The Bitcoin marketplace recorded a insignificant 0.67% terms summation successful the past 24 hours, amid a little instrumentality to the $118,000 terms territory. This humble terms summation forms portion of a rebound observed implicit the erstwhile 48 hours, pursuing a important 4% terms correction earlier past week. Looking up to the caller week, renowned marketplace expert with X username KillaXBT has identified 2 imaginable terms improvement scenarios for the premier cryptocurrency.

Bitcoin Sees Bounce From Key Demand Zone, But What’s Next?

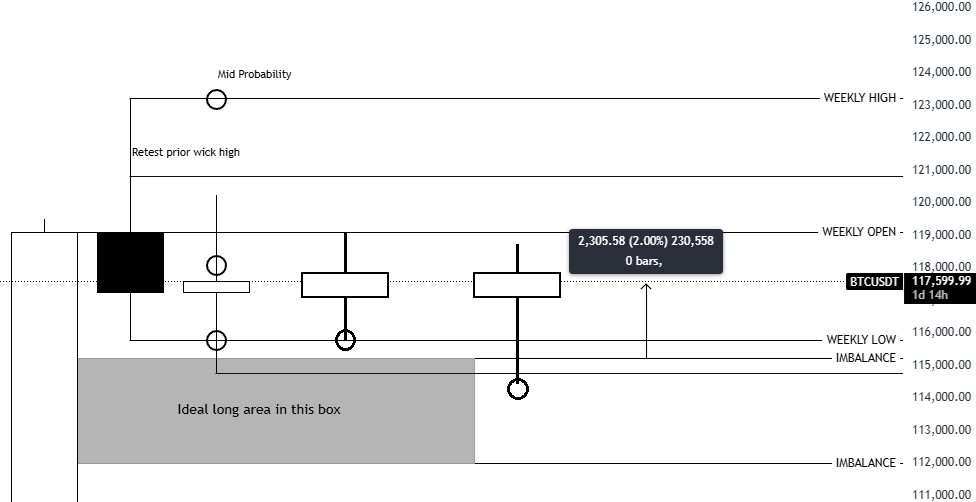

In an X post connected July 26, KillaXBT provides an in-depth method investigation of the Bitcoin marketplace to representation retired the asset’s imaginable terms trajectory successful this caller week. The fashionable marketplace adept duly notes that Bitcoin experienced a terms bounce aft dipping into a cardinal request portion astir $115,000, which they besides described arsenic an perfect agelong introduction region.

As earlier stated, the crypto marketplace person has since climbed to $118,000 pursuing this terms rebound. However, KillaXBT notes determination is an established CME Gap astir $117,071, which is apt to service arsenic a terms magnet successful the abbreviated term. For context, CME gaps are terms gaps connected the Chicago Mercantile Exchange (CME) Bitcoin futures illustration that hap erstwhile Bitcoin’s terms moves importantly connected the spot marketplace erstwhile CME markets are closed, typically implicit the weekend.

Source: @KillaXBT connected X

Source: @KillaXBT connected XIn presumption of adjacent week, KillaXBT explains script 1 successful which the Bitcoin marketplace opens connected a bullish note. In this case, the expert states investors should expect Bitcoin to yet signifier a higher low, ideally done a expanse of liquidity astir the $116,000 area. However, if Bitcoin bulls tin efficaciously clasp this terms pocket, it would trigger caller agelong setups with halt losses tucked beneath the anterior week’s low.

In script 2, KillaXBT paints a much assertive concern successful which Bitcoin performs a treble expanse of past week’s wick debased astir $114,800, thereby effecting a ruthless liquidity drawback earlier an upward reversal. However, the marketplace adept favours the world of script 1, pursuing the earlier liquidity drawback with the terms dip to $115,000.

The Invalidation Risk

Regardless of which scenario, KillaXBT has highlighted definite developments that could neutralize the prospects of a bullish reversal. In particular, the expert explains that nonaccomplishment for the terms to clasp supra the caller wick lows pursuing a retest would unit Bitcoin prices to deeper imbalance zones betwixt $112,000 – $113,800.

At the clip of writing, Bitcoin trades astatine $117,900, reflecting a 0.21% summation successful the past 7 days.

Featured representation from Pexels, illustration from Tradingview

3 months ago

3 months ago

English (US)

English (US)