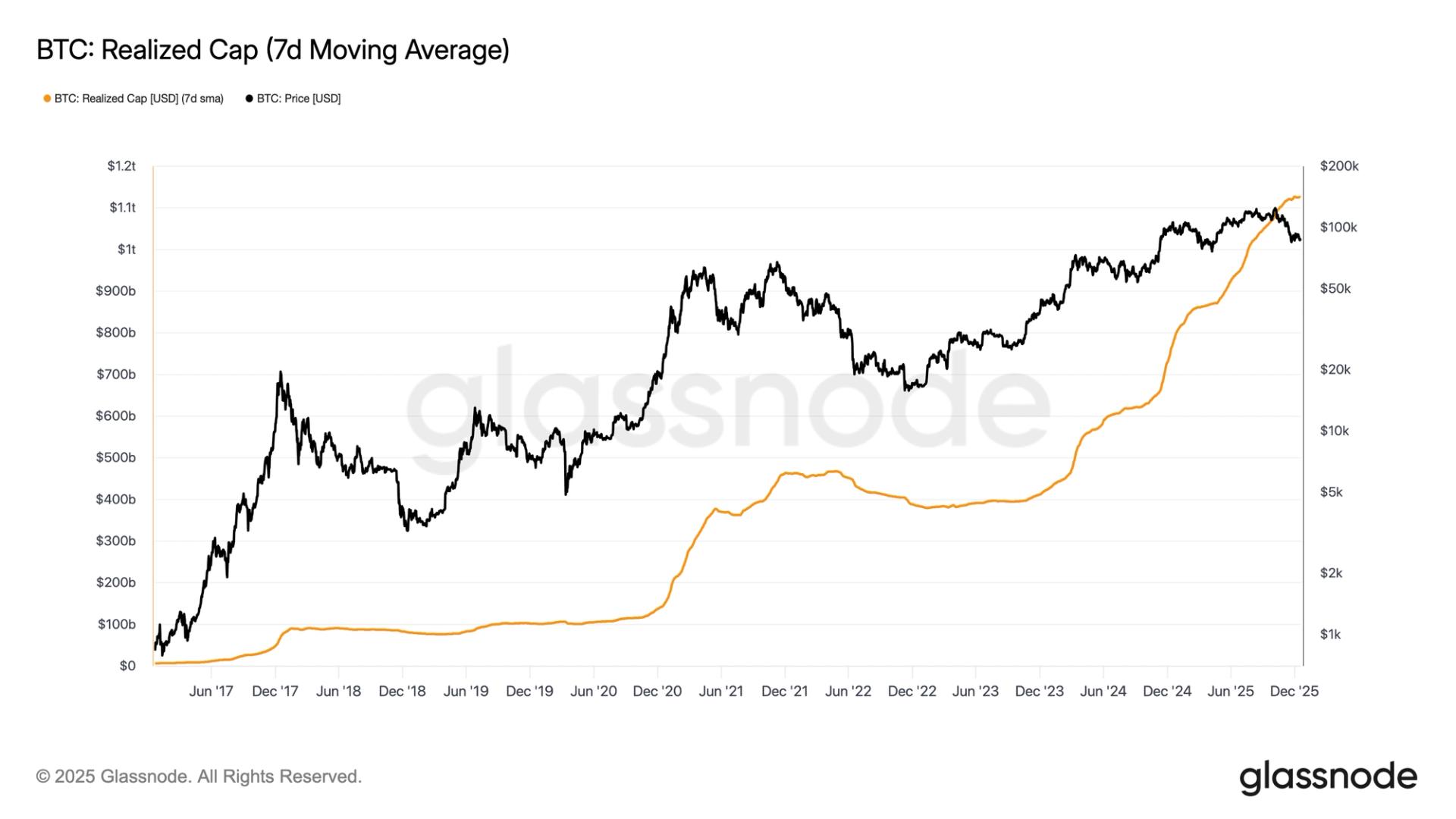

A surge successful CME BTC volumes and unfastened involvement item organization investors' increasing involvement successful Bitcoin. Will it beryllium capable to support the terms successful the existent range?

Bitcoin (BTC) terms presently battles to clasp the $34,000 level aft a stellar rally and abbreviated compression saw its terms propulsion supra $35,000 connected Oct. 23.

In an Oct. 24 marketplace update, Capriole Investments laminitis Charles Edwards noted that aft 7 months of consolidation, Bitcoin’s upward determination melted the $32,000 absorption “like butter” and helium expects that the upcoming monthly absorption is improbable to beryllium a hurdle.

Edwards said:

“It would marque consciousness to spot either a accelerated continuation to mid-range ($43K) oregon short-term consolidation betwixt enactment absorption astatine $32-$35K earlier continuation.”As Cointelegraph mentioned successful an earlier price update,

“Successive regular closes supra the $31,700 level would beryllium notable, arsenic regular oregon play higher precocious candles supra this level puts the terms supra a cardinal pivot constituent and enters territory not seen since May 2022.”Regarding the catalysts for this week’s terms move, Edwards agrees that the caller fervor implicit what looks to beryllium a sooner-than-later SEC support of a spot Bitcoin ETF is contributing to the rally, but helium besides cites a fistful of different near-term factors.

Bitcoin terms catalysts. Source: Capriole Investments

Bitcoin terms catalysts. Source: Capriole InvestmentsLayerTwo Labs laminitis Paul Sztorc concurred, saying, “I deliberation we’re seeing meaningful inklings of a broader decoupling of Bitcoin from equities, and this divergence of sorts has taken a batch of marketplace participants by surprise”

Potential concerns related to “foreign struggle and rising macroeconomic uncertainty, expectations among traders had been focused connected a forthcoming dip that yet didn’t materialize.”But Sztorc explained that during the U.S. determination banking situation the marketplace underwent “a akin divergence” which resulted successful “Bitcoin outperforming past arsenic well.”

Sztorc believes that the bulk of the caller divergent terms enactment is “a batch of traders and investors are present accumulating up of that event.”

“I besides deliberation determination are expectations that the Federal Reserve volition apt person to commencement easing monetary argumentation soon due to the fact that of the contented of rapidly rising yields. More specifically, traders are astir apt anticipating this easing by mode of the Fed having to revert to immoderate signifier of yield-curve control, the consequences of which tends to beryllium monetary debasement.”CME Bitcoin unfastened involvement surpasses 100,000 BTC

Further impervious that organization investors are warming up to Bitcoin and the thought that a spot BTC ETF volition beryllium approved comes from the CME wherever BTC unfastened involvement deed a caller grounds supra 100,000 BTC. Beyond the bare terms speculation, the takeaway present is that if organization investors are accumulating spot Bitcoin, they past request to hedge this position, hence the surge successful volumes and unfastened involvement seen astatine CME and different places.

CME BTC futures OI has breached 100k BTC for the archetypal clip ever.

While offshore perp OI shrank by 26,735 BTC yesterday, CME's OI grew by 4,380 BTC. pic.twitter.com/kjKBRYCoSX

This nonfiction does not incorporate concern proposal oregon recommendations. Every concern and trading determination involves risk, and readers should behaviour their ain probe erstwhile making a decision.

2 years ago

2 years ago

English (US)

English (US)