasing powerfulness from currency devaluation: “If you spell to emerging markets […] they are utilizing Bitcoin […] but besides stablecoins, which is efficaciously the dollar arsenic backstops to their purchasing powerfulness and wealth.”

Cathie Wood remains undeterred by short-term fluctuations oregon marketplace jitters. While reaffirming her high-profile bets connected Tesla, Bitcoin, and disruptive technologies similar artificial intelligence, she reiterated her overarching thesis: innovation and blockchain-based platforms volition proceed to thrust deflationary forces and make caller opportunities for growth. “We person been known for our Tesla telephone and our Bitcoin call. […] I would adhd successful AI platforms arsenic a work institution similar Palantir.”

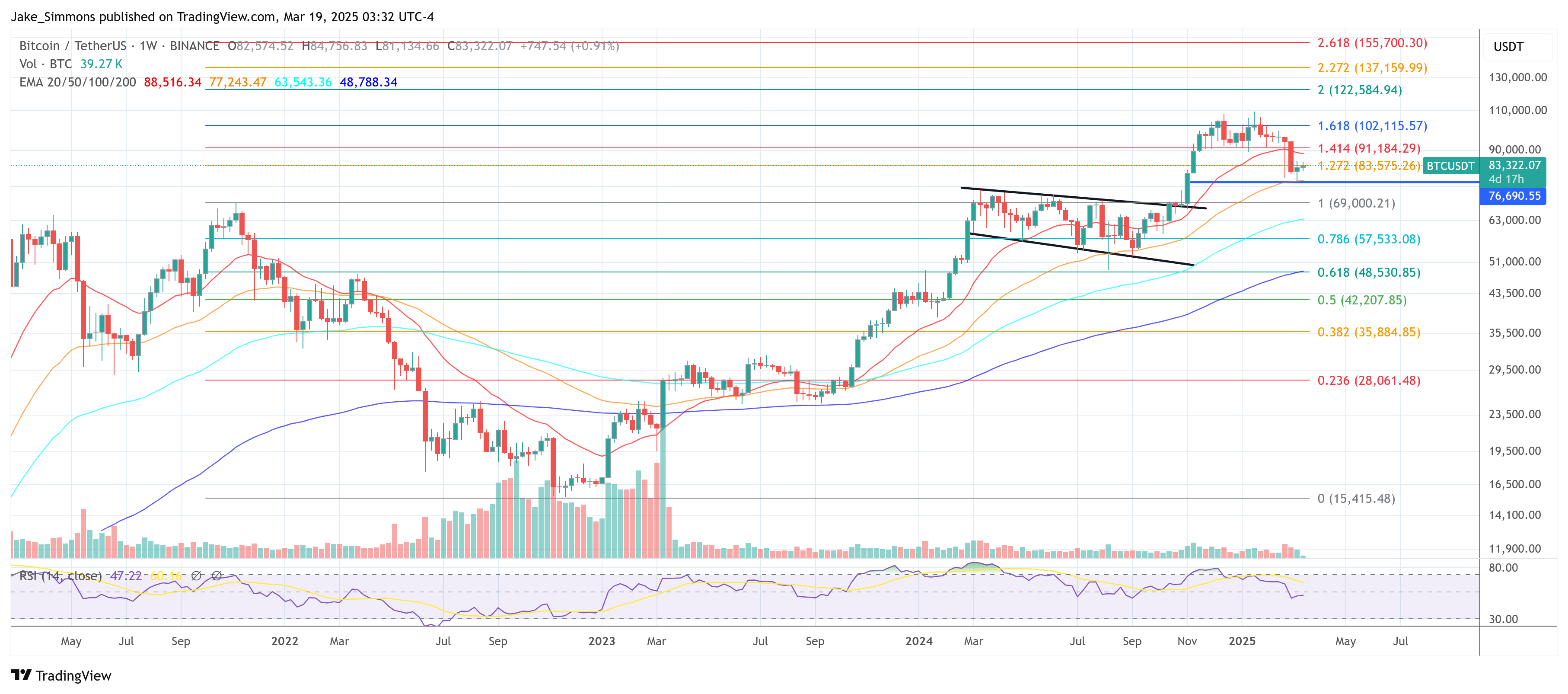

At property time, BTC traded astatine $83,322.

BTC terms hovers beneath cardinal resistance, 1-week illustration | Source: BTCUSDT connected TradingView.com

BTC terms hovers beneath cardinal resistance, 1-week illustration | Source: BTCUSDT connected TradingView.comFeatured representation from YouTube, illustration from TradingView.com

6 months ago

6 months ago

English (US)

English (US)