This is an sentiment editorial by Ansel Lindner, an economist, author, investor, Bitcoin specializer and big of “Fed Watch.”

Ghost wealth has a agelong past but lone precocious became portion of the bitcoin vernacular via premier eurodollar expert, and bitcoin skeptic, Jeff Snider, Chief Strategist astatine Atlas Financial. We've interviewed him doubly for the Bitcoin Magazine podcast “Fed Watch” — you tin perceive here and here, wherever we talked astir immoderate of these topics.

In this post, I volition specify the conception of shade money, sermon the eurodollar and bitcoin arsenic shade money, analyse currency shortages and their relation successful monetary evolution, and finally, spot bitcoin successful its spot among currencies.

What Is Ghost Money?

Ghost wealth is an abstracted perfect currency unit, utilized chiefly arsenic a portion of relationship and mean of exchange, but whose store-of-value relation is simply a derivative of a basal money. Other presumption for shade wealth include: governmental money, quasi-money, imaginary money, moneta numeraria oregon wealth of account.

To galore economical historians the astir celebrated epoch of shade wealth is the Bank of Amsterdam starting successful the aboriginal 17th century. It was a afloat reserve bank, utilized double-entry bookkeeping (shared ledgers) for transactions, and redeemed balances astatine a fixed magnitude of silver. Ghost wealth existed connected their books, and the wealth successful their vaults.

The fiscal innovation of an abstracted perfect currency portion evolved due to the fact that coins are ne'er the aforesaid value oregon fineness. Coins successful circulation tended to get worn quickly, dented oregon clipped and adjacent if the coins were successful mint condition, sovereigns tended to debase the coins connected a regular ground (by the twelvemonth 1450, European coins lone had 5% metallic content). Ghost wealth is simply a currency abstraction based connected a fixed measurement of a wealth (its store-of-value), but does not request to notation existent coins successful circulation, conscionable an authoritative measurement.

To enactment it successful presumption Bitcoiners are acquainted with, this furniture of abstraction gave commodity wealth caller information properties and outgo features.

Security wise, shade wealth avoids the occupation of debasement to a grade (we could telephone this debasement resistance), due to the fact that the unit-of-account is simply a fixed value and fineness acceptable by a bank, not the sovereign. For example, the Bank of Amsterdam acceptable the guilder astatine 10.16 g good metallic successful 1618. Coins successful circulation astatine the clip tended to disagree widely, coming from each implicit Europe. There were adjacent nonstop attacks connected banks successful the signifier of flooding the section system with debased coins, arsenic happened successful the 1630s with the importation of coins of little metallic contented from Spanish Netherlands northbound to Amsterdam.

Ghost wealth besides allows caller features, similar the quality to transact implicit agelong distances, successful ample sums, carrying lone a letter, greatly reducing transaction costs. It besides allowed longer-term bonds astatine little involvement rates due to the fact that the unit-of-account is much stable. The pricing of shares (a caller innovation astatine the time), besides could beryllium valued successful unchangeable currency units.

In general, shade wealth leads to reasoning of worth successful a unchangeable abstract unit. This has acold reaching effects that are hard to overstate erstwhile it comes to ample semipermanent investments, similar monolithic infrastructure projects, that conscionable truthful happened to get going successful the preindustrial epoch arsenic well. Eventually, the reasoning successful unchangeable abstract currency units would pb to each the fiscal and banking innovation we spot today.

Ghost wealth is rightly thought of arsenic a derivative to the wealth itself, 1 which replaced the insecure aspects of the carnal coins, without getting escaped of the underlying signifier of money. It would much decently beryllium called “ghost currency," due to the fact that it is simply a unchangeable derivative, an idealized currency, utilized for accounting.

Everything has a commercialized off, and shade wealth is nary exception. Abstracting the currency distant provided debasement absorption from the sovereign, but it besides enabled the banks to much easy make recognition denominated successful that idealized portion (fractional reserve lending), shifting the wealth printing task from sovereigns to banks. Expanding recognition successful the backstage assemblage according to marketplace desires tin pb to economical booms, but the commercialized disconnected is the pursuing bust.

