After Monday’s marketplace crash, concerns astir the stableness of Bitcoin’s bull tally person emerged. Yet, Ki Young Ju, laminitis and CEO of CryptoQuant, a starring blockchain analytics firm, maintains a affirmative outlook. He suggests that, contempt the caller crash, on-chain information continues to enactment the conception that the bull marketplace for Bitcoin remains intact.

Bitcoin On-Chain Analysis: Bullish Arguments

#1 Bitcoin Hashrate

The Bitcoin hashrate, which gauges the computational powerfulness utilized successful mining and processing transactions, is nearing an all-time precocious (ATH). Ju notes, “Miner capitulation is astir over, with hashrate nearing ATH. US mining costs are ~$43K per BTC, truthful hashrate apt unchangeable unless prices dip beneath this.”

#2 Whale Behavior

Significant Bitcoin inflows into custody wallets are different statement to beryllium bullish, indicating beardown accumulation by large-scale investors, often referred to arsenic ‘whales’. Ju highlights, “Significant BTC inflows into custody wallets. Permanent Holder addresses accrued by 404K BTC, including 40K BTC successful US spot ETFs implicit the past 30 days. New whales are accumulating.”

#3 Retail Investor Participation

The existent subdued information of retail investors is akin to patterns observed successful mid-2020. Ju remarks, “Retail investors are mostly absent, akin to mid-2020.” This lack mightiness lend to little volatility, arsenic retail trading often leads to accelerated terms swings.

#4 Old Whales Still HODL

Between March and June, semipermanent holders (those who person held for implicit 3 years) transferred their Bitcoin holdings to newer investors. Currently, determination is nary important selling unit from these seasoned holders.

Bearish On-Chain Data

#1 Macro Risks

On the downside, Ju points retired macroeconomic risks and caller marketplace activities that could interaction Bitcoin’s terms stability: “Macro risks could pb to forced sell-offs. There were ample crypto deposits by Jump Trading recently, and Binance deed YTD precocious successful regular deposits.”

#2 Borderline On-Chain Indicators

While immoderate on-chain indicators person precocious turned bearish, these are borderline, according to Ju. He asserts, “Some on-chain indicators turned bearish but are borderline. If bearish trends persist for implicit 2 weeks, marketplace betterment could beryllium challenging.”

