While the existent strategy is contributing to expanding inequality, Bitcoin serves to payment everyone arsenic and beforehand just competition.

This is an sentiment editorial by Andrew Hetherington, a contributor to Bitcoin Magazine.

Since the Nixon Shock of 1971, wealth inequality has soared to levels not seen successful implicit a century. The dollar was nary longer redeemable for golden but was alternatively backed lone by faith. Without the limitations of a backed currency, those successful powerfulness were fixed the accidental to make arsenic overmuch fiat currency arsenic they desired, with small to nary consequence. Destined to suffer religion owed to abuse, fiat currency was doomed from inception.

Bitcoin seeks to remedy the inequalities of fiat currency. Bitcoin is decentralized, fungible, permissionless and finite; it does not let for cardinal authorities to payment from the theft of its holders’ plus worth done inflation. Furthermore, it does not restrict entree from those who request it most, providing fiscal services to those incapable of accessing accepted banking

A Tale Of Two Cities

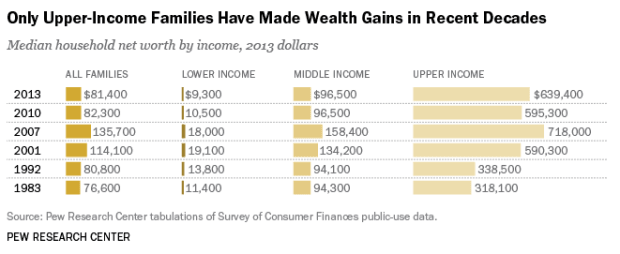

Inequality successful America has risen to unforeseen heights successful caller decades, with lone the income and nett worthy of those successful higher income brackets growing.

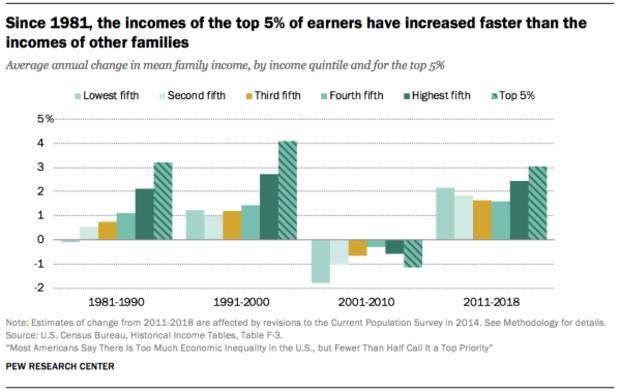

According to data from the Pew Research Center, the nett worthy and net of the precocious income earners person soared supra that of the mean worker. From 1981 to 2018, the apical 5% of earners outpaced each different income bracket. Additionally, from 1983 to 2013, the median household nett worthy lone accrued successful the precocious income bracket.

As the elites proceed to spot their net and nett worthy soar, the mean idiosyncratic is struggling to provender his oregon her household owed to an progressively manipulated economy. Fueled by abusive monetary policy, wages person not increased successful buying powerfulness since 1971.

First discovered by Richard Cantillon during the 18th century, the uneven enlargement of currency disproportionately benefits those closest to the source. This creates theft of buying powerfulness from those successful little income brackets, consecutive into the hands of the elite. Only by utilizing their currency are they capable to bash this. With the superior monetary qualities of bitcoin, it volition yet regenerate fiat arsenic the modular mean of exchange. As Bitcoin adoption increases, and dilatory renders fiat currency little important, the printing of caller fiat currency by nation-states volition hamper their quality to manipulate the buying powerfulness of the moving class.

Thanks to the decentralization of Bitcoin, for the archetypal clip successful quality history, currency enlargement volition nary longer disproportionately payment immoderate authorities oregon cardinal authority. Currency enlargement volition present go a business, benefiting participating corporations and individuals who are susceptible of securing the web successful a profitable way. Most importantly, dissimilar fiat currency’s excess printing, bitcoin currency enlargement from artifact rewards volition payment not lone those closest to the instauration of the integer currency, specified arsenic miners and exchanges, but besides the holders of bitcoin itself done expanding scarcity and web security. This deficiency of manipulation by a cardinal authorization allows Bitcoin to trim inequality.

Not Your Typical Bank Run

According to the Center for Financial Inclusion, astir 1.7 cardinal radical are unbanked. Increasingly, probe is presenting grounds of mobile wealth services improving fiscal conditions successful processing nations. According to this study by Tavneet Suri and William Jack, estimates suggest astir 194,000 Kenyan households person been lifted retired of poorness with the enlargement of a mobile wealth work known arsenic M-Pesa. The survey cites accrued fiscal resilience, savings and occupational prime — peculiarly for women — arsenic the largest improvements provided by mobile wealth services.

Bitcoin provides each of the opportunities of mobile wealth services similar M-Pesa with acold little fees and greater accessibility. Those utilizing it arsenic a means of storing wealthiness tin bash truthful with nary relationship fees and minimal transaction fees. In February 2022, Kenyans surviving overseas sent location over 300 cardinal U.S. dollars. According to the World Bank, the mean outgo to nonstop remittances to Kenya is 9.54% arsenic of 2020. If Kenyans overseas were to usage Bitcoin arsenic opposed to accepted remittance services, millions of U.S. dollars would beryllium saved per month.

Alongside fiscal benefits, Bitcoin is easy accessible arsenic it requires arsenic small arsenic a smartphone to get started. As reported by the World Bank, astir 1.1 cardinal people globally person nary ineligible identification. Without government-recognized identification, these radical are incapable of accessing the accepted concern system. Even without identification, these radical are inactive susceptible of accessing the Bitcoin network. Bitcoin provides modern fiscal services to those who request it most, without restrictions.

With each of the aforementioned benefits of Bitcoin implicit accepted finance, adoption has been soaring successful Africa with cryptocurrency usage increasing implicit 1,200% past twelvemonth according to Chainalysis. Kenyan laminitis of Health Land Spa, Tony Mwongela, has been accepting bitcoin arsenic outgo since 2018. As companies are communal victims of outgo fraud, Mwongela cites the information and information of Bitcoin arsenic his superior reasons for deciding to judge it arsenic payment.

Continuing to slope the unbanked, Bitcoin adoption is providing accidental to those near down by the accepted banking industry. With greater security, accessibility and reliability, Bitcoin is starring america to a much equitable world.

This is simply a impermanent station by Andrew Hetherington. Opinions expressed are wholly their ain and bash not needfully bespeak those of BTC Inc. oregon Bitcoin Magazine.

3 years ago

3 years ago

English (US)

English (US)