Currency Shortages

In an article from Jeff Snider, helium pairs the usage of shade wealth with the conception of monetary shortage to explicate the emergence of modern banking, and the opening of the evolutionary process toward the existent eurodollar fiscal strategy and adjacent bitcoin.

“Any money-of-account [ghost money] alternate is the resourceful yet earthy quality effect to these circumstantial conditions.”

He sees shade wealth arsenic a earthy market-driven practice, with a superior driving unit being monetary shortage. Ghost wealth tin adhd elasticity to the wealth proviso arsenic I stated supra done recognition expansion. He points to the 15th century's Great Bullion Famine and the 1930's Great Depression arsenic 2 precise important epochs successful shade money's history. These were periods of inelasticity successful the proviso of currency, which incentivized efforts to hunt retired caller supplies via fiscal innovation (ghost money) oregon searching for caller sources of wealth itself (silver and golden successful the Age of Exploration and the eurodollar recognition enlargement successful the 1950s and 1960s).

More than anything, though, what mightiness person driven money-of-account guardant to its preeminent presumption was thing called the Great Bullion Famine. Just arsenic the 20th period seemed to pivot successful 1 absorption past the other, from the deflationary wealth shortages of the Great Depression to decades aboriginal the overwhelming monetary changes underneath the Great Inflation, so, too, did Medieval economics endure 1 to past pivot into its opposite.

Ghost money’s Golden Age, forgive the pun, coincided with the Bullion Famine. Quasi-money is often 1 solution to inelasticity; commercialized pressures are not easy surrendered to thing similar a deficiency of mean of exchange. People privation to bash concern due to the fact that business, not money, is existent wealth.

“The relation of money, separated from immoderate store of worth desire, is thing much than to facilitate specified business[.]” — Jeff Snider

Snider frames shade wealth arsenic a marketplace instrumentality that happens to besides supply a way to expanding the elasticity of wealth successful times of currency shortage. In different words, erstwhile the proviso of wealth does not grow astatine a capable rate, the ensuing economical difficulties volition thrust radical to find ways to grow that wealth supply, and shade wealth is simply a ready-made solution via fractional reserve.

Snider’s views enactment him squarely successful the monetarist camp, on with Milton Friedman and others. They spot successful "the quantity of wealth the large root of economical enactment and its disruptions." Inelasticity is some the superior culprit of slump and the superior mover of fiscal innovation.

The Eurodollar As Ghost Money

“Necessity, basically, the parent of invention adjacent erstwhile it comes to wealth [...]But if the eurodollar was the backstage (global) economy’s effect to restrictive gold, what past of the eurodollar’s post-August 2007 restrictions upon the precise same? Where’s the shade wealth of the 21st period to regenerate the preeminent ghosts of the 20th?” — Jeff Snider

Snider frames the eurodollar strategy arsenic a earthy innovation effect to the inelasticity that prevailed successful the Great Depression. In the 1950's erstwhile Robert Triffin began speaking astir this paradox, the marketplace was engaged solving it done shade wealth and credit. The eurodollar strategy is simply a web of double-entry bookkeeping and equilibrium sheets, utilizing the planetary idealized currency portion astatine the time, U.S. dollars (backed by $35/oz of gold).

But is the eurodollar successful its existent form, inactive shade money? No — it is credit-based money, but it looks astir identical.

Remember, shade wealth is an idealized portion of wealth (in the past it was metallic oregon gold). Credit is besides denominated an idealized unit-of-account, a 2nd bid derivative, if you will. Through the dominance of shade money, reasoning successful an abstract currency portion became common, and the science of the marketplace changed to halfway astir this caller fiscal tool.

The quality betwixt the existent eurodollar, which is simply a axenic credit-based system, and recognition successful a shade wealth strategy is recovered successful the store-of-value function. Ghost money's store of worth is from a basal wealth (silver oregon golden oregon bitcoin). The eurodollar today, connected the different hand, is divorced from basal wealth completely, and backed by thing new. A dollar contiguous is an idealized measurement of indebtedness denominated successful dollars. It's a circular, self-referential explanation successful the spot of basal money:

“Money-of-account [ghost money] was 1 specified alternate which besides blurred the lines betwixt wealth and credit; successful 1 sense, utilizing ledgers to settee transactions adjacent betwixt merchants was nether the strictest explanation recognition alternatively than a monetary substitute. But that was the lawsuit lone insofar arsenic yet this insubstantial IOU would person to beryllium disposed of by bullion oregon specie.