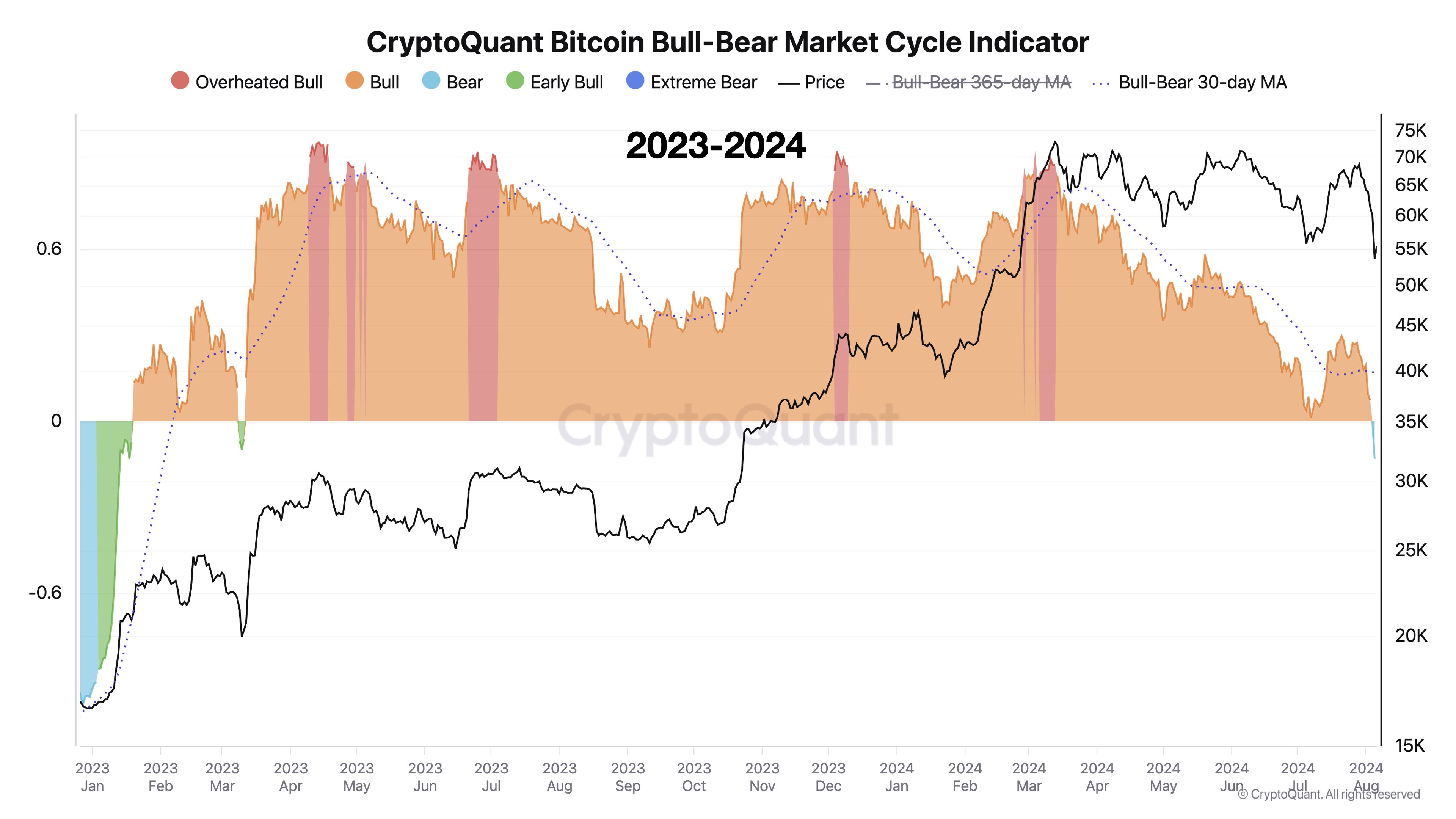

#3 Bull-Bear Cycle Indicator Flags Bear Phase

Notably, the Bull-Bear Market Cycle Indicator has besides flagged a carnivore signifier for the archetypal clip since January 2023 (high bluish country successful the chart), warranting adjacent observation. CryptoQuant Head of Research Julio Moreno added that this indicator has antecedently identified constricted carnivore phases during important marketplace events similar the COVID sell-off successful March 2020 and the Chinese mining prohibition successful May 2021. Moreover, it besides correctly anticipated the commencement of the carnivore marketplace successful November 2021.

Bitcoin Bull-Bear Market Cycle Indicator | Source: X @jjcmoreno

Bitcoin Bull-Bear Market Cycle Indicator | Source: X @jjcmorenoDespite these bearish undercurrents, Ju remains cautiously optimistic astir the imaginable of Bitcoin to scope a caller all-time precocious until the extremity of the year. “As agelong arsenic the Bitcoin terms stays supra $45K, it could interruption its all-time precocious again wrong a year, imo. Some indicators are showing bearish signals. However, they could inactive retrieve with a rebound, truthful we request to ticker if it stays astatine this level for a week oregon two. If it lingers longer, the hazard of a carnivore marketplace grows, and betterment whitethorn beryllium hard if it lasts implicit a month,” Ju concludes.

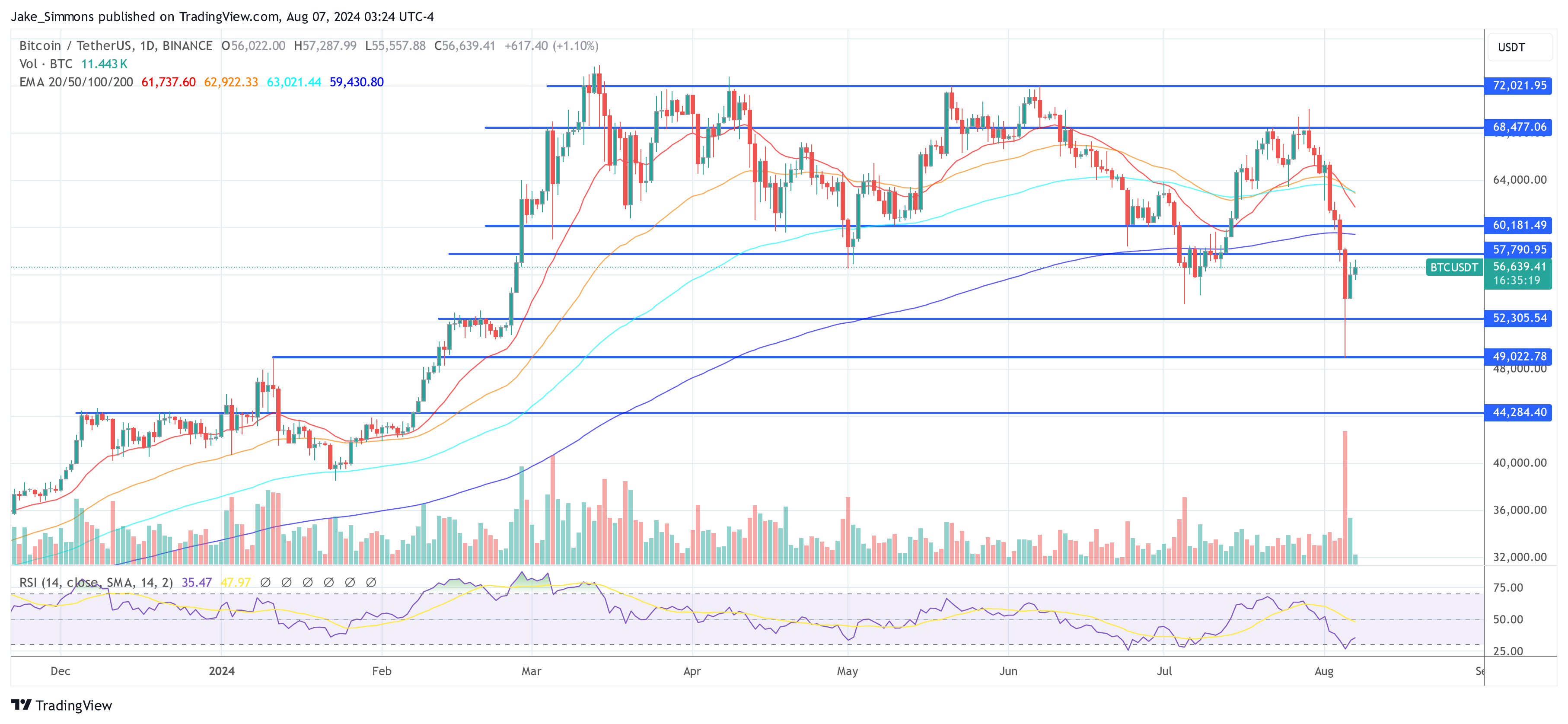

At property time, BTC traded astatine $56,639.

Bitcoin price, 1-day illustration | Source: BTCUSDT connected TradingView.com

Bitcoin price, 1-day illustration | Source: BTCUSDT connected TradingView.comFeatured representation created with DALL.E, illustration from TradingView.com

1 year ago

1 year ago

English (US)

English (US)