Bitcoin edged higher connected Sunday arsenic signs of easing US-China commercialized tensions lifted hazard assets, portion Strategy’s laminitis hinted the institution kept adding to its Bitcoin holdings.

Strategy Keeps Buying

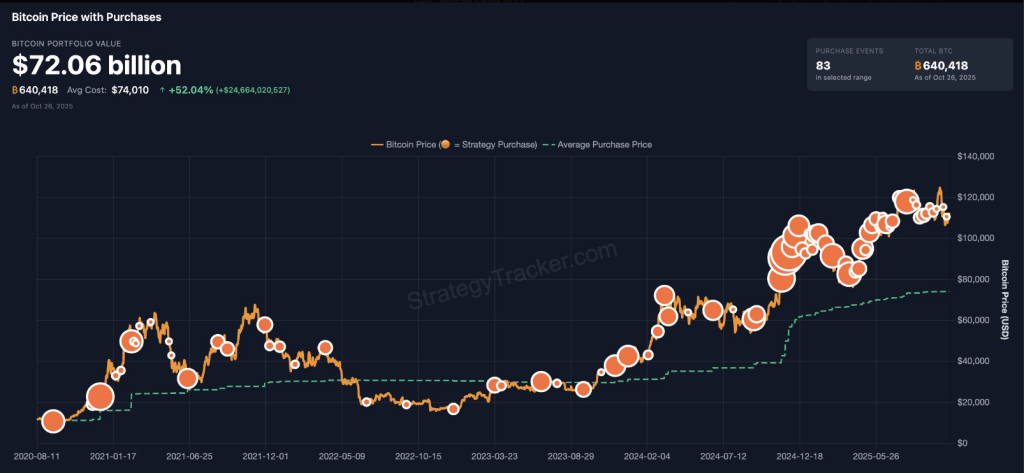

Michael Saylor posted a illustration connected October 26 that uses orangish dots to people caller purchases. The ocular cue has go his shorthand for caller buys.

Based connected reports, Strategy added 387 BTC betwixt October 13 and October 20, bringing its full to 640,418 BTC. That fig is striking connected its own. It shows a steady, deliberate attack to buying adjacent erstwhile prices are volatile.

Strategy’s disclosed mean outgo for its Bitcoin stands astatine $74,010. The company’s moves lately person been tiny compared with September, erstwhile it took successful much than 7,000 BTC crossed respective ample transactions. The size of immoderate caller purchases this week has not been publically revealed.

At the aforesaid time, Bitcoin’s marketplace moves were influenced by broader news. The terms of Bitcoin roseate astir 1.6% connected Sunday, portion Ethereum gained astir 2.8%. Short-term swings look driven much by headlines than by a azygous company’s actions.

It’s Orange Dot Day. pic.twitter.com/5FSGmxwoNS

— Michael Saylor (@saylor) October 26, 2025

Holdings, Valuation And Track Record

Based connected reports, astatine prices a small implicit $115,000 per BTC, Strategy’s Bitcoin stash is valued astatine astir $72 billion. That valuation implies a insubstantial summation of much than $25 cardinal implicit a full outgo ground of astir $47.4 cardinal since the programme began successful 2020.

Reports person logged 83 abstracted acquisition events successful that time, a signifier that has near investors with a wide presumption of the firm’s playbook: bargain repeatedly and study afterward.

Some of the buying was concentrated successful September, erstwhile the steadfast added thousands of coins successful a fewer ample moves. Recently, however, allocations person looked smaller and much frequent. That displacement suggests a penchant for dependable accumulation alternatively than azygous large bets.

Buying Behavior And Market Response

Strategy shares person been trading supra the company’s nett plus value. That information suggests investors are comfy owning MSTR arsenic a mode to summation Bitcoin vulnerability without buying the token directly. The company’s method — denote purchases aft the information and fto the marketplace bespeak the holdings — has been accordant and predictable.

Geopolitical Headlines Drive Volatility

Meanwhile, officials from the US and China signaled advancement successful commercialized talks, and that helped calm immoderate investors. According to reports, Scott Bessent told CBS News helium expected the menace of 100% tariffs and an contiguous export power authorities to person receded.

Earlier successful October, China announced tighter limits connected uncommon world exports utilized successful spot manufacturing. On October 11, US President Donald Trump said helium would enforce an further 100% tariff connected Chinese goods and planned export controls connected definite bundle to instrumentality effect connected November 1.

Those days of crisp rhetoric caused dense losses crossed markets and triggered 1 of the largest liquidation events successful crypto this year.

Featured representation from Gemini, illustration from TradingView

1 month ago

1 month ago

English (US)

English (US)