Bitcoin (BTC) is having a infinitesimal again. The biggest cryptocurrency successful the satellite is enjoying a 150% summation this twelvemonth arsenic its terms surged beyond $44,000 connected Wednesday, marking the archetypal clip it had done truthful successful implicit 18 months.

The summation is indicative of the cryptocurrency’s continuous upswing, which is being supported by a fig of elements specified arsenic a driblet successful involvement rates and increasing expectations implicit the imaginable support of a spot Bitcoin exchange-traded money (ETF) successful the US.

Spot ETFs: Democratizing Bitcoin Investment With Lower Risks

Supporters of the manufacture accidental that this caller mode to put successful bitcoin astatine spot prices alternatively of futures prices could marque it easier for everyone to get into the cryptoverse portion lowering immoderate of the well-known risks that travel with it.

It’s imaginable that regulators volition o.k. the archetypal bitcoin spot ETF exertion arsenic soon arsenic adjacent month, adjacent though immoderate crypto money managers person precocious won cases that made the chances of this happening better.

“I deliberation what the ETF means truly is that Bitcoin is going mainstream, and that’s what radical were waiting for,” Ledger CEO Pascal Gauthier precocious said.

The information that Bitcoin has recovered supra the important terms level highlights however resilient its upward momentum is, drafting involvement from some seasoned investors and the larger cryptocurrency community.

How High Can BTC Price Go?

Given that quality sources and fiscal analysts person taken announcement of Bitcoin’s latest breakout supra the psychologically captious $44,000 threshold, it is wide that the marketplace is presently bullish biased.

Bloomberg has made a bold prediction regarding the largest cryptocurrency successful presumption of marketplace capitalization erstwhile it entered the fray. The quality website claims that Bitcoin’s summation supra $42,000 marks the commencement of a caller “crypto supercycle” alternatively than conscionable a passing peak.

According to this bullish prediction, Bitcoin volition soar to values supra an astounding $500,000 and go the cornerstone of a revolutionary caller monetary paradigm that is already gaining enactment connected Wall Street.

This prediction, which is successful enactment with the expanding feeling of cryptocurrency fans, signals a paradigm alteration successful accepted fiscal markets arsenic Bitcoin keeps redefining the planetary economical country and establishing its domination.

Bitcoin’s Clear Path: $48K-$53K Sweet Spot For Upside – Analyst

Based connected method terms levels, peculiarly highs acceptable successful March 2022 and September 2021, Joel Kruger, marketplace strategist astatine LMAX Group, believes that Bitcoin’s upward terms momentum has a wide way guardant until the portion betwixt $48,000 and $53,000.

Between these 2 levels, Kruger identified a saccharine spot wherever the way to the March 2022 precocious is remarkably escaped of large opposition.

He stated:

“There is simply a bully portion betwixt those 2 levels with precise small successful the mode of immoderate meaningful absorption betwixt the existent terms and that March 2022 high.”

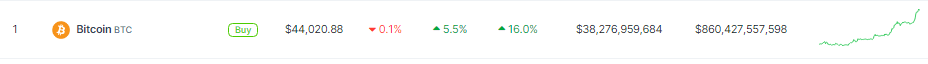

BTC moves past $44K today. Source: Coingecko

BTC moves past $44K today. Source: Coingecko

According to marketplace data, arsenic of this writing, the terms of Bitcoin is $44,020, up 5.5% implicit the erstwhile day, and sustaining a 16% summation successful the past week, information from Coingecko shows.

As the marketplace dynamic unfolds, each eyes are connected Bitcoin, wondering if it volition proceed its bullish tally and acceptable its sights connected the adjacent important milestone astatine $45,000.

(This site’s contented should not beryllium construed arsenic concern advice. Investing involves risk. When you invest, your superior is taxable to risk).

Featured representation from Shutterstock

2 years ago

2 years ago

English (US)

English (US)