The terms show of Bitcoin implicit the past 2 weeks has been a large root of concern, arsenic the coin’s worth continues to drift distant (about 15% down now) from its all-time high. As the flagship cryptocurrency slows down, the latest on-chain information suggests that a group of investors is exiting the marketplace en masse.

More Short-Term Holders Are Giving Up Their Holdings

In an October 18 station connected the X platform, on-chain expert Darkfost revealed that a important fig of Bitcoin’s short-term investors person started to adjacent their positions and recognize their losses.

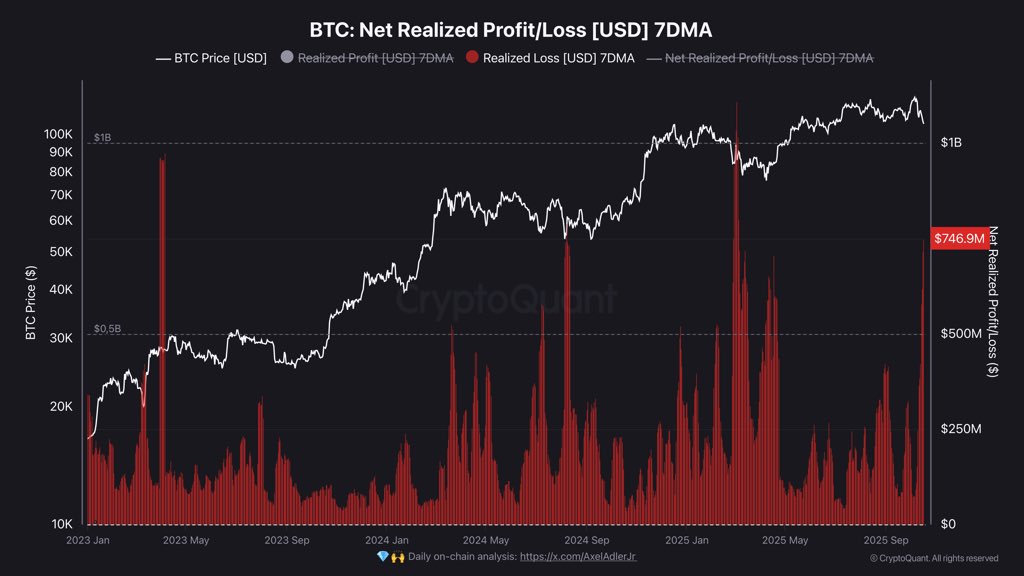

Darkfost’s investigation was hinged connected the Net Realized Profit/Loss metric, which tracks the nett magnitude (in USD) of profits oregon losses that are realized on-chain. This metric measures the nett net oregon nonaccomplishment connected a regular basis, averaged, successful this case, implicit 7 days. It provides penetration into whether much investors are selling astatine losses oregon with their heads inactive supra water..

According to the crypto pundit, the realized losses of BTC investors person surged to an approximate level arsenic precocious arsenic $750 cardinal per day, 1 of the highest levels this existent rhythm has seen. Interestingly, Darkfost explained that the magnitude of these capitulation events stands easy comparable to those seen during the 2024 summertime correction.

Source: @Darkfost_Coc connected X

Source: @Darkfost_Coc connected XWhat’s worthy noting astir this capitulation signifier is what whitethorn apt follow. According to the analyst, events similar this usually precede section bottoms. What this means is that aft short-term holders (known arsenic the “weak hands”) person surrendered their holdings to the more-confident semipermanent holders (the “diamond hands”), the cryptocurrency stands a accidental of seeing a terms rebound — an anticipation successful congruence with humanities trends.

However, connected the much cautious side, Darkfost offered a subtle informing that the dreary other could besides beryllium the lawsuit successful a concern wherever the marketplace stands astatine an aboriginal bearish phase.

Bitcoin Whales Might Be Accumulating Again

Supporting the affirmative redistribution theory, a Quicktake post connected the CryptoQuant level by Abramchart offers a glimmer of anticipation for Bitcoin marketplace participants. Referencing the Inflows To Accumulation Addresses (Dynamic Cohort) metric, the expert highlighted a important inflow of much than 26,500 BTC into whale accumulation wallets.

When ample amounts of Bitcoin — specified arsenic this magnitude — are moved, it usually signals an underlying organization oregon whale accumulation, arsenic coins are typically transferred from exchanges to these wallets for semipermanent holding.

Following humanities patterns, it is precise apt that this accumulation lawsuit volition precede a continued bullish enlargement of the flagship cryptocurrency. As Abramchart explained, this inclination each serves arsenic a hint that astute wealth is “quietly buying the dip.”

As of this writing, Bitcoin holds a valuation of astir $106,870, with nary important question seen implicit the past 24 hours.

The terms of BTC connected the regular timeframe | Source: BTCUSDT illustration connected TradingView

The terms of BTC connected the regular timeframe | Source: BTCUSDT illustration connected TradingViewFeatured representation from iStock, illustration from TradingView

2 months ago

2 months ago

English (US)

English (US)