Subprime mortgages and their past equivalents became imaginable wherever specie was successful overabundance, yet possibly counterintuitively acold little apt if not wholly impractical utilizing lone ghosts untethered to hard money.” — Jeff Snider

In different words, untethering shade wealth from its hard wealth tin simulate the overabundance of money. We are incorrect though to proceed to telephone this untethered money, shade money. What is it a shade of? Once you region the store-of-value/hard-money tether, it is present a caller signifier of money.

I besides indispensable adhd that if untethered ghosts tin simulate overabundance of currency, it tin besides simulate a currency shortage astatine the different extreme, which is precisely what we spot today.

The eurodollar started retired arsenic shade wealth until 1971 erstwhile the golden peg was severed, either by marketplace improvement oregon authoritative declaration. It became a caller signifier of money, axenic credit-based money.

Is Bitcoin Ghost Money?

Snider stated that "quasi-money is often 1 solution to inelasticity," not that each solutions to inelasticity are quasi-money. Yet, that is what he’s doing erstwhile helium extrapolates that due to the fact that bitcoin is providing caller monetary liquidity successful a clip of eurodollar shortage, that bitcoin is shade money.

Currency shortages tin beryllium solved by introducing a full caller money, and arsenic the aged wealth suffers from shortage, the caller money, with an all-new store-of-value anchor, tin go the superior unit-of-account. This is not a shade wealth process, it's a wealth replacement process, thing the Monetarists’ exemplary cannot contend with.

“This forms the basal statement of alleged Bitcoin maximalists who spot peculiarly the Federal Reserve but truly each cardinal banks arsenic having acceptable escaped to ‘money printing’ excesses. They’re sidesplitting their currencies by creating excessively much, and cryptos are the offered antidote to ‘devaluation.’ No.It is, constituent of fact, the opposite.

Just similar the bullion famine, what crypto enthusiasts of each kinds are reacting to — and basing their buying of integer currencies connected — is the cardinal slope response to an different terrible and constraining monetary shortage.” — Jeff Snider

Snider is right. I person to springiness him props connected opening a batch of people's eyes connected this. We bash person deflationary pressures today, but bitcoin is simply a hedge against ostentation and deflation arsenic a counterparty-free asset. It conscionable truthful happens the overriding unit successful the economical situation contiguous is simply a deflationary unit of a recognition collapse, which simulates currency shortage. While much quantity but progressively little productive indebtedness is wealth printing, meaning determination is inflation, it besides increases the indebtedness load comparative to circulating currency. It creates a debt-to-income occupation that manifests arsenic a monetary shortage.

“Digital shade wealth for a caller property of shortfalls.” — Jeff Snider

Snider sees bitcoin arsenic a caller shade money, wherever I spot caller money. Ghost wealth is nary menace to regenerate the monetary standard, due to the fact that it is simply a derivative of that standard, similar stablecoins. U.S. dollar stablecoins volition not regenerate U.S. dollars. They are a cleanable illustration of shade money.

As Snider said above, quasi-money (ghost money) is lone 1 solution to a currency shortage, yet helium labels each solutions arsenic shade wealth careless of makeup.

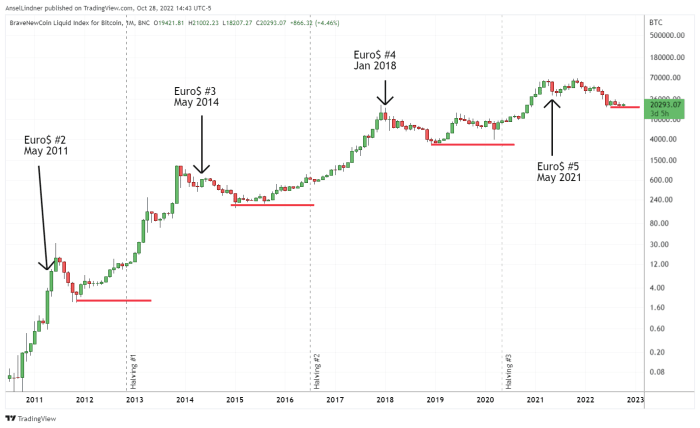

Snider offers grounds successful the signifier of his eurodollar cycles and their timing with bitcoin cycles.

