On-chain information shows tiny Bitcoin holders person accumulated precocious portion whale holdings person decreased, a motion that whitethorn beryllium bullish successful the agelong term.

Bitcoin Investors With 0-1,000 Coins Have Increased Their Holdings Recently

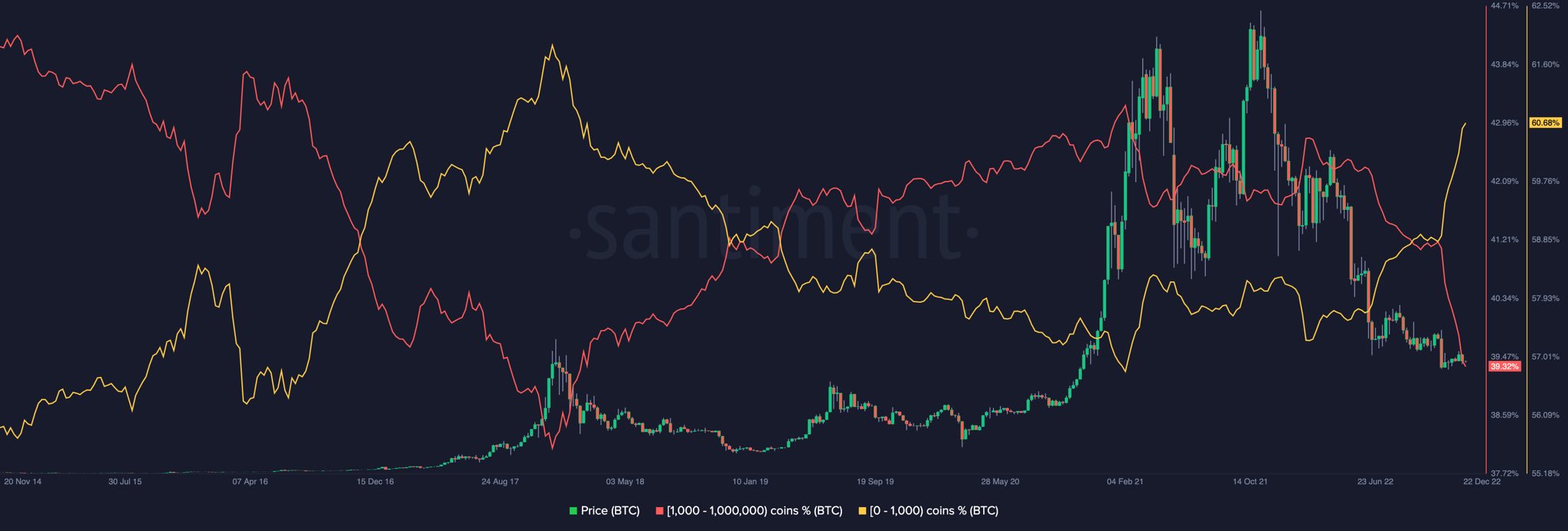

As a Twitter user has pointed retired utilizing information from Santiment, holders with wallet amounts successful the 0-1,000 coins scope person aggressively accumulated astatine caller lows. The applicable indicator present is the “Bitcoin Supply Distribution,” which tells america which wallet groups are holding what percent of the full proviso close now.

Wallets (or much simply, holders) are divided into wallet bands based connected the fig of coins they are holding astatine the moment. For example, the 1-10 coins cohort includes each addresses that are presently carrying astatine slightest 1 and astatine astir 10 BTC. The Supply Distribution metric for this radical measures the corporate equilibrium of each the wallets falling wrong this range.

Now, present is simply a illustration that shows the inclination successful the Bitcoin Supply Distribution information for the 0-1,000 coins and 1,000-1,000,000 coins bands:

As you tin spot above, the Bitcoin Supply Distribution curve for the 1,000-1,000,000 coins set has observed a crisp diminution recently. The holders belonging to this radical are the whales, which means that the percent of the proviso held by these humongous holders has been going down, suggesting that they person been capitulating during this heavy carnivore market.

The proviso stock held by the 0-1,000 coins group, connected the different hand, has rapidly accrued recently, implying that retail investors person been accumulating ample amounts during the caller lows successful the terms of the asset.

From the chart, it’s evident that specified a signifier was besides seen during the 2018/2019 carnivore market, albeit the standard of question from some these groups was overmuch smaller. Interestingly, this inclination lone formed successful that carnivore aft the cyclical debased was already successful for BTC.

Thus, if past is thing to spell by, this caller accumulation from the 0-1,000 coins radical could assistance Bitcoin signifier the bottommost for the existent rhythm (if it’s not already in), and truthful reverse the coin towards a bullish inclination successful the agelong term.

BTC Price

At the clip of writing, Bitcoin’s price floats astir $16,800, up 1% successful the past 7 days. Over the past month, the crypto has gained 2% successful value.

Featured representation from André François McKenzie connected Unsplash.com, charts from TradingView.com, Santiment.net

2 years ago

2 years ago

English (US)

English (US)