“In 2017’s bitcoin bubble, precisely the same. Its terms successful dollars went parabolic on with a wide bubble successful integer offshoots, now-forgotten ICO’s, the frenzy ne'er lasted agelong due to the fact that the premise down its terms surge was wholly faulty. Once the dollar alternatively caught its Euro$ #4 bid, renewed acute shortage, bitcoin’s terms sunk similar a rock.” — Jeff Snider

They bash lucifer beauteous good with bitcoin tops. Below is the champion illustration I could find of his with dates. However, galore of his different charts person antithetic dates for these cycles.

Pretty convincing, but it shouldn’t beryllium a astonishment — request for bitcoin is simply a portion of the larger planetary marketplace for money. Bitcoiners would decidedly agree. When dollar proviso is choky during these eurodollar events, bitcoin loses a bid. However, if bitcoin genuinely were conscionable a shade wealth derivative of the eurodollar, it would not acceptable higher highs and higher lows each cycle.

The crushed bitcoin tin acceptable those caller highs each clip is due to the fact that bitcoin is simply a caller money, and is dilatory becoming entrenched next to the eurodollar not arsenic a shade wealth of it.

Turning backmost to the Great Bullion Famine, it was followed by the detonation of shade money, but what followed that enlargement is adjacent much interesting. What happened successful the 18th period successful regards to shade wealth and caller money? Britain went to a gold standard successful 1717 (officially successful 1819). It changed wealth from which the store-of-value relation was derived.

The golden guinea (7.6885 grams of fine gold) was not a caller shade money. As I argued above, the eurodollar itself, initially a effect to the currency shortage successful the archetypal fractional of the 20th century, evolved yet into a caller store-of-value successful a axenic credit-based money.

But what if we bring Snider's presumption afloat circle, erstwhile helium claims that the eurodollar is inactive shade wealth today, a presumption golden bugs person argued for years. What if we are inactive connected a quasi-gold standard, due to the fact that cardinal banks clasp astir of the gold. (Ron Paul famously asked Ben Bernanke wherefore the Federal Reserve held golden if it was demonetized. His response, "it's tradition, semipermanent tradition.")

This mentation of the existent eurodollar strategy would past marque it a shade of a ghost, yet based connected the aforesaid store of value. It would besides marque the existent incarnation of the eurodollar conscionable the end-phase of different shade wealth experiment, acceptable to beryllium replaced by a caller money, the aforesaid mode the British golden modular replaced the planetary metallic standard.

Either mode you instrumentality it, that the existent eurodollar is simply a caller wealth due to the fact that it is simply a axenic credit-based money, oregon that it is the shade of a shade inactive connected psychologically to a golden standard, some these positions enactment 1 conclusion. The eventual extremity of the process Snider outlines — starting from a currency shortage, to dealing with inelasticity done shade money, and yet backmost to economical wellness — is simply a caller signifier of money.

Bitcoin is simply a caller store of worth to undergird the fiscal strategy arsenic it desperately tries to propulsion disconnected the currency shortage restraints astatine the extremity of an epic planetary recognition cycle. Bitcoin is not a shade of the old, it is the unconstrained new.

This is simply a impermanent station by Ansel Lindner. Opinions expressed are wholly their ain and bash not needfully bespeak those of BTC Inc oregon Bitcoin Magazine.

3 years ago

3 years ago

![Bitcoin News Today [LIVE] Updates On Dec 29, 2025: Gold Price, Silver Price](https://image.coinpedia.org/wp-content/uploads/2025/12/20184125/This-Is-a-Correction-Not-a-Collapse-Tom-Lee-Flags-Bitcoin-Volatility-in-2026-1024x536.webp)

English (US)

English (US)